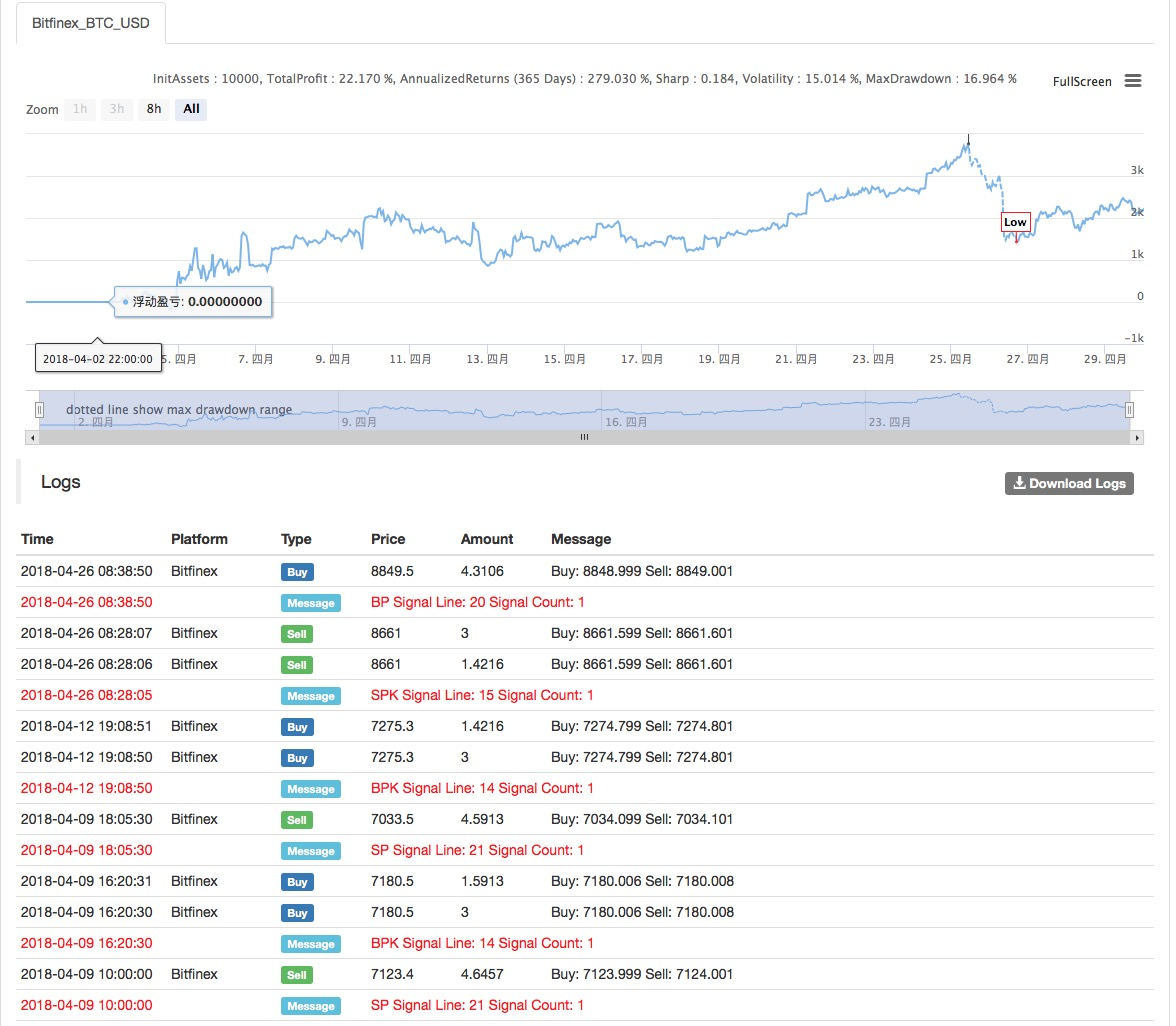

Strategy name: Channel strategy based on ATR volatility index

Strategy idea: Channel Adaptive Strategy, Fixed Stop + Floating Stop

Data Cycle: Multi-Cycle

- Main chart:

Draw UBAND, formula: UBAND ^^ MAC + MATR;

