Strategy Name: Multilevel Take Profit Strategy

Data Cycle: Multi-Cycle

Support: Commodity Futures, Digital Currency

- Main chart:

Upper line, formula:UPPERLINE^^TODAYOPEN+BAND;

Lower line, formula:LOWERLINE^^TODAYOPEN-BAND;

MA, formula:MALINE^^MA(CLOSE,LENGTH); - Secondary chart:

none

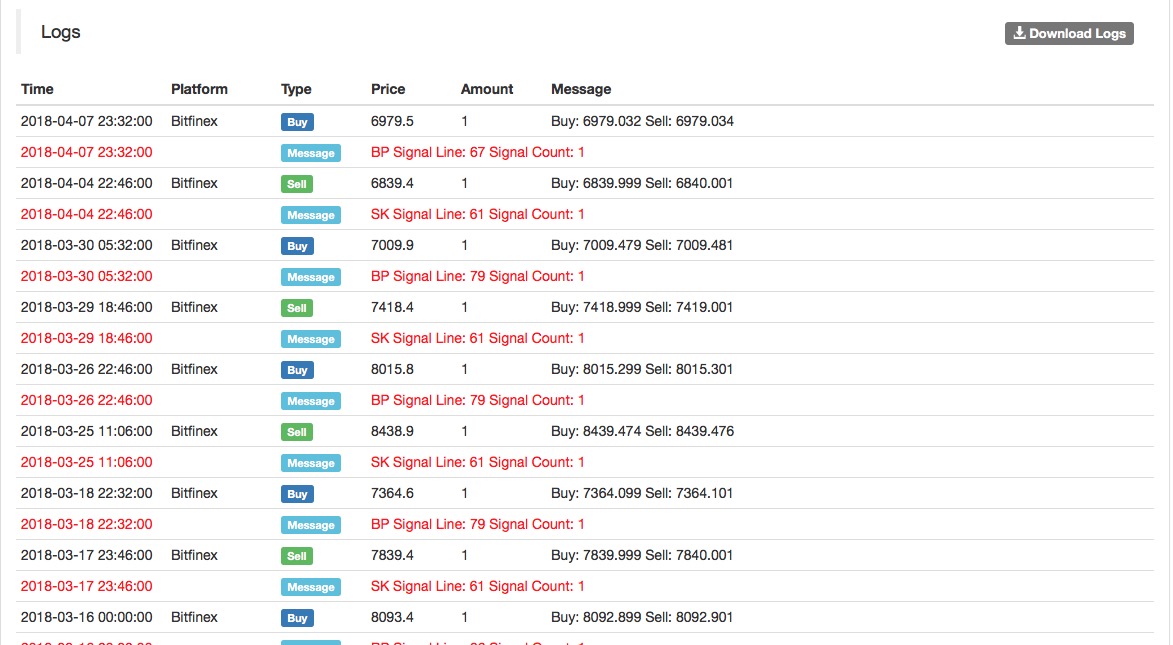

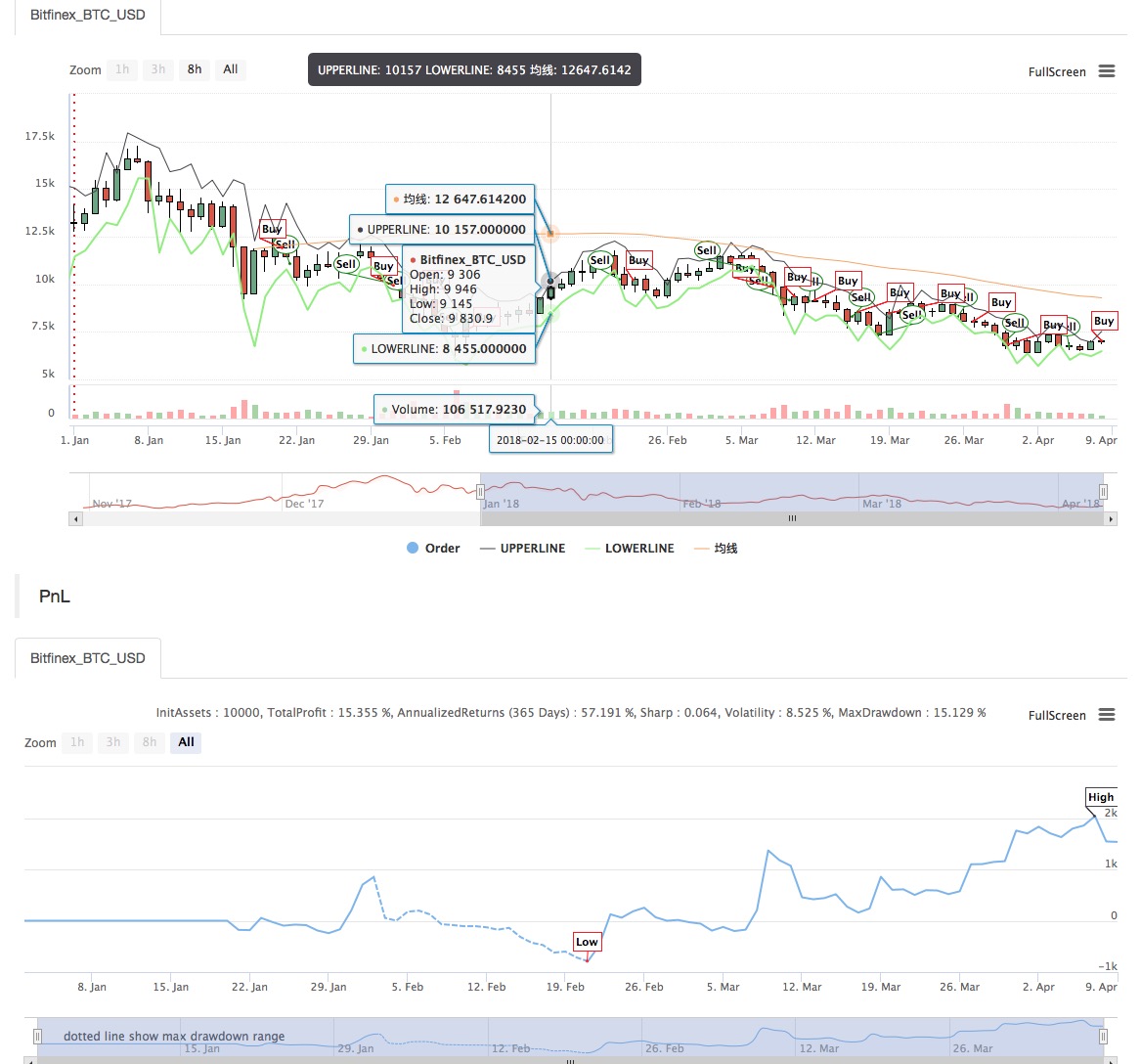

(*backtest

start: 2018-01-01 00:00:00

end: 2018-04-09 00:00:00

period: 1d

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

args: [["LENGTH",80]]

*)

STARTPER1:=5; // 1 level tracking take profit, if profit 5% then start

STOPPER1:=100; // 1 level tracking take profit, if profit retracement is 100% then trigger

STARTPER2:=10; // 2 level tracking take profit, if profit 10% then start

STOPPER2:=50; // 2 level tracking take profit, if profit retracement is 50% then trigger

STARTPER3:=20; // 3 level tracking take profit, if profit 20% then start

STOPPER3:=20; // 3 level tracking take profit, if profit retracement is 20% then trigger

// Upper and lower intervals

NN:=BARSLAST(DATE<>REF(DATE,1))+1; // The number of cycles since the opening today

TODAYOPEN:=VALUEWHEN(NN=1,O); // Opening price of the day

TODAYHIGH:=HHV(H,NN); // today’s highest price

TODAYLOW:=LLV(L,NN); // today’s lowest price

YESTDAYHIGH:=REF(TODAYHIGH,NN); // yesterday's highest price

YESTDAYLOW:=REF(TODAYLOW,NN); // yesterday's lowest price

BAND:=YESTDAYHIGH-YESTDAYLOW;

UPPERLINE^^TODAYOPEN+BAND;

LOWERLINE^^TODAYOPEN-BAND;

// MA

MALINE^^MA(CLOSE,LENGTH);

