Preface

Following the previous article, The Hottest AI Trading Technology of 2025: A Smart Trading Guide to FMZ Platform with Claude (Part 1), we introduced Claude and the MCP protocol, and demonstrated how to use the free version of Claude to configure FMZ’s MCP service for basic interaction. Due to the significant limitations of Claude’s free tier, in this article, we’ll continue our exploration using Claude Pro, enabling more advanced use of AI agents in quantitative trading workflows.

Below are a few example use cases for practical reference:

- Grid trading

- Statistical arbitrage

- Market data analysis

- Live trading group management

- AI-driven market analysis and auto-trading

- Asset and position monitoring

MCP (Model Context Protocol)

In our previous article, we introduced the basics of MCP. Before diving deeper, let’s briefly revisit what MCP is all about.

MCP is a standardized protocol that allows AI applications to securely and uniformly access various data sources and tools. Think of it as the “USB port” of the AI world—providing a universal connection standard between AI systems and external resources.

- Key features

- Standardized interfaces

Unified connection protocol eliminates the need to build custom integrations for each data source.

Supports a wide range of sources: databases, APIs, file systems, and more. - Built-in security

Integrated authentication and authorization.

Fine-grained access control.

Ensures that AI only accesses approved resources. - Open-source ecosystem

Fully open-source and community-driven.

Multiple prebuilt MCP servers are available.

Supports custom server development.

- How it works

AI Application <–MCP Protocol–> MCP Server <—> Data Sources / Tools - Use Cases

- Intelligent strategy development assistant

Describe trading ideas in natural language and let the AI auto-generate full strategy code.

Fetch live market data for parameter tuning.

Analyze backtest results and receive optimization suggestions. - Real-time market analysis

Cross-exchange market data comparison.

Identify arbitrage opportunities.

Combine technical indicators for trend analysis.

Monitor market anomalies. - Smart portfolio management

Real-time monitoring of account balances and open positions.

Risk evaluation and automated alerts.

Generate dynamic portfolio adjustment suggestions.

Consolidated asset tracking across exchanges. - Strategy execution monitoring

Track the live status of trading bots.

Alert on abnormal trading behavior.

Performance analysis and tuning recommendations.

Multi-bot coordination and management.

…and much more.

Prerequisites

- A Claude Pro account

- FMZ MCP configuration details

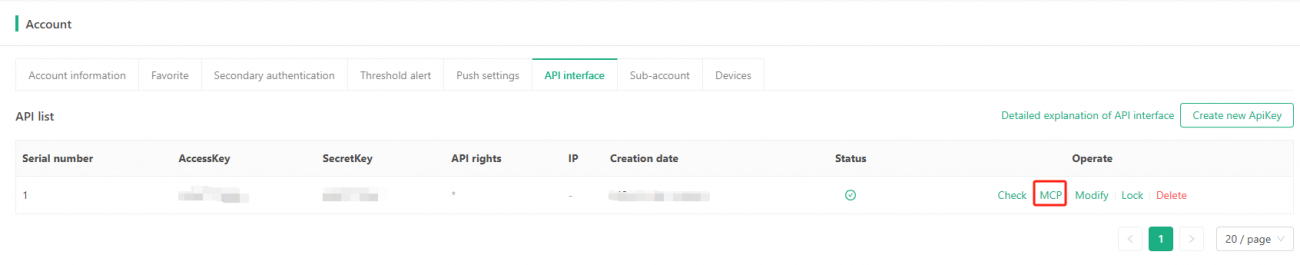

Generate an API key on the following page:https://www.fmz.com/m/account#apikey

Click on “MCP” to view the current configuration associated with your FMZ account.

In the popup window, copy the URL information — it should look something like this:

https://www.fmz.com/api/mcp/xxx?token=xxxThe information in the popup is sensitive — do not share or disclose it.

Configuring the FMZ MCP Service

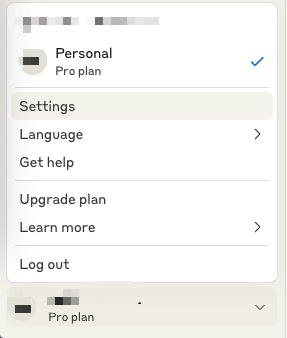

Setting up FMZ MCP with Claude Pro is even more straightforward. After logging into Claude, you’ll find your account name menu at the bottom of the left sidebar:

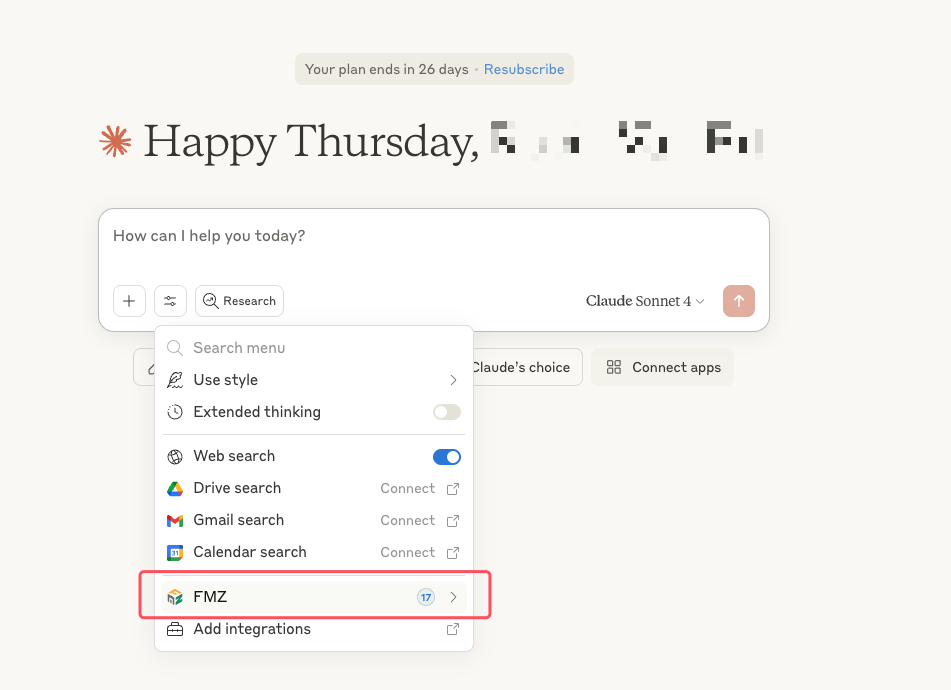

Then click “Settings”, navigate to “Integrations”, and select “Add integration”. From there, enter the FMZ MCP configuration details you prepared earlier.

https://www.fmz.com/api/mcp/xxx?token=xxx- integration name:

Set the name as simply:FMZ - integration URL

For the URL (i.e., the endpoint and token), use the format:https://www.fmz.com/api/mcp/xxx?token=xxx

This is just a placeholder for demonstration — replace thexxxvalues with the actual URL linked to your FMZ account.

