Recently, some of our platform users are looking forward to transplanting a MyLanguage strategy into a JavaScript strategy, which can flexibly add many optimization ideas. Even expand the strategy to multi-species versions. Because the MyLanguage strategy is usually a trend strategy, and many of them are executed based on the closing price model. The API interface of the strategy request exchange is not very frequent, which is suitable for transplanting to multi-species strategy version. In this article, we will take a simple MyLanguage strategy as an example to transplant it into a simple version of JavaScript language. The main purpose is teaching and backtesting research. If you want to make a real bot, you may need to add some details (order price, quantity accuracy, order quantity control, order by asset percentage, status information display, etc.), and also need real bot test.

The Strategy of the MyLanguage to be Transplanted

TR:=MAX(MAX((H-L),ABS(REF(C,1)-H)),ABS(REF(C,1)-L)); ATR:=EMA(TR,LENGTH2); MIDLINE^^EMA((H + L + C)/3,LENGTH1); UPBAND^^MIDLINE + N*ATR; DOWNBAND^^MIDLINE - N*ATR; BKVOL=0 AND C>=UPBAND AND REF(C,1)<REF(UPBAND,1),BPK; SKVOL=0 AND C<=DOWNBAND AND REF(C,1)>REF(DOWNBAND,1),SPK; BKVOL>0 AND C<=MIDLINE,SP(BKVOL); SKVOL>0 AND C>=MIDLINE,BP(SKVOL); // stop loss // stop loss C>=SKPRICE*(1+SLOSS*0.01),BP; C<=BKPRICE*(1-SLOSS*0.01),SP; AUTOFILTER;

The trading logic of this strategy is simple. First, calculate ATR according to the parameters, then calculate the average of the highest, lowest and closing prices of all K-line BARs, and then calculate the EMA indicator according to the average data. Finally, combine ATR and coefficient N in parameters to calculate the upBand and downBand.

Opening and selling positions are based on the closing price. Open long positions when it surmount the upBand and sell the opening position (when holding short positions). Open short positions when it surmount the downBand and sell the opening position.

When the closing price reaches the midline, the position will be closed, and when the closing price reaches the stop loss price, the position will also be closed (stop loss according to the SLOSS, SLOSS is 1, that is 0.01, that is, 1%).

The strategy is executed in a closing price model.

OK, if we understand the strategic requirements and ideas of MyLanguage, we can start to transplant them.

Transplant and Design Strategy Prototype

There are not many strategy prototype codes, ranging from 1 to 200 lines. In order to facilitate the learning of strategy writing ideas, comments are directly written in the strategy code.

// parse params parameters, and parse strings as objects

var arrParam = JSON.parse(params)

// this function creates a chart configuration

function createChartConfig(symbol, atrPeriod, emaPeriod, index) { // symbol : trading pair, atrPeriod : ATR parameter period , emaPeriod : EMA parameter period, exchange object index corresponding to index

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol + "-" + index,

data: []

}, {

type: 'line', // EMA

name: symbol + ',EMA:' + emaPeriod,

data: [],

}, {

type: 'line', // upBand

name: symbol + ',upBand' + atrPeriod,

data: []

}, {

type: 'line', // downBand

name: symbol + ',downBand' + atrPeriod,

data: []

}, {

type: 'flags',

onSeries: symbol + "-" + index,

data: [],

}

]

}

return chart

}

// main Logic

function process(e, kIndex, c) { // e is the exchange object, exchanges [0]..., kIndex is the K-line data series in the chart, and c is the chart object

// obtain K-line data

var r = e.GetRecords(e.param.period)

if (!r || r.length < e.param.atrPeriod + 2 || r.length < e.param.emaPeriod + 2) {

// if the K-line data length is insufficient, return

return

}

// calculate ATR indicators

var atr = TA.ATR(r, e.param.atrPeriod)

var arrAvgPrice = []

_.each(r, function(bar) {

arrAvgPrice.push((bar.High + bar.Low + bar.Close) / 3)

})

// calculate EMA indicators

var midLine = TA.EMA(arrAvgPrice, e.param.emaPeriod)

// calculate upBand and downBand

var upBand = []

var downBand = []

_.each(midLine, function(mid, index) {

if (index < e.param.emaPeriod - 1 || index < e.param.atrPeriod - 1) {

upBand.push(NaN)

downBand.push(NaN)

return

}

upBand.push(mid + e.param.trackRatio * atr[index])

downBand.push(mid - e.param.trackRatio * atr[index])

})

// draw the chart

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == e.state.lastBarTime) {

// update

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

c.add(kIndex + 1, [r[i].Time, midLine[i]], -1)

c.add(kIndex + 2, [r[i].Time, upBand[i]], -1)

c.add(kIndex + 3, [r[i].Time, downBand[i]], -1)

} else if (r[i].Time > e.state.lastBarTime) {

// add

e.state.lastBarTime = r[i].Time

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

c.add(kIndex + 1, [r[i].Time, midLine[i]])

c.add(kIndex + 2, [r[i].Time, upBand[i]])

c.add(kIndex + 3, [r[i].Time, downBand[i]])

}

}

// check the position

var pos = e.GetPosition()

if (!pos) {

return

}

var holdAmount = 0

var holdPrice = 0

if (pos.length > 1) {

throw "long and short positions are checked at the same time!"

