- The Aberration trading system was invented by Keith Fitschen in 1986. In 1993, Keith Fitschen commercialized the system in Futures Truth magazine. Since its release, the system has consistently ranked among the best in 1997, 2001 and 2005. The system ranks in the top ten in the performance rankings of published trading systems. The trading system is characterized by simultaneous trading on eight different varieties, including grain, meat, metals, energy, foreign exchange, finance and stock index futures. The Aberration trading system often trades 3–4 times a year, and holds positions 60% of the time, with an average of 60 days per transaction. It captures huge profits through long-term trading to capture trends.

- How does it make up for the loss? Because it trades in multiple unrelated markets at the same time, when one species loses, another one may make a profit. In one year, there is always one or more varieties that can make huge profits. These large profits make up for small losses in those markets that have no trend. The Aberration trading system manages funds in combination, so it can accept a relatively large amount of money.

- the optical line difference is also based on the Bollinger line trading system, but the trading target is longer than the Bollinger robber system, because it can use twice the standard deviation channel, and no stop loss is used, and the channel indicator itself is used to stop loss.

The following code just a framework of above ideas, you need adjust the detail for your trading choices. Also, please beware of the exchanges houses commission fee and other restriction policy.

Coding framework is clear and reusable.

Real-time debugging when running through the interactive function.

Stable operation, perfect details design.

Support multiple trading varieties at the same time, can control the trading position amount separately.

Automatically resumes progress based on position when restarting.

With risk control module, real-time display the risk situation, stop loss condition.

If you don’t want to rent a server, you can use your own computer or Raspberry Pi that any machine runs Windows, Linux or Mac system.

function Aberration(q, e, symbol, period, upRatio, downRatio, opAmount) {

var self = {}

self.q = q

self.e = e

self.symbol = symbol

self.upTrack = 0

self.middleTrack = 0

self.downTrack = 0

self.nPeriod = period

self.upRatio = upRatio

self.downRatio = downRatio

self.opAmount = opAmount

self.marketPosition = 0

self.lastErrMsg = ''

self.lastErrTime = ''

self.lastBar = {

Time: 0,

Open: 0,

High: 0,

Low: 0,

Close: 0,

Volume: 0

}

self.symbolDetail = null

self.lastBarTime = 0

self.tradeCount = 0

self.isBusy = false

self.setLastError = function(errMsg) {

self.lastErrMsg = errMsg

self.lastErrTime = errMsg.length > 0 ? _D() : ''

}

self.getStatus = function() {

return [self.symbol, self.opAmount, self.upTrack, self.downTrack, self.middleTrack, _N(self.lastBar.Close), (self.marketPosition == 0 ? "--" : (self.marketPosition > 0 ?

"Long#ff0000" : "short#0000ff")), self.tradeCount, self.lastErrMsg, self.lastErrTime]

}

self.getMarket = function() {

return [self.symbol, _D(self.lastBarTime), _N(self.lastBar.Open), _N(self.lastBar.High), _N(self.lastBar.Low), _N(self.lastBar.Close), self.lastBar.Volume]

}

self.restore = function(positions) {

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == self.symbol) {

self.marketPosition += positions[i].Amount * ((positions[i].Type == PD_LONG || positions[i].Type == PD_LONG_YD) ? 1 : -1)

}

}

if (self.marketPosition !== 0) {

self.tradeCount++

Log("restore", self.symbol, "Current position is", self.marketPosition)

}

}

self.poll = function() {

if (self.isBusy) {

return false

}

if (!$.IsTrading(self.symbol)) {

self.setLastError("Not in trading hours")

return false

}

if (!self.e.IO("status")) {

self.setLastError("Unconnected exchange")

return false

}

var detail = self.e.SetContractType(self.symbol)

if (!detail) {

self.setLastError("Switching contract failed")

return false

}

if (!self.symbolDetail) {

self.symbolDetail = detail

Log("contract", detail.InstrumentName.replace(/\s+/g, ""), ", Strategy first time to open a position:", self.opAmount, "hand, one hand", detail.VolumeMultiple, "unit, Maximum order quantity",

detail.MaxLimitOrderVolume, "Margin rate:", detail.LongMarginRatio.toFixed(4), detail.ShortMarginRatio.toFixed(4), "Delivery date", detail.StartDelivDate);

}

var records = self.e.GetRecords()

if (!records || records.length == 0) {

self.setLastError("Failed to get the bar line")

return false

}

var bar = records[records.length - 1]

self.lastBar = bar

if (records.length <= self.nPeriod) {

self.setLastError("The length of the bar line is not enough")

return false

}

if (self.lastBarTime < bar.Time) {

var sum = 0

var pos = records.length - self.nPeriod - 1

for (var i = pos; i < records.length - 1; i++) {

sum += records[i].Close

}

var avg = sum / self.nPeriod

var std = 0

for (i = pos; i < records.length - 1; i++) {

std += Math.pow(records[i].Close - avg, 2)