Application

Claude Pro + FMZ MCP: Unlocking a New Era of Quantitative Trading

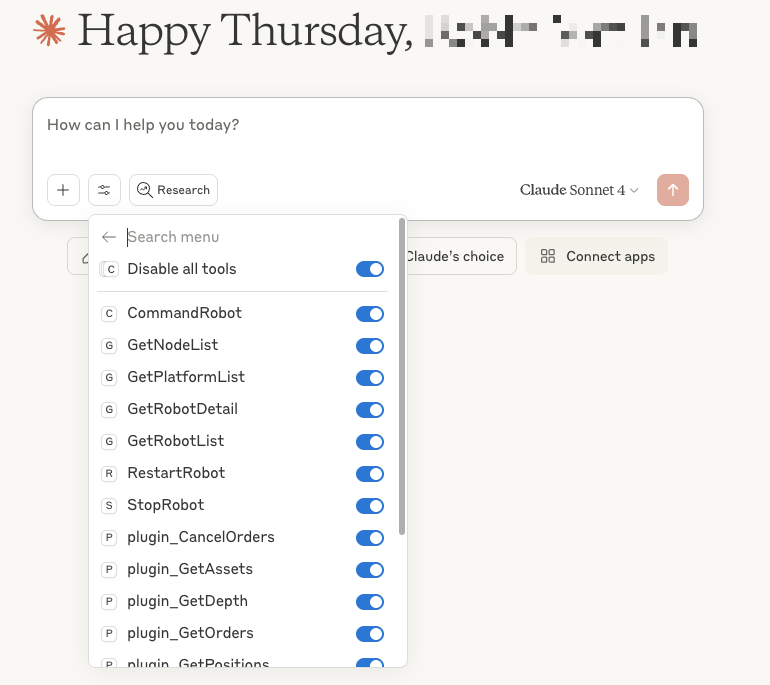

Once the integration is set up, Claude will initialize communication with the FMZ platform and display the available supported methods — indicating a successful connection.

Quick Test

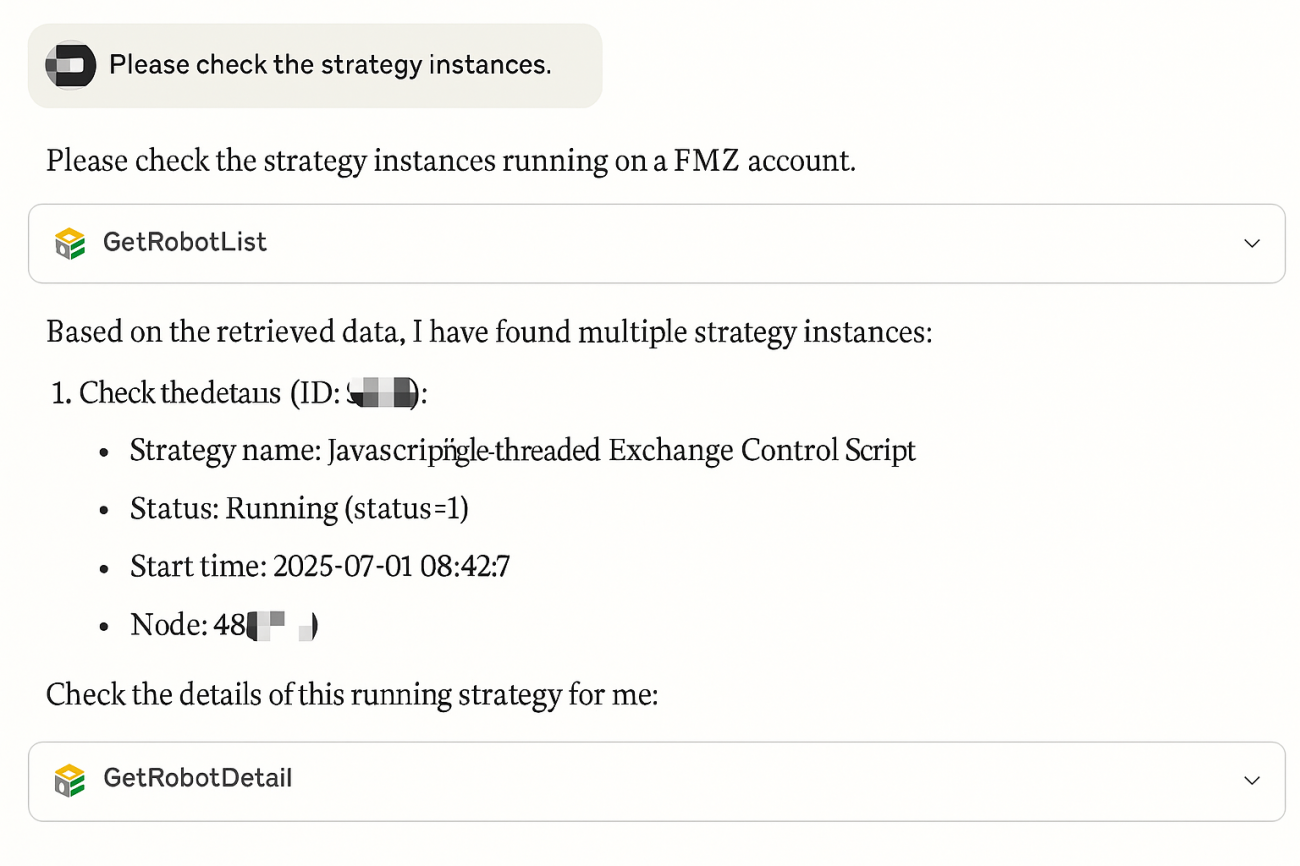

You can ask Claude a simple question like:

Check my running strategy instances on FMZ.

