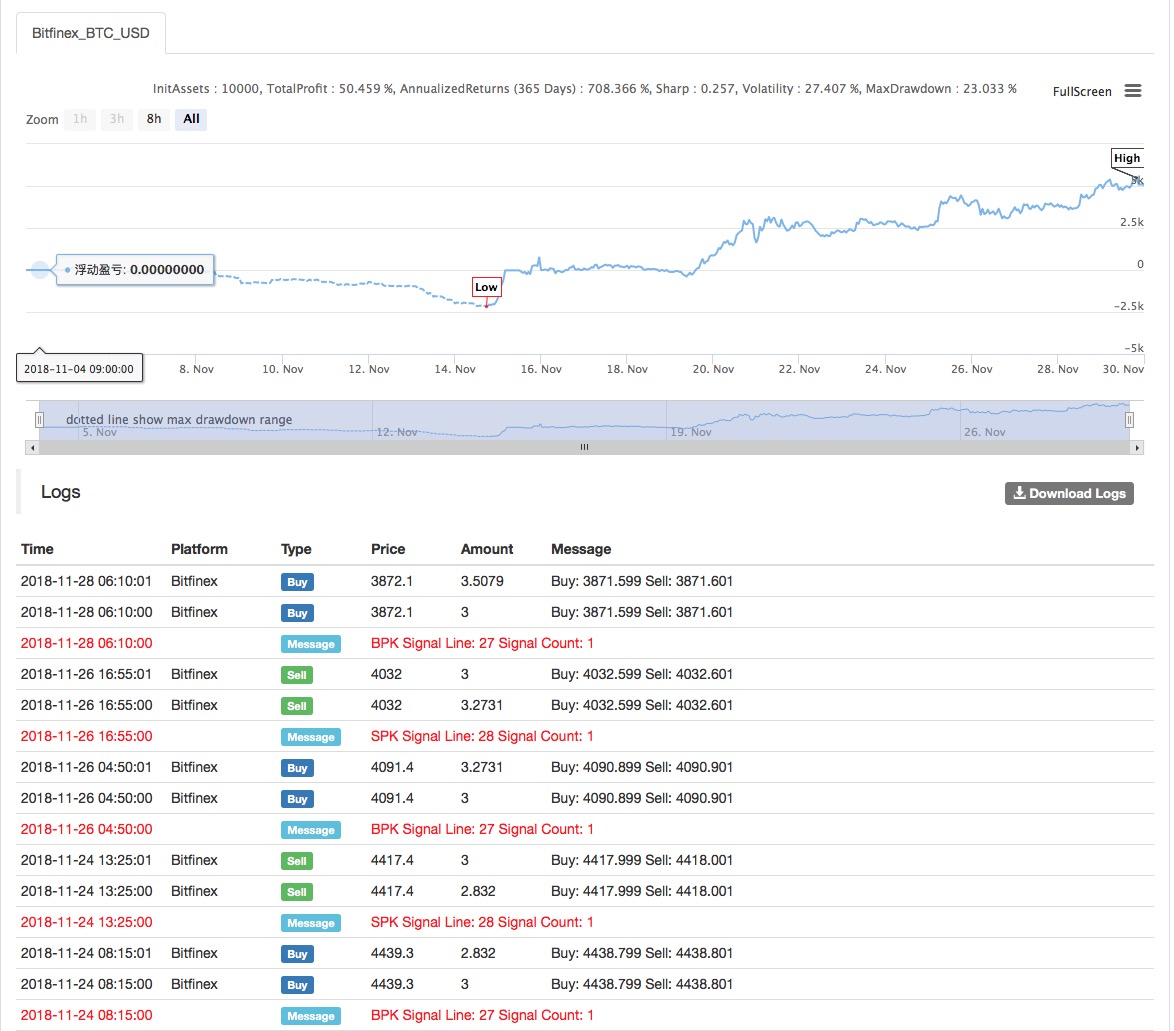

Strategy Name: DMI and High-Low Strategy

Data Cycle: 5M

Support: Commodity Futures

Main chart:

AMA1 index, formula: AMA1 ^ ^ EMA (DMA (CLOSE, CQ1), 2);

AMA2 index, formula: AMA2 ^ ^ EMA (DMA (CLOSE, CQ2), 2);