}

std = Math.sqrt(std / self.nPeriod)

self.upTrack = _N(avg + (self.upRatio * std))

self.downTrack = _N(avg - (self.downRatio * std))

self.middleTrack = _N(avg)

self.lastBarTime = bar.Time

}

var msg

var act = ""

if (self.marketPosition == 0) {

if (bar.Close > self.upTrack) {

msg = 'Buying Long trigger price: ' + bar.Close + ' Upper rail:' + self.upTrack;

act = "buy"

} else if (bar.Close < self.downTrack) {

msg = 'Selling short trigger price: ' + bar.Close + ' lower rail:' + self.downTrack;

act = "sell"

}

} else {

if (self.marketPosition < 0 && bar.Close > self.middleTrack) {

msg = 'close the short position trigger price: ' + bar.Close + ' close position line:' + self.middleTrack;

act = "closesell"

} else if (self.marketPosition > 0 && bar.Close < self.middleTrack) {

msg = 'close the long position trigger price: ' + bar.Close + ' close position line:' + self.middleTrack;

act = "closebuy"

}

}

if (act == "") {

return true

}

Log(self.symbol + ', ' + msg + (NotifyWX ? '@' : ''))

self.isBusy = true

self.tradeCount += 1

if (self.lastErrMsg != '') {

self.setLastError('')

}

self.q.pushTask(self.e, self.symbol, act, self.opAmount, function(task, ret) {

self.isBusy = false

if (!ret) {

return

}

if (task.action == "buy") {

self.marketPosition = 1

} else if (task.action == "sell") {

self.marketPosition = -1

} else {

self.marketPosition = 0

}

})

}

return self

}

function main() {

if (exchange.GetName() !== 'Futures_CTP') {

throw "Only support traditional commodity futures(CTP)"

}

SetErrorFilter("login|ready|initialization")

LogStatus("Ready...")

if (Reset) {

LogProfitReset()

LogReset()

}

// Ref: https://www.botvs.com/bbs-topic/362

if (typeof(exchange.IO("mode", 0)) == 'number') {

Log("Switching the market mode successfully")

}

LogStatus("Waiting to connect with the futures dealer server..")

while (!exchange.IO("status")) {

Sleep(500)

}

LogStatus("Get asset information")

var tblRuntime = {

type: 'table',

title: 'Trading Information',

cols: ['Variety', 'Each open position volume', 'upper rail', 'lower rail', 'middle rail', 'last transaction price', 'position', 'transaction count', 'last error', 'error time'],

rows: []

};

var tblMarket = {

type: 'table',

title: 'Quote information',

cols: ['Variety', 'current cycle', 'opening', 'highest', 'lowest', 'last transaction price', 'volume'],

rows: []

};

var tblPosition = {

type: 'table',

title: 'Position information',

cols: ['Variety', 'leverage', 'direction', 'average price', 'quantity', 'holding profit and loss'],

rows: []

};

var positions = _C(exchange.GetPosition)

if (positions.length > 0 && !AutoRestore) {

throw "There can be no positions when the program starts, but you can check the automatic recovery for automatic identification!"

}

var initAccount = _C(exchange.GetAccount)

var detail = JSON.parse(exchange.GetRawJSON())

if (positions.length > 0) {

initAccount.Balance += detail['CurrMargin']

}

var initNetAsset = detail['CurrMargin'] + detail['Available']

var initAccountTbl = $.AccountToTable(exchange.GetRawJSON(), "Initial funding")

if (initAccountTbl.rows.length == 0) {

initAccountTbl.rows = [

['Balance', 'Available margin', initAccount.Balance],

['FrozenBalance', 'Frozen funds', initAccount.FrozenBalance]

]

}

var nowAcccount = initAccount

var nowAcccountTbl = initAccountTbl

var symbols = Symbols.replace(/\s+/g, "").split(',')

var pollers = []

var prePosUpdate = 0

var suffix = ""

var needUpdate = false

var holdProfit = 0

function updateAccount(acc) {

nowAcccount = acc

nowAcccountTbl = $.AccountToTable(exchange.GetRawJSON(), "Current funds")

if (nowAcccountTbl.rows.length == 0) {

nowAcccountTbl.rows = [

['Balance', 'Available margin', nowAcccount.Balance],

['FrozenBalance', 'Frozen funds', nowAcccount.FrozenBalance]

]