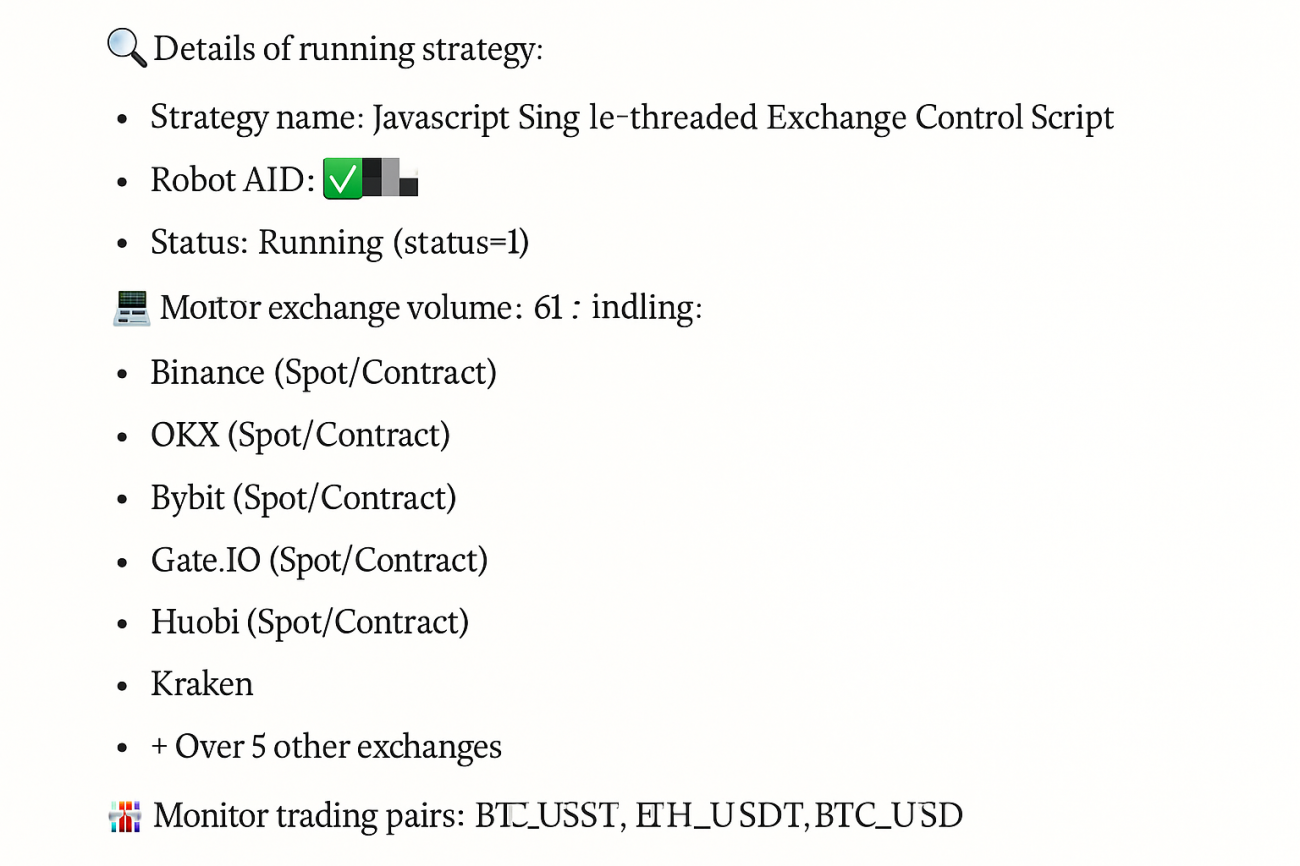

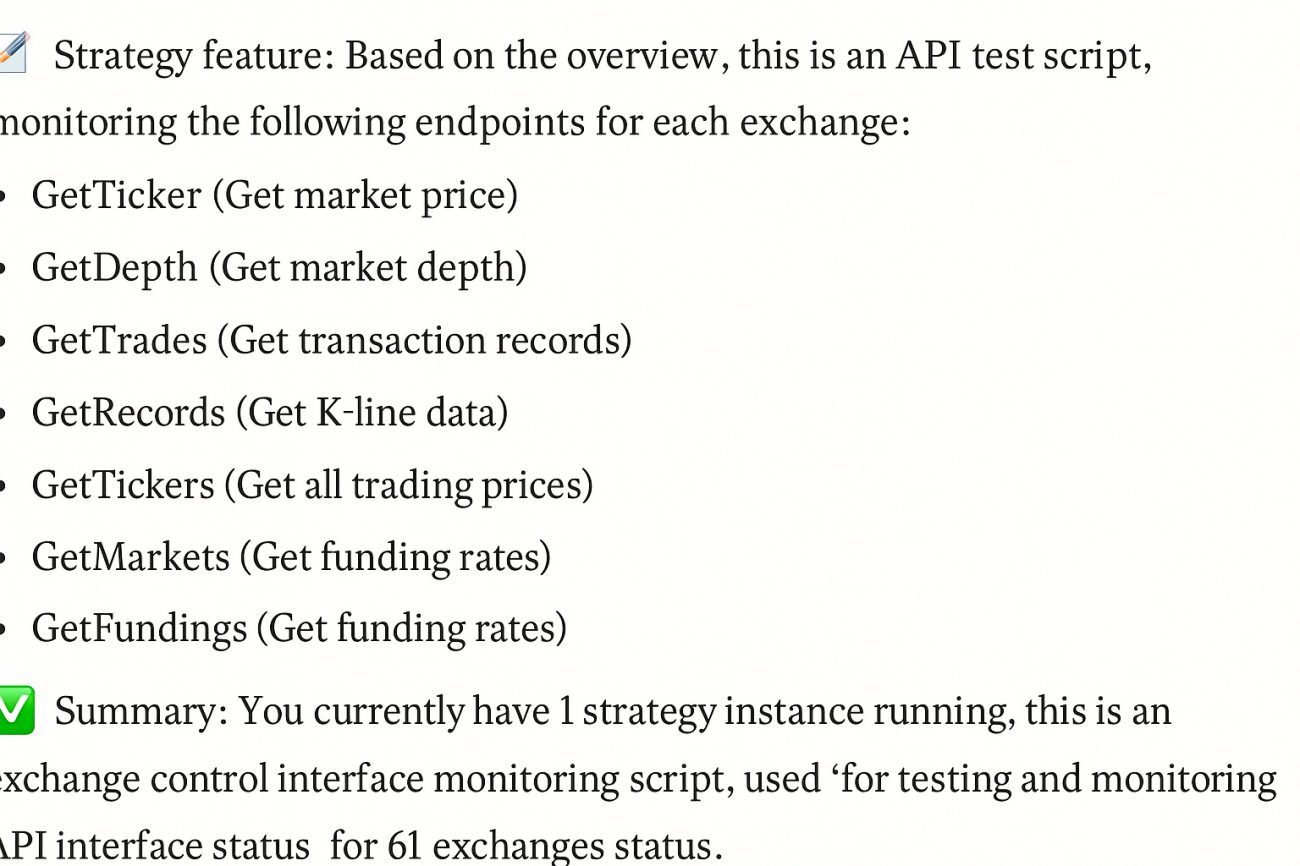

Here’s how the AI agent Claude might respond:

Seeing Claude’s response honestly blew me away — AI described my exchange interface monitoring script with surprising clarity.