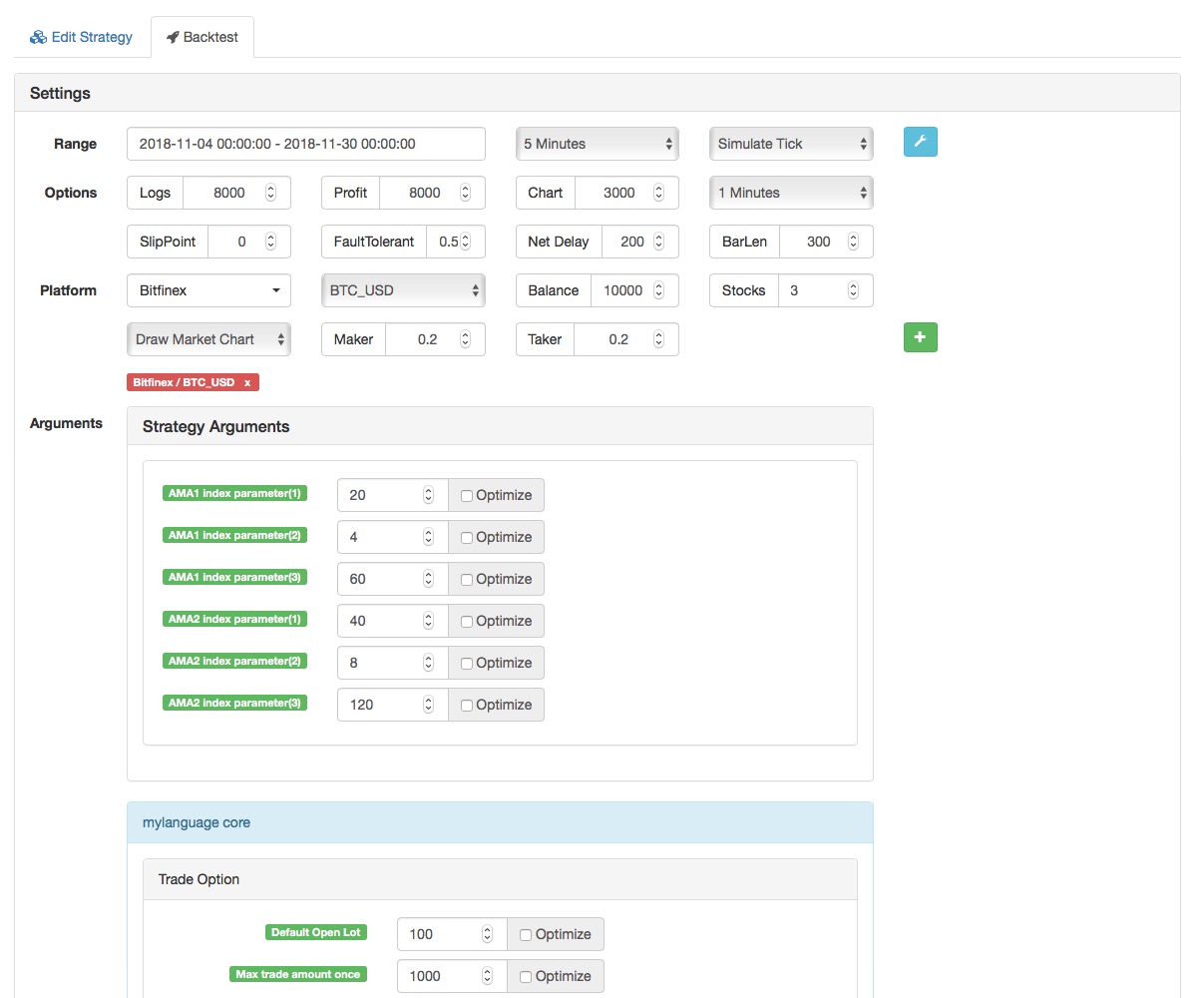

(*backtest

start: 2018-11-04 00:00:00

end: 2018-11-30 00:00:00

period: 5m

exchanges: [{"eid":"Futures_BitMEX","currency":"XBT_USD"}]

args: [["TradeAmount",100,126961],["ContractType","XBTUSD",126961]]

*)

DIR1:=ABS(CLOSE-REF(CLOSE,N));

VIR1:=SUM(ABS(CLOSE-REF(CLOSE,1)),N);

ER1:=DIR1/VIR1;

CS1:=ER1*(2/(N1+1)-2/(N2+1))+2/(N2+1);

CQ1:=CS1*CS1;

AMA1^^EMA(DMA(CLOSE,CQ1),2);

DIR2:=ABS(CLOSE-REF(CLOSE,M));

VIR2:=SUM(ABS(CLOSE-REF(CLOSE,1)),M);

ER2:=DIR2/VIR2;

CS2:=ER2*(2/(M1+1)-2/(M2+1))+2/(M2+1);

CQ2:=CS2*CS2;

AMA2^^EMA(DMA(CLOSE,CQ2),2);

cq22:CQ2;

aa:DMA(CLOSE,CQ2);

BKVOL=0 AND REF(AMA1,1)<REF(AMA2,1) AND AMA2<AMA1,BPK;

SKVOL=0 AND REF(AMA1,1)>REF(AMA2,1) AND AMA2>AMA1,SPK;

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128418