In this article, we will explain how to design a simple trending strategy, only at the strategy design level, to help beginners learn how to design a simple strategy and understand the strategy execution process. The performance of the strategy is largely related to the strategy parameters (as is the case with almost all trending strategies).

Strategy design

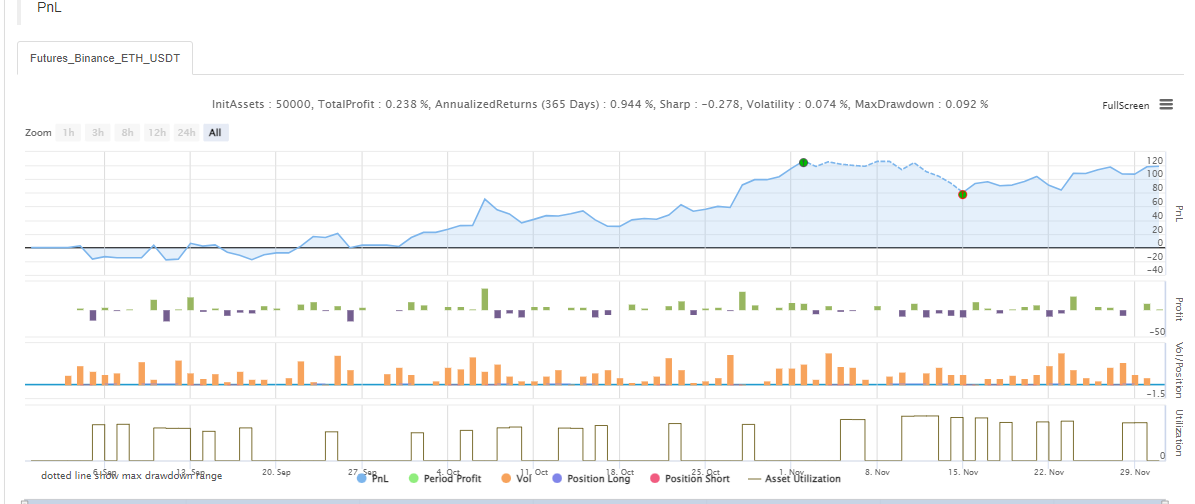

We use two EMA indicators when both EMA averages have turning points. The turning point is used as a signal to open positions (or sell the opening position) for opening long, opening short positions, and a fixed target profit differential position closing is designed. The comments are written directly in the strategy code for convenient reading. The strategy code is generally very short and suitable for beginners to learn.

Strategy code

/*backtest

start: 2021-09-01 00:00:00

end: 2021-12-02 00:00:00

period: 1h

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// The above /**/ is the default setting for backtesting, you can reset it on the backtesting page by using the relevant controls

var LONG = 1 // Markers for holding long positions, enum constant

var SHORT = -1 // Markers for holding short positions, enum constant

var IDLE = 0 // Markers without holding positions, enum constant

// Obtain positions in the specified direction. Positions is the position data, and direction is the position direction to be obtained

function getPosition(positions, direction) {

var ret = {Price : 0, Amount : 0, Type : ""} // Define a structure when no position is held

// Iterate through the positions and find the positions that match the direction

_.each(positions, function(pos) {

if (pos.Type == direction) {

ret = pos

}

})

// Return to found positions

return ret

}

// Cancel all makers of current trading pairs and contracts

function cancellAll() {

// Dead loop, keep detecting until break is triggered

while (true) {

// Obtain the makers' data of the current trading pair and contract, i.e. orders

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

// When orders is an empty array, i.e. orders.length == 0, break is executed to exit the while loop

break

} else {

// Iterate through all current makers and cancel them one by one

for (var i = 0 ; i < orders.length ; i++) {

// The function to cancel the specific order, cancel the order with ID: orders[i].Id

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// The closing function, used for closing positions according to the trading function-tradeFunc and direction passed in

function cover(tradeFunc, direction) {

var mapDirection = {"closebuy": PD_LONG, "closesell": PD_SHORT}

var positions = _C(exchange.GetPosition) //Obtain the position data of the current trading pair and contract

var pos = getPosition(positions, mapDirection[direction]) // Find the position information in the specified closing position direction