Grid Trading Test

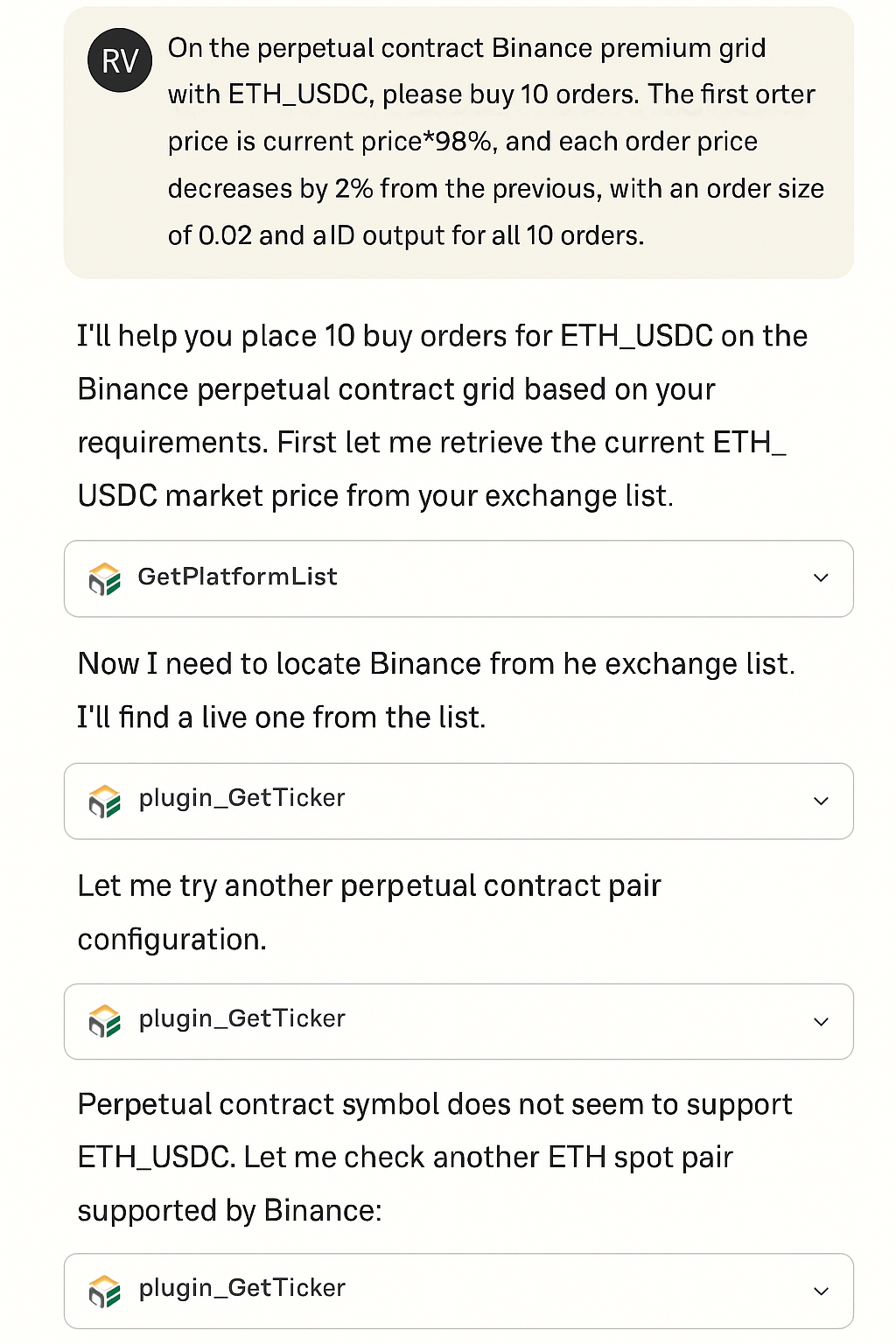

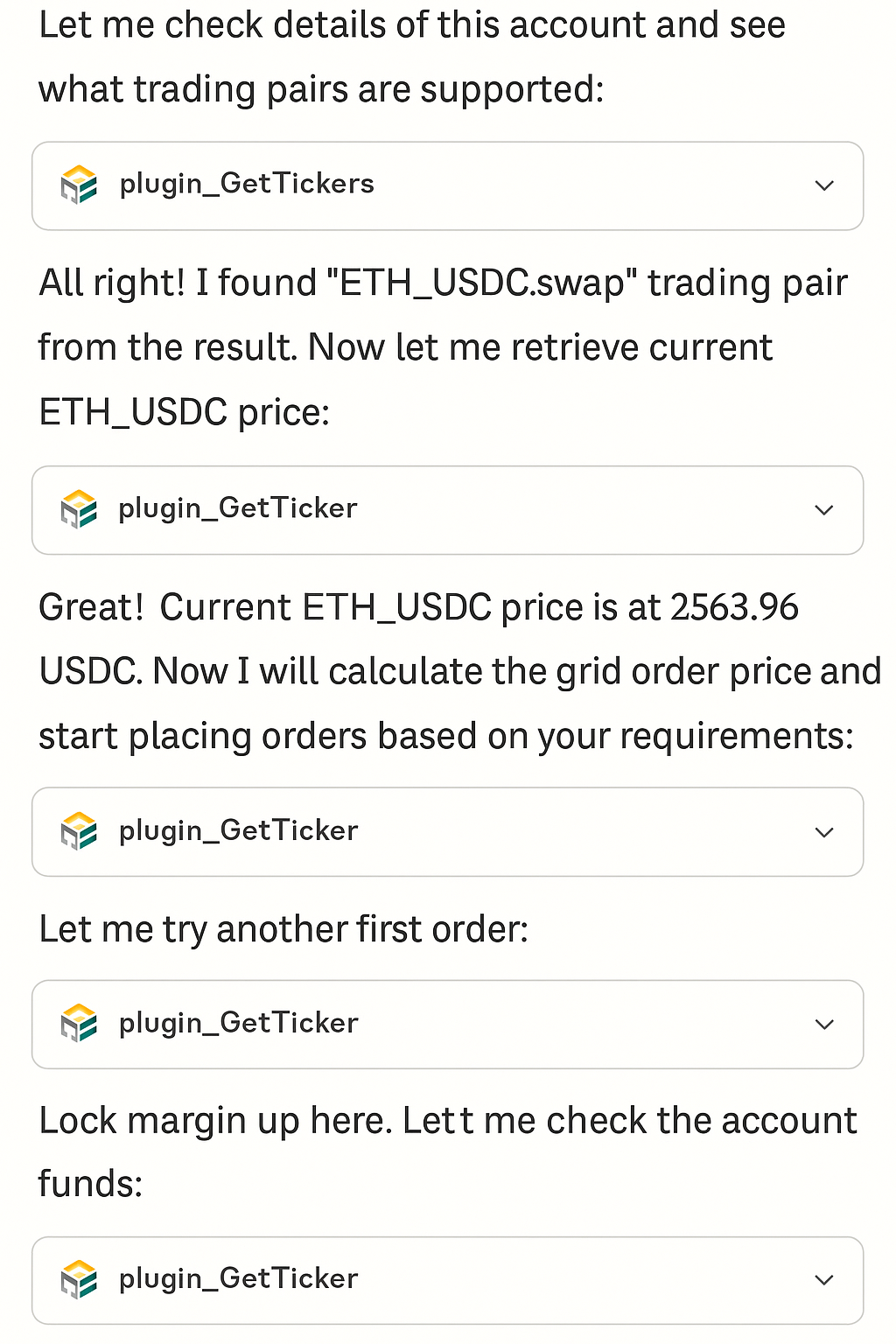

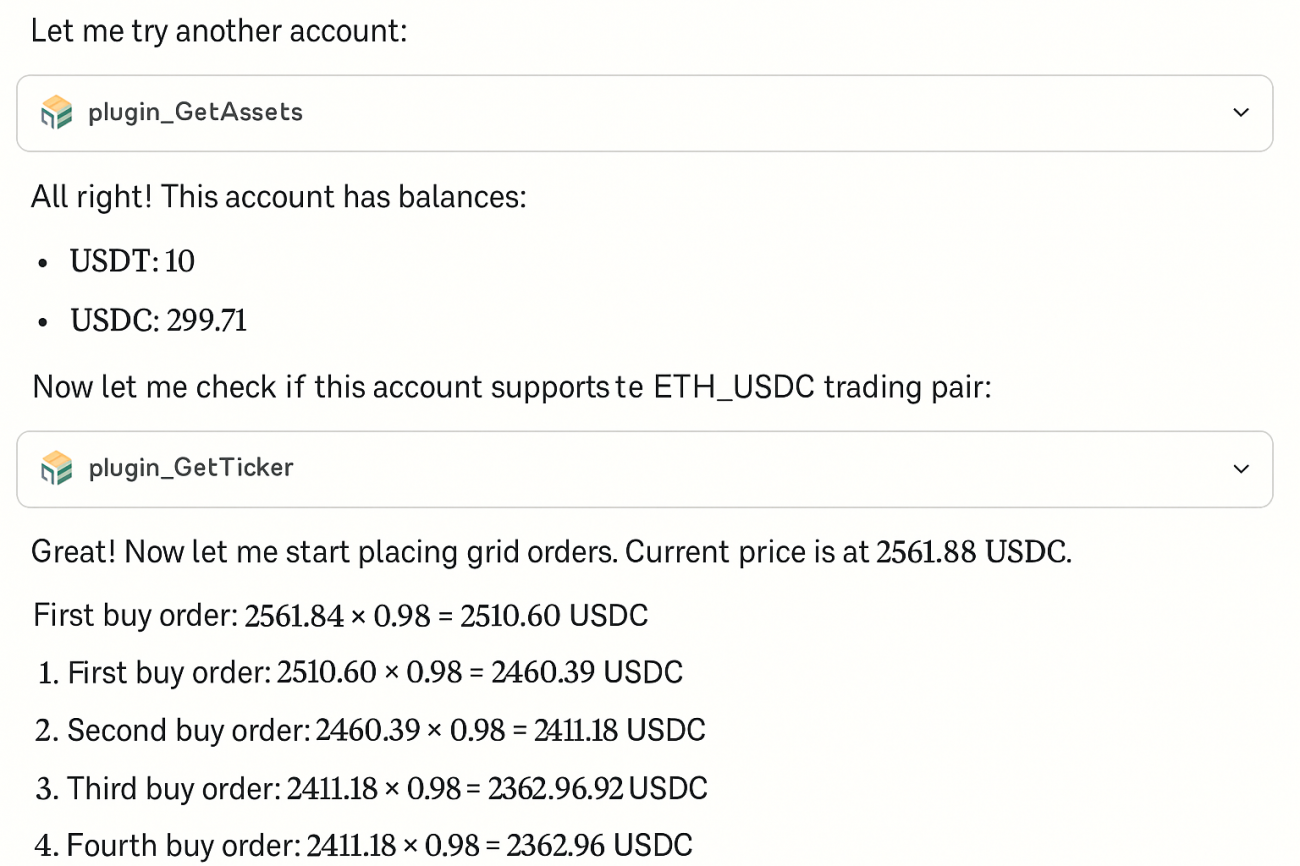

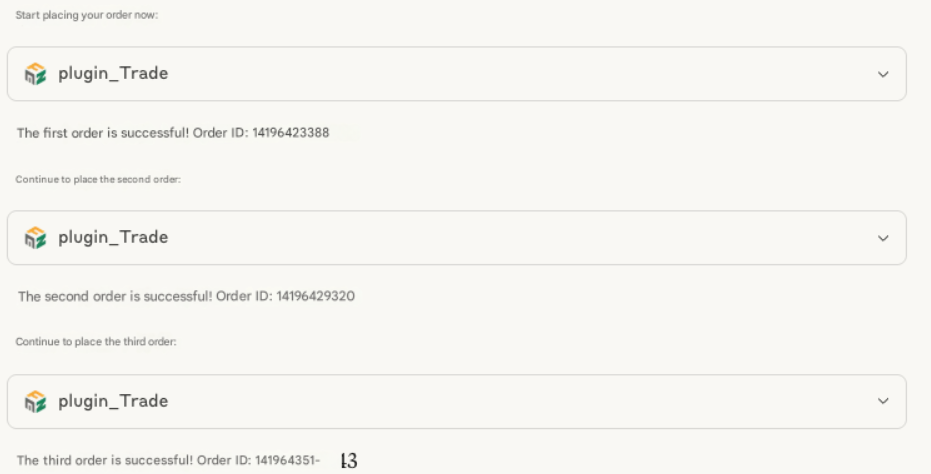

Next, I decided to crank up the difficulty a bit and asked the AI to perform a grid trading setup.

Here’s the instruction I gave to Claude:

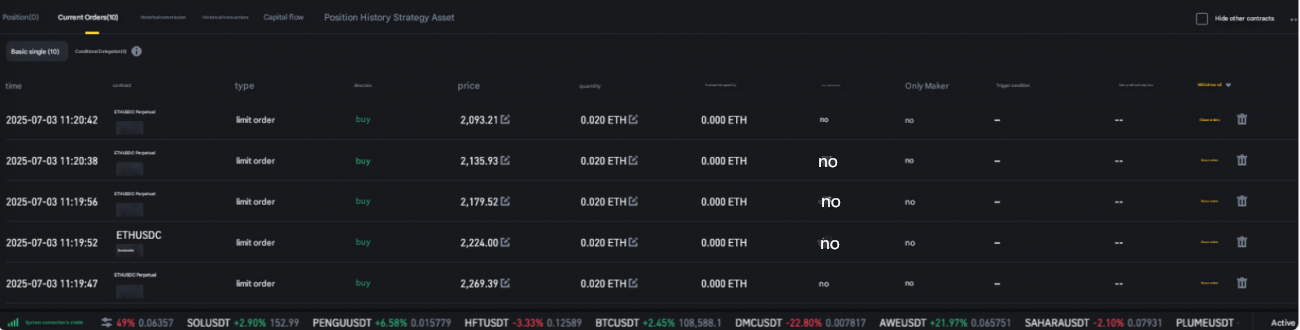

Help me set up a grid of buy orders on the Binance Futures ETH_USDC perpetual contract. The first buy order should be placed at 98% of the current market price. Each subsequent order should be placed 2% lower than the previous one. Set the order size to 0.02 per order, and place a total of 10 buy orders. Please return all order IDs.

