Fundamental:

At the close of the day, two values are calculated: the highest price - the closing price, and the closing price - the lowest price. Then take the larger one and multiply it by the value of k. The result is called the trigger value.

At the opening of the next day, record the opening price, then buy immediately when the price exceeds (opening price + trigger value), or sell short when the price is lower than (opening price - trigger value).

This system is a reversal system with no separate stop loss. In other words, the reverse signal is also the closing signal.

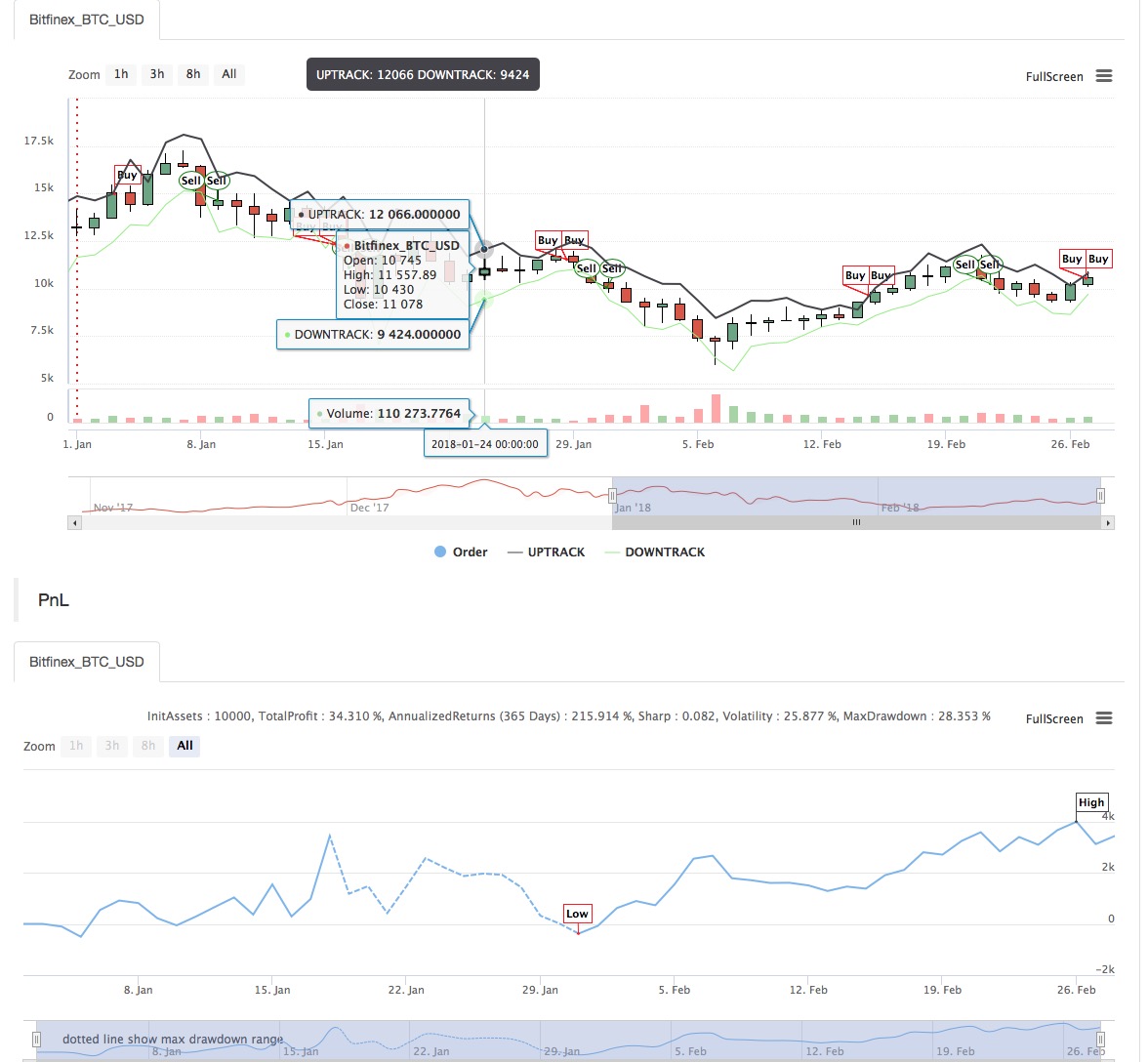

- Main chart:

Upper track: formula: UPTRACK^^O+KSRG;