Draw DBAND, formula: DBAND ^^ MAC-MATR; - Secondary chart:

none

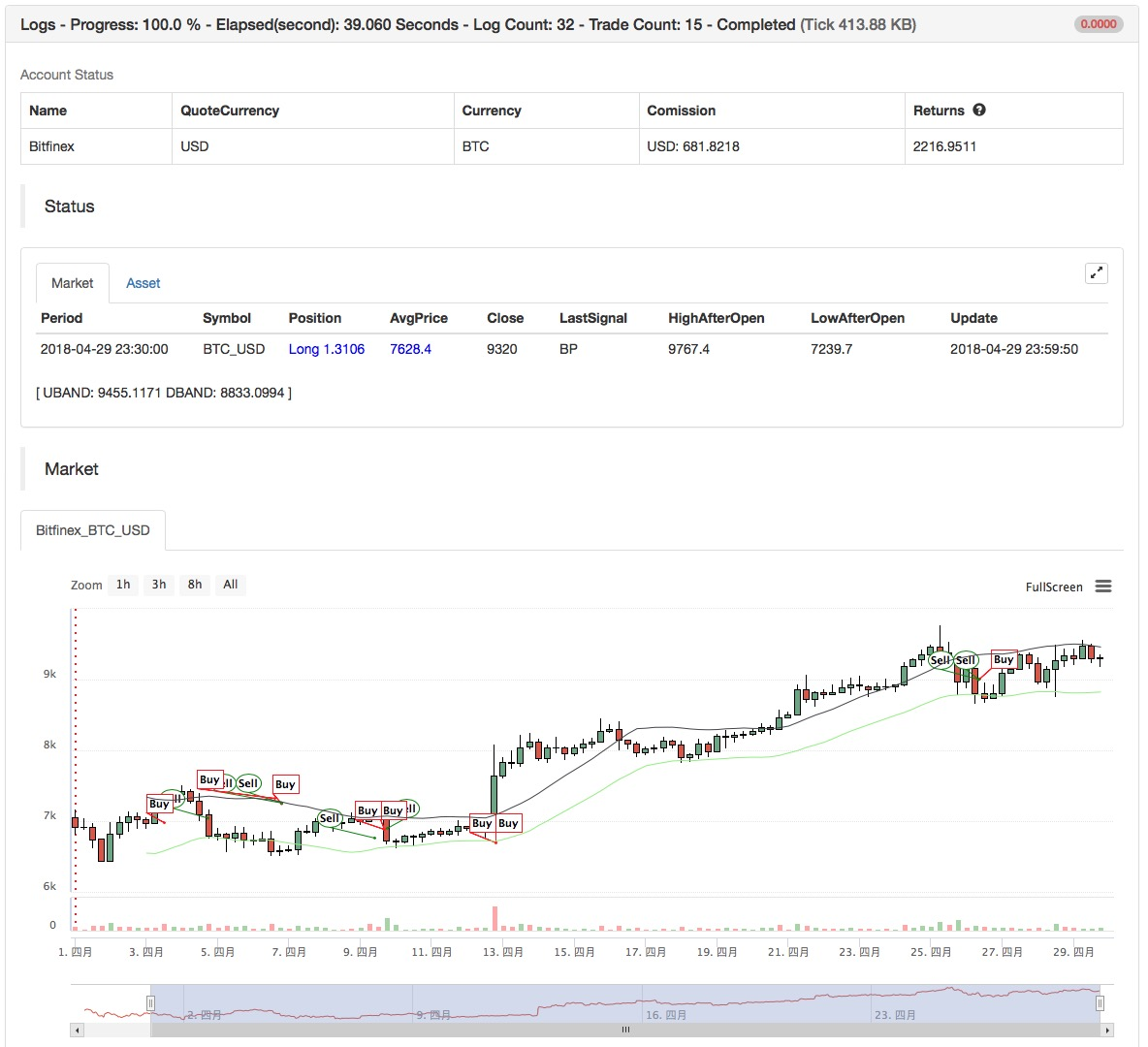

(*backtest

start: 2018-06-01 00:00:00

end: 2018-07-01 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

TR1:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

ATR:=MA(TR1,N);

MAC:=MA(C,N);

UBAND^^MAC+M*ATR;

DBAND^^MAC-M*ATR;

H>=HHV(H,N),BPK;

L<=LLV(L,N),SPK;

(H>=HHV(H,M*N) OR C<=UBAND) AND BKHIGH>=BKPRICE*(1+M*SLOSS*0.01),SP;

(L<=LLV(L,M*N) OR C>=DBAND) AND SKLOW<=SKPRICE*(1-M*SLOSS*0.01),BP;

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

Source Code: https://www.fmz.com/strategy/128126