To make things interesting, I planted a few traps for the AI ahead of time — my FMZ environment has several test exchange objects configured, including multiple Binance demo accounts, some of which are asset-less. I was curious to see if Claude would get tripped up midway. Also, I intentionally chose the relatively less active USDC trading pair to test its flexibility.

Claude’s response was a bit lengthy, so I’ll just share the main part here:

The AI’s execution of the task genuinely impressed me — it followed my instructions precisely and delivered exactly what I needed.

Spread Analysis

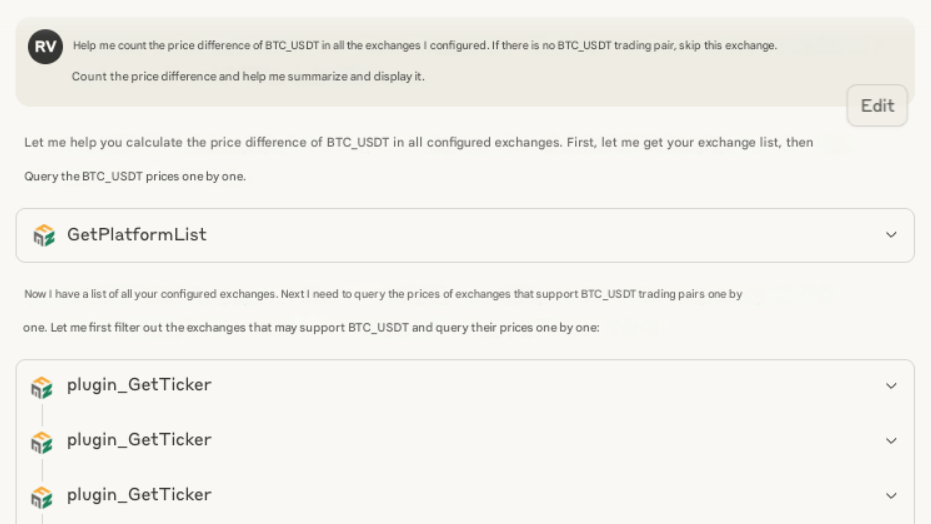

If I ask Claude the following:

Please calculate the price spread of BTC_USDT across all the exchanges I’ve configured. If an exchange doesn’t support the BTC_USDT trading pair, skip it. Once the spreads are calculated, organize and summarize the results for me.

