Quantitative trading

Quantitative systemic traders, enter rules + exit rules + fund management are all quantified. The typical is the turtle trading rules. You are given the model and you know what to do. The model is written in detailed language and you can understand it. This is a systematic trading model that can be quantified.

Quantitative trading relies on a large number of data analysis to produce sample results, and the results are based on sufficient analytical data.

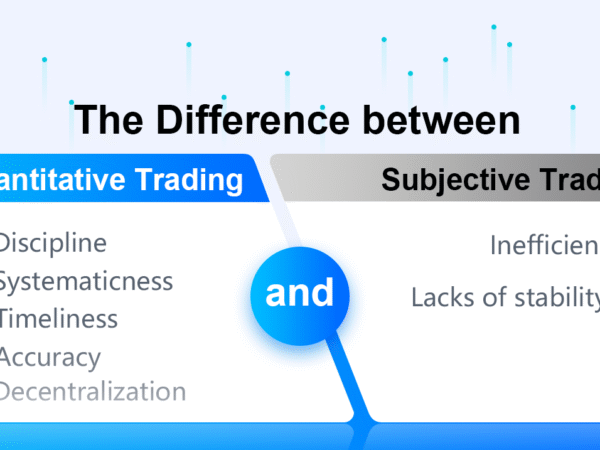

Advantage of quantitative trading

The advantage lies in its discipline, systematicness, timeliness, accuracy and decentralization.

- Discipline: Strictly implement strategic thinking and overcome the weakness of human nature: greed, fear, etc., to overcome the consequences of feeling good about themselves: chasing up and killing low.

- Systematicness: Capture more investment opportunities through multi-level quantitative models, multi-angle observations and massive data.

- Timeliness: Quickly track market changes, comprehensively scan market information, and continuously discover new statistical models that can provide excess returns and find more trading opportunities.

- Accuracy: Accurately and objectively evaluate trading opportunities, overcome subjective emotional biases, and capture opportunities arising from mispricing and erroneous valuation.

- Decentralization: that is, winning by probability. There are two main aspects. First, quantitative investment continuously extracts historical laws that are expected to be repeated in the future and uses them. These historical laws are strategies with a high probability of winning. The second is to rely on the selection of portfolios that have high probability of winning, rather than focusing on one. As the saying goes: don’t put eggs in the same basket.

Quantitative features:

- Each analysis has consistency and reproducibility in the early stage. More importantly, consistency is the result of each analysis. It is difficult to evaluate trading opportunities accurately and objectively, overcome subjective emotional bias, and track market changes quickly and efficiently.

- Quantitative investment can be decentralized, Because people’s energy is limited after all. It is difficult to concentrate on trading multiple varieties simultaneously. The more varieties, the greater the error, the greater the human deviation. Quantitative investment does not have this problem, and it can achieve consistency, analyzability and verifiability for all kinds of trading.

Subjective trading

Subjective trading is man-made discovery of opportunities and man-made orders. It’s mainly based on experience, To study the market and summarize his own trading system, so as to choose whether to place an order or not when a trading signal appears. Subjective trading believes that things have happened in the past will happen in the future. The same decline pattern will still work next time. Though experience is very important, but no one can step into the same river. After all, the past is not the future, so it won’t work every time. Once it is not working, people are easily become suspicious, worrying about gains and losses. Thus, the randomness is strong, people are easy to be plagued by profit and loss, and affected by emotions, which makes it difficult to stabilize profits.

Defects in subjective trading:

- The subjective trading strategy contains the elements of human judgment, so it cannot be repeated precisely and lacks of stability. Because of subjective interference, there is no way to be consistent.

- Subjective trading is inefficient.

Quantitative trading is simply an investment method that uses the data model as the core, programmatic trading as the means, pursuing absolute returns as target. Quantitative investment mainly relies on mathematical models to find investment targets and investment strategies. By establishing mathematical models to realize trading concepts, it has a complete evaluation system. After the model is established, through the backtesting of historical data, to determine that the model can operate effectively in all market stages and achieve profitability.

And subjective trading pays more attention to human analysis and investors’ perceptions. People’s feelings are complex and unreliable. Human beings often have many misunderstandings about things. These misunderstandings make wrong judgments in investment.

We hope every trader can have more options when they choose trading methods instead of trading only by emotion, and we will share more quantitative trading strategies on FMZ Quant to meet more quants.

Start your coding experience now on FMZ.COM