NO:01

Occasionally making money in the market is easy, as long as the luck is good enough, there are always one or few times you are right. But if you want to make money in the market for a long time, the first step is to establish the correct trading philosophy, and secondly, it is to derive a reasonable trading method.

Then, in the trading philosophy, the first question is: Is the speculative market an effective market or an ineffective market? This is a very classic and very important question; this article will tell you the answer!

NO:02

Effective Market Hypothesis (EMH)

The Efficient Market Hypothesis is one of the seven most important concepts in finance, and was deepened and proposed by Eugene Fama in 1970.

I believe that no other proposition in economics can be supported by so many solid economic evidence as the efficient market hypothesis. — Michael Jensen

Later, his “three-factor model” was born, which triggered a strong concern of the global investment community. Many people have done a lot of empirical tests in different markets, and it is a magic weapon popular with Wall Street. And winning the Nobel Prize in Economics in 2013 is enough to see the influence of the theory.

NO:03

Overview of the efficient market hypothesis

According to the effective market theory, if the relevant information is not distorted, new information will appear in the future, and the price will continue to reflect the new information. At this time, the price still contains all the latest information, and the market is always in a dynamic equilibrium.

The market is composed of the same economic rational people. Rational people make rational judgments on all the information of the market and generate rational expectations. All investment decisions are made on the basis of rational judgment and rational expectations, that is, the market is always right.

According to this hypothesis, the price of the market is unpredictable. Whether it is luck or based on inside information, the time, money, and effort spent on predicting prices are in vain. Any technical analysis of prices is Invalid.

NO:04

The opposite of the efficient market hypothesis

However, there are many people who hold the opposite opinion. Soros said this before — “The efficient market hypothesis has gone bankrupt.” It is said that Buffett also said this sentence — “If the market is always effective, I can only beg along the street.”

After listening to the evaluations of the two most effective investor in the global investment community in this century, I wonder how do you think about the “Efficient Market Hypothesis” now?

This made me think of a small story about the satirical effective market hypothesis:

One day, Professor Eugene Fama took a walk with the students who were devout to him. The student suddenly saw that a dollar with a denomination of 100 dollar fell to the ground. The student said:

Teacher, there is a $100 in front.

The professor looked at the students with his wisdom and sympathetic eye, and said to the students:

If that is really $100, it has long been taken away, let’s go, ignore it.

So, these two swaggered and walked away without blink.

At this time, suddenly ran through a child, he shouted with surprise:

what! 100 dollars!

Pick it up right away and buy what he wants with joy.

Through this little story, it is a bit unrealistic to regard “effective market” as the fundamental belief in “financial theory.”

NO:05

The core of Buffett’s value investing is to find those pricing when the market makes them wrong, and hold it until it returns to its real value. But if the market is correct, undervalued stocks will not exist.

And he added, the market is often effective, but it is concluded that the market is always effective, which is wrong. Because it’s impossible that investors are all be rational, even the rational investors can’t be rational at all time. Second, even if the information is sufficient and effective, investors may not be able to analyze and use the information correctly. And the price reflects the intrinsic value of “current” rather than “long-term”.

NO: 06

Soros’s critique of the efficient market hypothesis

Buffett’s point of view is static values, and Soros is a speculative master, and his views are more focused on dynamic values:

Not only is the market wrong, but the views of all of us may be wrong, and all the distorted values are combined in everything, which promotes the mistake of the market, that is, Soros’ classic investment philosophy: reflexivity.

To give a simple example: if the supply of pork is in short supply, the price will be higher than the price of supply and demand, farmers will raises pig supple to a level higher than the demand at this price. However, because piglets grow into large pigs need three months to half year, before the pigs grow up, although the number of piglets has exceeded the demand for pork in the market after they grow up, the market is still in short supply, so the price is still high, people raise Piglets supply are also constantly being added at this price.

Six months later, the piglet turned into pork, and the demand for supply became oversupply. The high-priced pork bubble was finally blown, so people reduced the number of pigs by the price of pork below the equilibrium level, and the demand exceeded supply after half a year again. Such economic fluctuations often occur in economic activities such as production time-consuming and supply-price response.

NO:07

Falsification

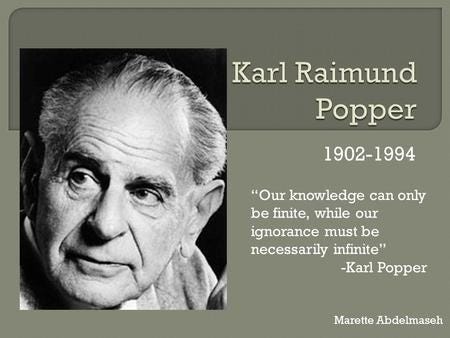

Soros’s philosophical foundation is mainly derived from Karl Popper’s falsification. The falsification concept believes that all scientific knowledge is temporary and waiting to be falsified. Some of the truths that seem to be unbreakable today are very likely may just be the paradox of tomorrow.

Scientific propositions cannot be confirmed, they can only be falsified, and falsification is a standard of division between science and non-science.

In fact, most of the truth is relative truth. For example, Newtonian mechanics is the truth in the macroscopic universe, but it is a fallacy in the quantum world. For example, the speed of light is constant, and in most cases it is truth, but it is also a fallacy in the black hole. This is the case with physics, sociology, and investment.

NO:08

The market is wrong

In the market, human cognition is limited. This limitation makes people not always rational in trading. Therefore, the market is not composed of rational people. On the contrary, it is composed of many people with different abilities. Each investor has different trading methods, and each time the investor updates his trading method according to the effect of the method, the invalid method Replaced by an effective method.

However, once an investor has modified the method, the market will change, and investors will need to continue to modify the method to adapt to the market. The direction of market movement is determined by the synergy of thousands of different individual decisions at the time. In some cases, once everyone makes the same decision, the market will be full of “the right methods”, the market will quickly become unbalanced and collapse, and then return to the state of “rational” decision-making.

This kind of individual “rational”, constant feedback, self-improvement, cycle collapse, and cyclical system is called complex adaptive system. This system is always in the process of change, there is no balance point, so market errors are inevitable, so, when the market is correct, it is just accidental.

NO:09

In short, in trading, the most important thing is to have a set of investment philosophy. If you haven’t formed yet, then learning from investment masters is the best way.

In reality, an important difference between investment masters and general investors is that they use investment philosophy to guide themselves, and every operation is sensible. In terms of conviction, they believe that they should be successful and make money, and they are responsible for their own career destiny, the so-called “trading for a living.”