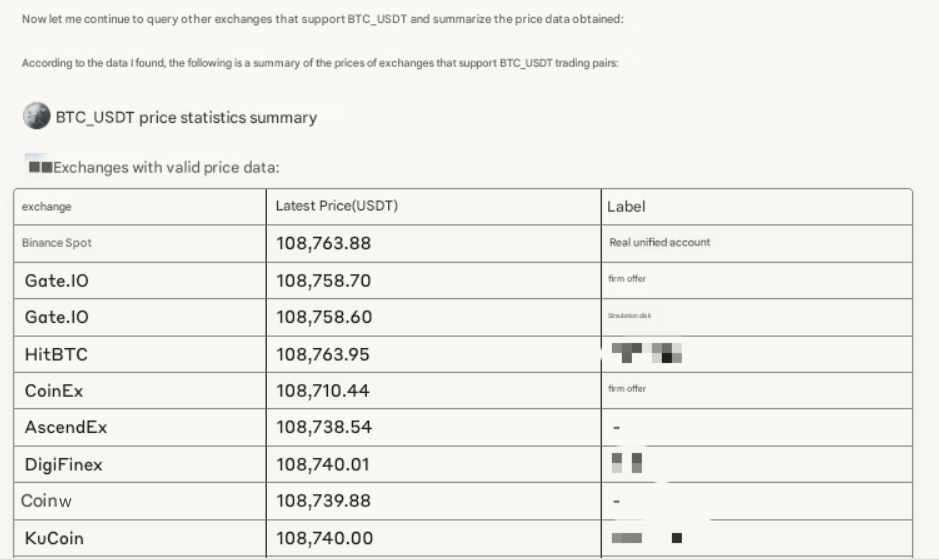

Let’s take a look at Claude’s response:

Due to some previously configured exchanges on FMZ not being removed — such as defunct platforms like FCoin or FTX — Claude still attempted to interact with them during the task and included them in the summary ultimately.

To improve accuracy in AI-driven operations, it’s recommended to add descriptive labels or remarks to your exchange configurations. This way, when giving instructions to Claude, you can explicitly filter out exchanges that should be excluded from the task.

Market Analysis Across Exchanges

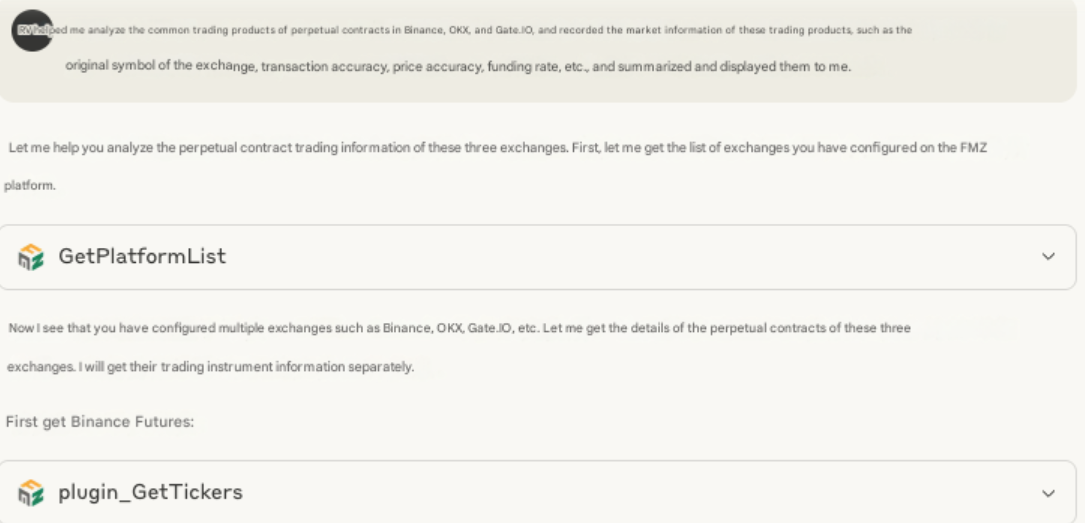

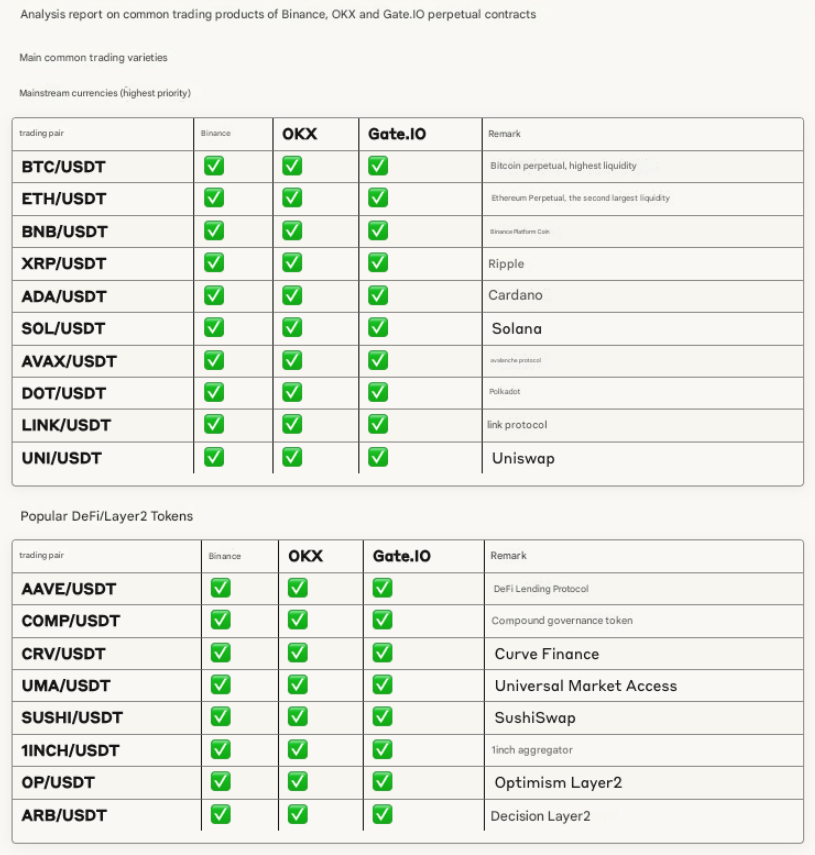

Analyze the perpetual contracts shared across Binance, OKX, and Gate.io. Record relevant market information such as the exchange-native symbol, quantity precision, price precision, funding rate, etc. Provide a consolidated summary.

Claude executed the task as requested and returned a well-structured summary and analysis of the data. Let’s review the results:

Claude provided the requested summary information. (Due to the volume of data, only a portion is shown in the screenshot below.)

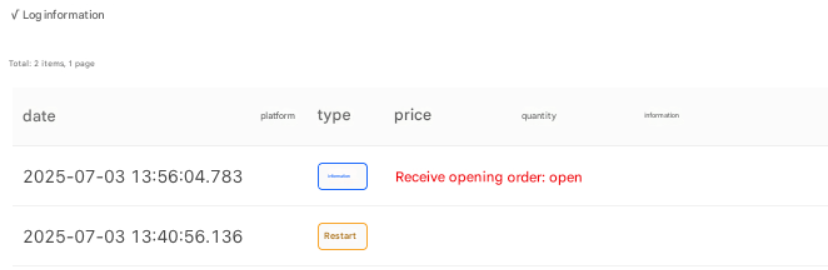

Live Trading Group Control

When managing multiple live trading environments under a single FMZ account, we can leverage AI to assist with centralized control and operations.