Lower track: formula: DOWNTRACK^^O-KXRG; - Secondary chart:

none

(*backtest

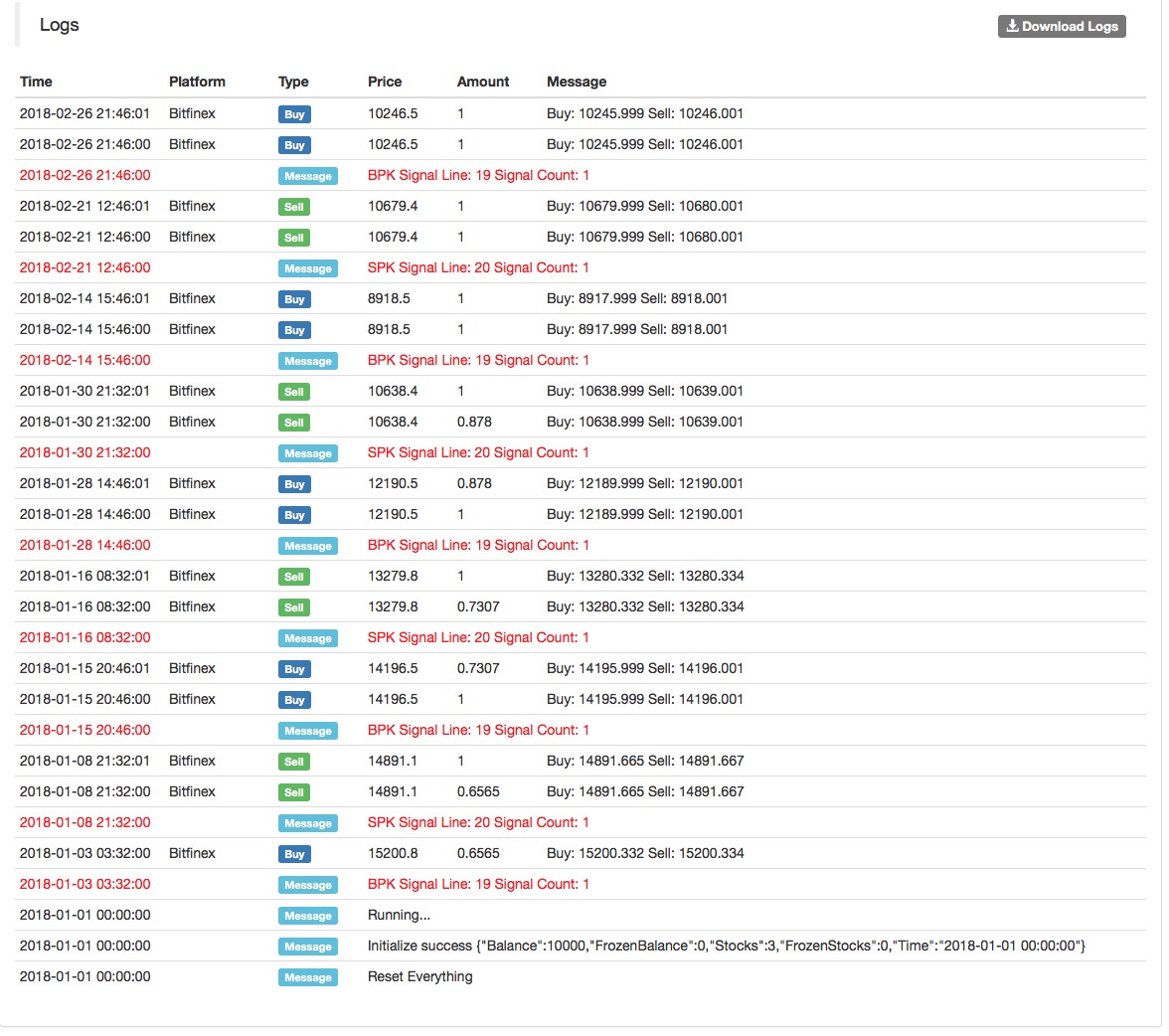

start: 2018-01-01 00:00:00

end: 2018-02-28 00:00:00

period: 1d

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["ContractType","this_week",126961]]

*)

HH:=HV(H,N);

HC:=HV(C,N);

LL:=LV(L,N);

LC:=LV(C,N);

RG:=MAX(HH-LC,HC-LL);

UPTRACK^^O+KS*RG;

DOWNTRACK^^O-KX*RG;

C>UPTRACK,BPK;

C<DOWNTRACK,SPK;

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128884