// When the position is greater than 0 (the position can be closed only when there is a position)

if (pos.Amount > 0) {

// Cancel all possible makers

cancellAll()

// Set the trading direction

exchange.SetDirection(direction)

// Execute closing position trade functions

if (tradeFunc(-1, pos.Amount)) {

// Return to true if the order is placed

return true

} else {

// Return to false if the order is failed to place

return false

}

}

// Return to true if there is no position

return true

}

// Strategy main functions

function main() {

// For switching to OKEX V5 Demo

if (okexSimulate) {

exchange.IO("simulate", true) // Switch to OKEX V5 Demo for a test

Log("Switch to OKEX V5 Demo")

}

// Set the contract code, if ct is swap, set the current contract to be a perpetual contract

exchange.SetContractType(ct)

// Initialization status is open position

var state = IDLE

// The initialized position price is 0

var holdPrice = 0

// Timestamp for initialization comparison, used to compare whether the current K-Line BAR has changed

var preTime = 0

// Strategy main loop

while (true) {

// Obtain the K-line data for current trading pairs and contracts

var r = _C(exchange.GetRecords)

// Obtain the length of the K-line data, i.e. l

var l = r.length

// Judge the K-line length that l must be greater than the indicator period (if not, the indicator function cannot calculate valid indicator data), or it will be recycled

if (l < Math.max(ema1Period, ema2Period)) {

// Wait for 1,000 milliseconds, i.e. 1 second, to avoid rotating too fast

Sleep(1000)

// Ignore the code after the current if, and execute while loop again

continue

}

// Calculate ema indicator data

var ema1 = TA.EMA(r, ema1Period)

var ema2 = TA.EMA(r, ema2Period)

// Drawing chart

$.PlotRecords(r, 'K-Line') // Drawing the K-line chart

// When the last BAR timestamp changes, i.e. when a new K-line BAR is created

if(preTime !== r[l - 1].Time){

// The last update of the last BAR before the new BAR appears

$.PlotLine('ema1', ema1[l - 2], r[l - 2].Time)

$.PlotLine('ema2', ema2[l - 2], r[l - 2].Time)

// Draw the indicator line of the new BAR, i.e. the indicator data on the current last BAR

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

// Update the timestamp used for comparison

preTime = r[l - 1].Time

} else {

// When no new BARs are generated, only the indicator data of the last BAR on the chart is updated

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

}

// Conditions for opening long positions, turning points

var up = (ema1[l - 2] > ema1[l - 3] && ema1[l - 4] > ema1[l - 3]) && (ema2[l - 2] > ema2[l - 3] && ema2[l - 4] > ema2[l - 3])

// Conditions for opening short positions, turning points

var down = (ema1[l - 2] < ema1[l - 3] && ema1[l - 4] < ema1[l - 3]) && (ema2[l - 2] < ema2[l - 3] && ema2[l - 4] < ema2[l - 3])

// The condition of opening a long position is triggered and the current short position is held, or the condition of opening a long position is triggered and no position is held

if (up && (state == SHORT || state == IDLE)) {

// If you have a short position, close it first

if (state == SHORT && cover(exchange.Buy, "closesell")) {

// Mark open positions after closing them

state = IDLE

// The price of reset position is 0

holdPrice = 0

// Mark on the chart

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Open a long position after closing the position

exchange.SetDirection("buy")

if (exchange.Buy(-1, amount)) {

// Mark the current status

state = LONG

// Record the current price

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openLong', 'L')

}

} else if (down && (state == LONG || state == IDLE)) {

// The same as the judgment of up condition

if (state == LONG && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

}

exchange.SetDirection("sell")

if (exchange.Sell(-1, amount)) {

state = SHORT

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openShort', 'S')

}

}

// Stop profits

if (state == LONG && r[l - 1].Close - holdPrice > profitTarget && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

} else if (state == SHORT && holdPrice - r[l - 1].Close > profitTarget && cover(exchange.Buy, "closesell")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// Display time on the status bar

LogStatus(_D())

Sleep(500)

}

}

Strategy source code: https://www.fmz.com/strategy/333269

The strategy is for program design tutorial only, please do not use it in the real bot.