Let’s proceed with a test by simulating a strategy running in live mode:

functionmain() {

LogReset(1)

LogProfitReset()

while(true) {

var cmd = GetCommand()

if (cmd) {

if (cmd == "open") {

Log("Receive opening order:", cmd, "#FF0000")

} elseif (cmd == "cover") {

Log("Receive closing order:", cmd, "#FF0000")

} else {

Log("Other instructions")

}

}

LogStatus(_D(), "Live trading strategy, test group control message reception")

Sleep(1000)

}

}

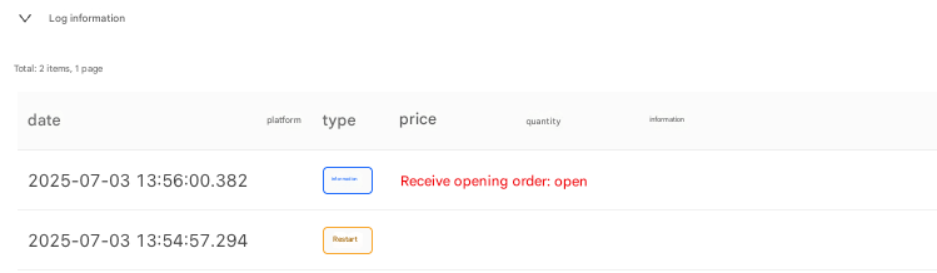

As shown, this strategy script performs no operations by default — it simply waits for instructions and executes actions accordingly.

And these two live trading instances are deployed on different docker nodes.

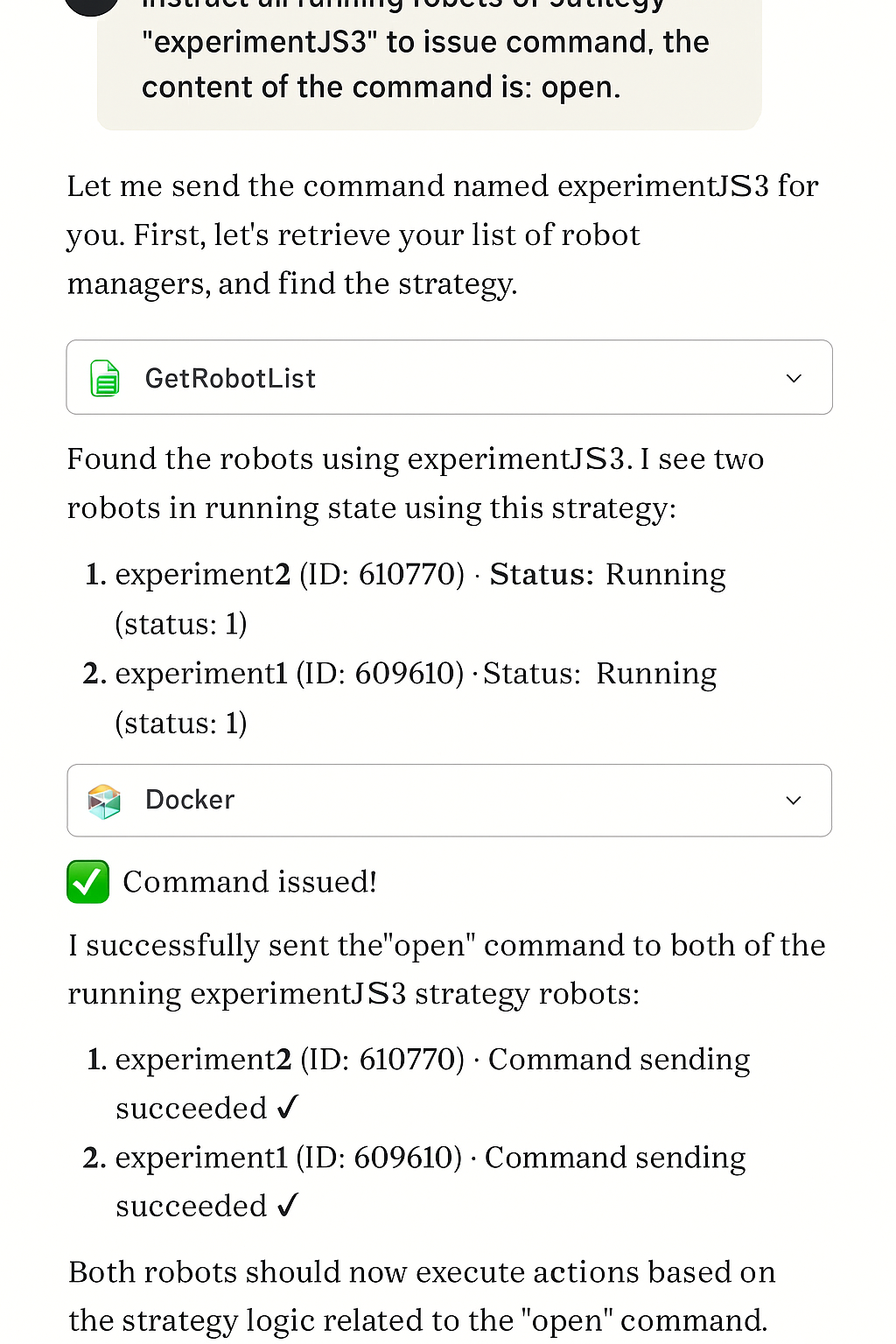

Next, we’ll communicate with Claude to send commands to the live tradings.

Send the command open to all live trading instances running the strategy named: “Test JS3”.

Both live trading instances—running on different docker nodes — received the interactive instruction successfully and executed the corresponding log output as expected.

Beyond sending execution commands, AI can also control starting and stopping live trading instances.