} else if (pos.length != 0) {

holdAmount = pos[0].Type == PD_LONG ? pos[0].Amount : -pos[0].Amount

holdPrice = pos[0].Price

}

if (e.state.preBar == -1) {

e.state.preBar = r[r.length - 1].Time

}

// check the signal

if (e.state.preBar != r[r.length - 1].Time) { // closing price model

if (holdAmount <= 0 && r[r.length - 3].Close < upBand[upBand.length - 3] && r[r.length - 2].Close > upBand[upBand.length - 2]) { // the closing price cross over the upBand

if (holdAmount < 0) { // hold a short positions, close them

Log(e.GetCurrency(), "close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

// open long positions

Log(e.GetCurrency(), "open long positions", "#FF0000")

$.OpenLong(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'long', text: "open long positions"})

} else if (holdAmount >= 0 && r[r.length - 3].Close > downBand[downBand.length - 3] && r[r.length - 2].Close < downBand[downBand.length - 2]) { // the closing price cross down the downBand

if (holdAmount > 0) { // hold long positions, close them

Log(e.GetCurrency(), "close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

}

// open short positions

Log(e.GetCurrency(), "open short positions", "#FF0000")

$.OpenShort(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'short', text: "open short positions"})

} else {

// close positions

if (holdAmount > 0 && (r[r.length - 2].Close <= holdPrice * (1 - e.param.stopLoss) || r[r.length - 2].Close <= midLine[midLine.length - 2])) { // Hold a long position, the closing price is less than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

} else if (holdAmount < 0 && (r[r.length - 2].Close >= holdPrice * (1 + e.param.stopLoss) || r[r.length - 2].Close >= midLine[midLine.length - 2])) { // Hold a short position, the closing price is greater than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

}

e.state.preBar = r[r.length - 1].Time

}

}

function main() {

var arrChartConfig = []

if (arrParam.length != exchanges.length) {

throw "Parameters and exchange objects do not match!"

}

var arrState = _G("arrState")

_.each(exchanges, function(e, index) {

if (e.GetName() != "Futures_Binance") {

throw "The exchange is not supported!"

}

e.param = arrParam[index]

e.state = {lastBarTime: 0, symbol: e.param.symbol, currency: e.GetCurrency()}

if (arrState) {

if (arrState[index].symbol == e.param.symbol && arrState[index].currency == e.GetCurrency()) {

Log("restore:", e.state)

e.state = arrState[index]

} else {

throw "The restored data does not match the current settings!"

}

}

e.state.preBar = -1 // initial setting -1

e.SetContractType(e.param.symbol)

Log(e.GetName(), e.GetLabel(), "set contracts:", e.param.symbol)

arrChartConfig.push(createChartConfig(e.GetCurrency(), e.param.atrPeriod, e.param.emaPeriod, index))

})

var chart = Chart(arrChartConfig)

chart.reset()

while (true) {

_.each(exchanges, function(e, index) {

process(e, index + index * 4, chart)

Sleep(500)

})

}

}

function onexit() {

// record e.state

var arrState = []

_.each(exchanges, function(e) {

arrState.push(e.state)

})

Log("record:", arrState)

_G("arrState", arrState)

}

Strategy parameters:

var params = '[{

"symbol" : "swap", // contract code

"period" : 86400, // K-line period, 86,400 seconds is a day

"stopLoss" : 0.07, // stop loss factor, 0.07 or 7%

"atrPeriod" : 10, // ATR indicator parameters

"emaPeriod" : 10, // EMA indicator parameters

"trackRatio" : 1, // upBand and downBand coefficients

"openRatio" : 0.1 // The reserved opening percentage, which is not supported for now

}, {

"symbol" : "swap",

"period" : 86400,

"stopLoss" : 0.07,

"atrPeriod" : 10,

"emaPeriod" : 10,

"trackRatio" : 1,

"openRatio" : 0.1

}]'

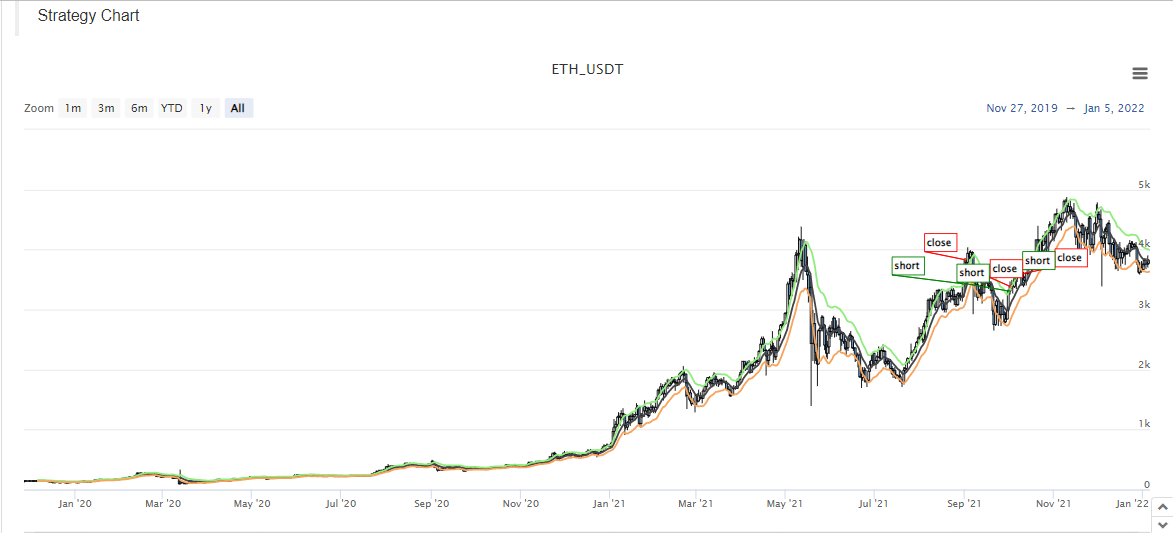

Backtest

Strategy source code: https://www.fmz.com/strategy/339344

Strategies are for backtesting and learning research only. Please modify, optimize, and refer to the real bot by yourself.