// When to open and close position

SKCOND: = C<LOWERLINE AND LOWERLINE<MALINE;

BKCOND: = C>UPPERLINE AND UPPERLINE>MALINE;

BPSHORT: = C>UPPERLINE OR C>MALINE;

SPLONG: = C<LOWERLINE OR C<MALINE;

//the mainbody of program

//open position

SKCOND,SK;

BKCOND,BK;

//close position

SPLONG,SP;

BPSHORT,BP;

//take profit

SKLOW<=SKPRICE*(1-0.01*STARTPER3) AND HIGH>=SKLOW+(SKPRICE-SKLOW)*0.01*STOPPER3,BP; // If profit get “STARTPER3”% and profit retracement get “STOPPER3”%, then close short position

BKHIGH>=BKPRICE*(1+0.01*STARTPER3) AND LOW<=BKHIGH-(BKHIGH-BKPRICE)*0.01*STOPPER3,SP; // If profit get “STARTPER3”% and profit retracement get “STOPPER3”%, then close long position

SKLOW<=SKPRICE*(1-0.01*STARTPER2) AND HIGH>=SKLOW+(SKPRICE-SKLOW)*0.01*STOPPER2,BP; // If profit get “STARTPER2”% and profit retracement get “STOPPER2”%, then close short position

BKHIGH>=BKPRICE*(1+0.01*STARTPER2) AND LOW<=BKHIGH-(BKHIGH-BKPRICE)*0.01*STOPPER2,SP; // If profit get “STARTPER2”% and profit retracement get “STOPPER2”%, then close long position

SKLOW<=SKPRICE*(1-0.01*STARTPER1) AND HIGH>=SKLOW+(SKPRICE-SKLOW)*0.01*STOPPER1,BP; // If profit get “STARTPER1”% and profit retracement get “STOPPER1”%, then close short position

BKHIGH>=BKPRICE*(1+0.01*STARTPER1) AND LOW<=BKHIGH-(BKHIGH-BKPRICE)*0.01*STOPPER1,SP; // If profit get “STARTPER1”% and profit retracement get “STOPPER1”%, then close long position

//stop loss

C>=SKPRICE*(1+STOPRANGE*0.01),BP;

C<=BKPRICE*(1-STOPRANGE*0.01),SP;

AUTOFILTER;

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128122