}

}

var q = $.NewTaskQueue(function(task, ret) {

needUpdate = true

Log(task.desc, ret ? "success" : "fail")

var account = task.e.GetAccount()

if (account) {

updateAccount(account)

}

})

_.each(symbols, function(symbol) {

var pair = symbol.split(':')

pollers.push(Aberration(q, exchange, pair[0], NPeriod, Ks, Kx, (pair.length == 1 ? AmountOP : parseInt(pair[1]))))

})

if (positions.length > 0 && AutoRestore) {

_.each(pollers, function(poll) {

poll.restore(positions)

})

}

var isFirst = true

while (true) {

var cmd = GetCommand()

if (cmd) {

var js = cmd.split(':', 2)[1]

Log("Execution debug code:", js)

try {

eval(js)

} catch (e) {

Log("Exception", e)

}

}

tblRuntime.rows = []

tblMarket.rows = []

var marketAlive = false

_.each(pollers, function(poll) {

if (poll.poll()) {

marketAlive = true

}

tblRuntime.rows.push(poll.getStatus())

tblMarket.rows.push(poll.getMarket())

})

q.poll()

Sleep(LoopInterval * 1000)

if ((!exchange.IO("status")) || (!marketAlive)) {

if (isFirst) {

LogStatus("Waiting for the market open...", _D())

}

continue

}

isFirst = false

var now = new Date().getTime()

if (marketAlive && (now - prePosUpdate > 30000 || needUpdate)) {

var pos = exchange.GetPosition()

if (pos) {

holdProfit = 0

prePosUpdate = now

tblPosition.rows = []

for (var i = 0; i < pos.length; i++) {

tblPosition.rows.push([pos[i].ContractType, pos[i].MarginLevel, ((pos[i].Type == PD_LONG || pos[i].Type == PD_LONG_YD) ? 'long#ff0000' : 'short#0000ff'),

pos[i].Price, pos[i].Amount, _N(pos[i].Profit)])

holdProfit += pos[i].Profit

}

if (pos.length == 0 && needUpdate) {

LogProfit(_N(nowAcccount.Balance - initAccount.Balance, 4), nowAcccount)

}

}

needUpdate = false

if (RCMode) {

var account = exchange.GetAccount()

if (account) {

updateAccount(account)

var detail = JSON.parse(exchange.GetRawJSON())

var netAsset = detail['PositionProfit'] + detail['CurrMargin'] + detail['Available']

var risk = detail['CurrMargin'] / (detail['CurrMargin'] + detail['Available'] + detail['PositionProfit'])

suffix = ", Initial net worth of the account: " + _N(initNetAsset, 2) + " , risk control minimum net value requirement" + MinNetAsset + " , Current account equity: " + _N(netAsset, 2) +

", Profit and loss: " + _N(netAsset - initNetAsset, 3) + " yuan, risk: " + ((risk * 100).toFixed(3)) + "% #ff0000"

if (netAsset < MinNetAsset) {

Log("The risk control module triggers, stops running and closes all positions, the current net value is ", netAsset, ", Require less than the minimum net value:", MinNetAsset)

if (RCCoverAll) {

Log("Start to close all positions")

$.NewPositionManager().CoverAll()

}

throw "Stop running"

}

}

}

}

LogStatus('`' + JSON.stringify([tblRuntime, tblPosition, tblMarket, initAccountTbl, nowAcccountTbl]) + '`\nLast price update: ' + _D() +

', Last update of position: ' + _D(prePosUpdate) + '\nCurrent holding position total profit and loss: ' + _N(holdProfit, 3) + suffix)

}

}

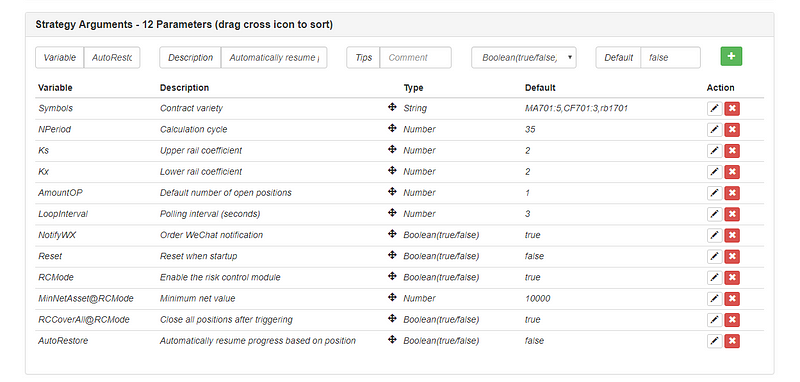

And the Strategy Arguments setting:

for more information, please see: https://www.fmz.com/bbs-topic/2292