The commodity futures library implements the strategic framework of the $.CTA function. With this strategy framework, a multi-variety strategy of concurrent stable and real market strategy can be achieved in just a few dozen lines.

function main() {

// using commodity futures library of the CTA strategy framework

$.CTA(Symbols, function(st) {

var r = st.records

var mp = st.position.amount

var symbol = st.symbol

/*

r is the K line, mp is the current variety position, positive number refers to long positions, negative number refers to short position, 0 means no position,

symbol refers to variety name

The return value is n:

n = 0 : Refers to close all position (regardless of the current holdings position)

n > 0 : If there are currently holding long positions, adding n long positions, if the current position is short position, then close n short positions,

if n is greater than the current holding position, then open long positions

n < 0 : If the current position is short position, adding n short positions. If the current position is long positions, then close n long positions.

If -n is greater than the current holding position, then open short position.

No return value means doing nothing

*/

if (r.length < SlowPeriod) {

return

}

var cross = _Cross(TA.EMA(r, FastPeriod), TA.EMA(r, SlowPeriod));

if (mp <= 0 && cross > ConfirmPeriod) {

Log(symbol, "up cross cycle", cross, "Current holding position", mp);

return Lots * (mp < 0 ? 2 : 1)

} else if (mp >= 0 && cross < -ConfirmPeriod) {

Log(symbol, "down cross cycle", cross, "Current holding position", mp);

return -Lots * (mp > 0 ? 2 : 1)

}

});

}

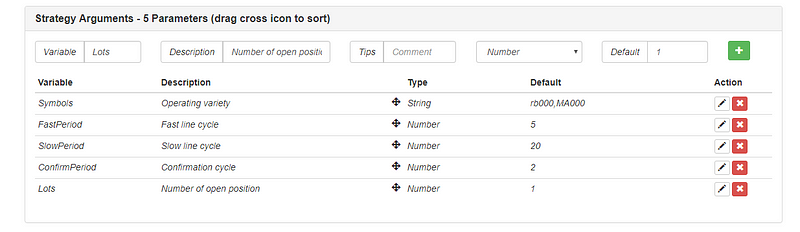

And the strategy arguments setting:

for more information please see: https://www.fmz.com/bbs-topic/2294