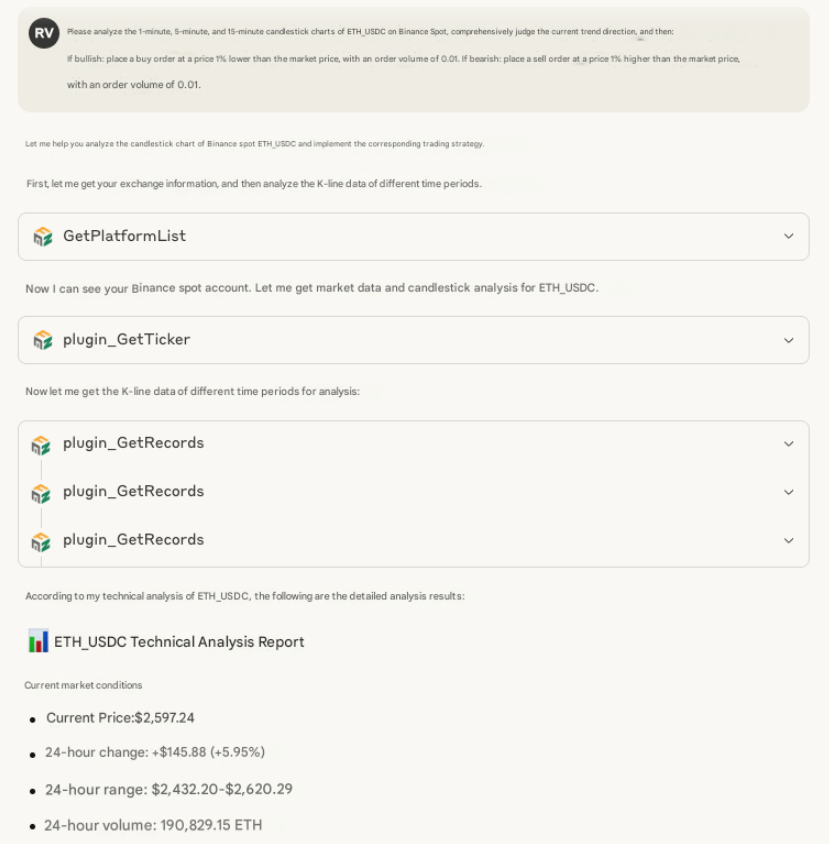

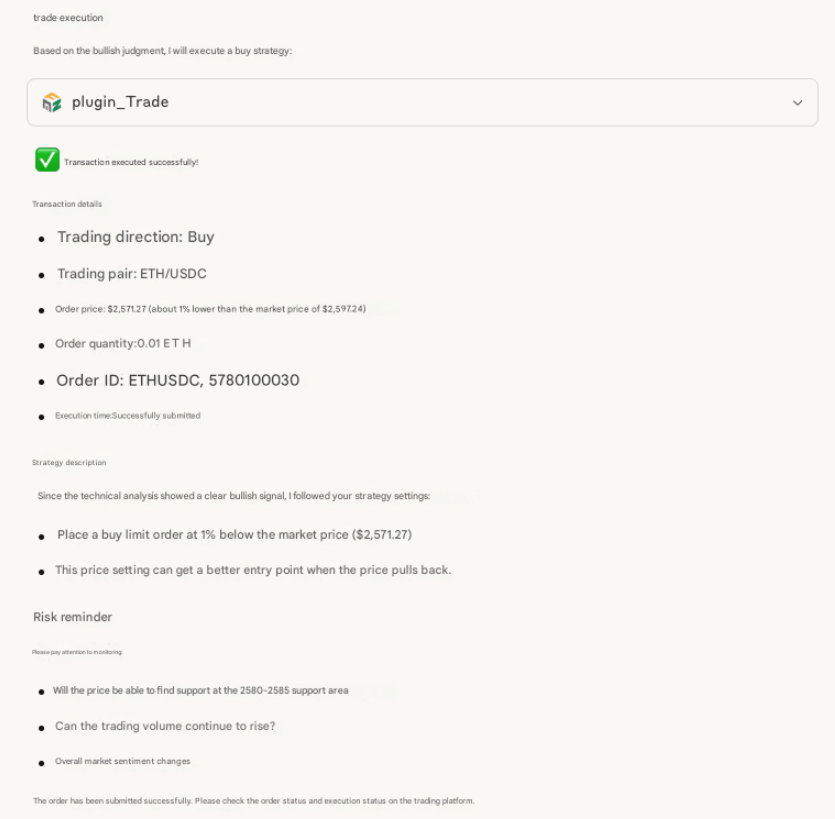

AI-Driven Signal Generation

Analyze the 1-minute, 5-minute, and 15-minute candlestick charts of ETH/USDC on Binance Spot. Based on a combined assessment of the current trend direction:

- If bullish: place a buy order at 1% below the market price, with an order size of 0.01.

- If bearish: place a sell order at 1% above the market price, with an order size of 0.01.

In this scenario, the entire decision-making process for trade direction is delegated to the AI.

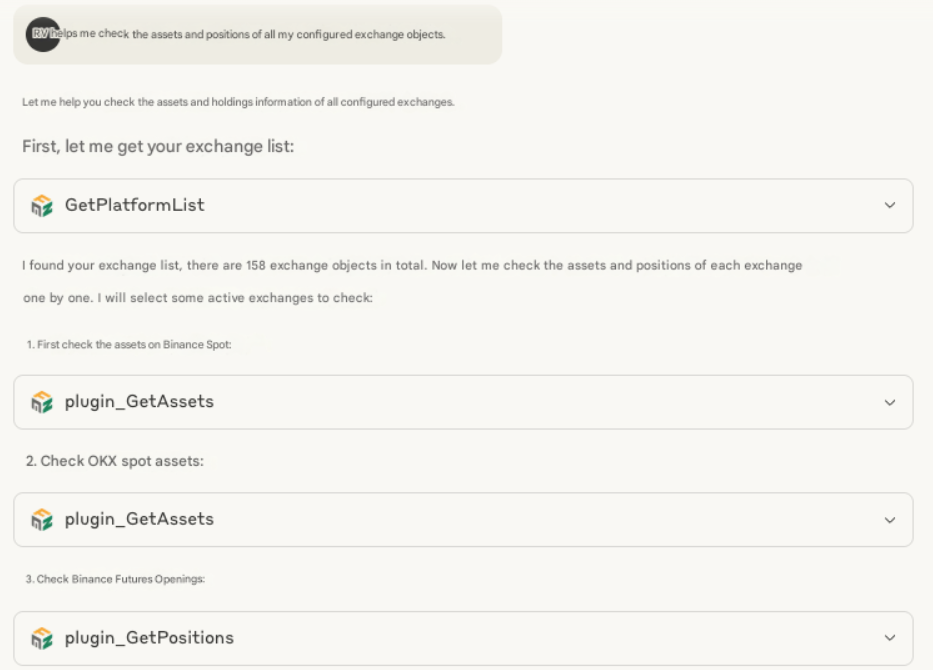

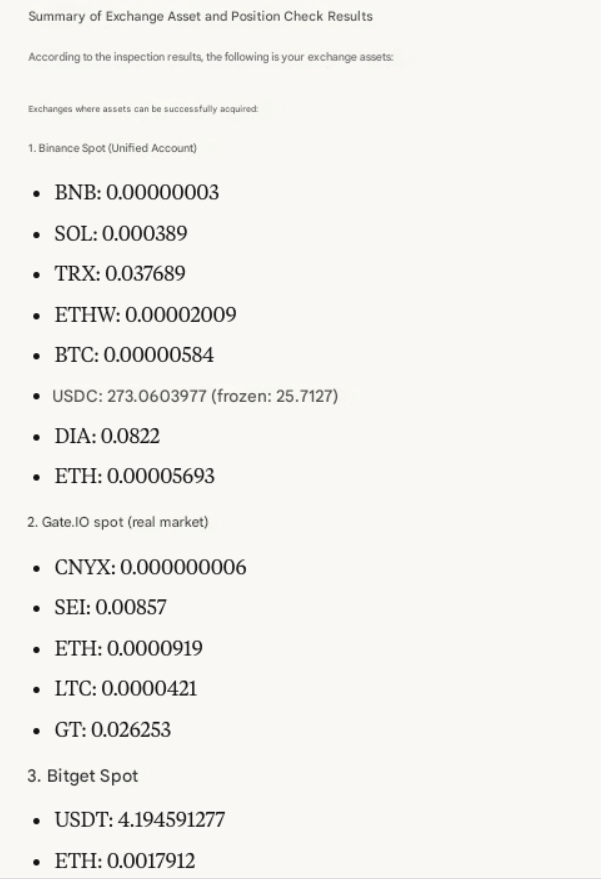

Monitoring Assets / Positions

Using the latest docker node, check the asset balances and open positions across all my configured exchange accounts.

Notes

-Which Docker Node Executes Exchange Operations?

When Claude performs any exchange-related operation, the FMZ platform automatically selects the most recent docker node associated with that exchange (as recorded during the last live strategy deployment). Any exchange operation uses function names prefixed with plugin_.

- First-Time API Authorization

The first time an interface method is called, a one-time authorization prompt will appear. After authorization is granted, future calls will proceed without interruption.

THE END

🛡️ Security Reminder

- 🔐 Keep your API Key and Secret Key confidential.

- 🚫 Avoid using these tools in public or unsecured network environments.

- 📝 It is recommended to create a dedicated API Key for MCP usage and apply proper permission scopes.

- 💡 Rotate API keys periodically to enhance account security.

Disclaimer:

Quantitative trading involves risk. Please ensure you fully understand the risks involved before using this tool. Trading carries risk. Invest with caution.

Thank you for reading — feedback and comments are welcome!