Some basic concepts

Fairy’s four-price is a short-term trading system based on yesterday’s closing price, yesterday’s highest price, yesterday’s lowest price and today’s opening price. The Fairy four-price system is also summarized by later generations, not what Fairy personally said. This system is just a trading strategy framework that contains Fairy’s subjective components.

From the current information, the inventor of the range-break system is Larry Williams, who invented the William indicator. He has more identities than the William indicator and the range-break system.

In 1987, he was still an unknown nameless person, but in this year, he participated in a trading competition held in the United States. A year later, Larry turned the initial fund of $10,000 into $1,147,607, 114, 114 times growth of the original fund, which was also the champion of that year. Such a game was later called the “World Cup Trading Championship”.

Ten years later, Larry’s daughter, Michelle Williams, also participated in the competition to commemorate Larry’s 10 years of winning, and she was an actor. In this competition, she turned $10,000 into $110,094, which was also the trading champion of the year.

We know that Japan has always studied in the United States. In 2000, Japan held a similar competition — the Robbins-Taicom Futures trading Championship, but unlike the US game, the game lasted only half a year. The person who get the first place is the Fairy we will talk about. If the ranking is calculated on the basis of the weekly earnings, Fairy has never left the champion seat of the week in the half-year competition, which shows the stability of his profit. The final income of Fairy is 1098%. Such achievements can also be ranked in the top three in the United States version game with 18 years of its history.

Fairy and the second place player of that competition, Michitaka Noda, wrote a book together — << 1000% Man — Futures Championship Miracle Trading Act >>, the first half is written by Fairy, and the second half is written by Michitaka. Fairy is written in the form of a diary, so it is difficult to see the trading theory and trading methods that Fairy sums up. Unless you study his every trade and the graphics where the trading was made on, then extracts his method based on his words. However, due to Japanese writing style and some translation problems, this is also difficult to do.

Fairy’s four-price is the trading method summarized by later future trading generations. It does not represent all the trading essence of Fairy trading method. From the outside view, we can only see the form, so can we add our own understanding on this trading method to see if we can form an effective trading strategy.

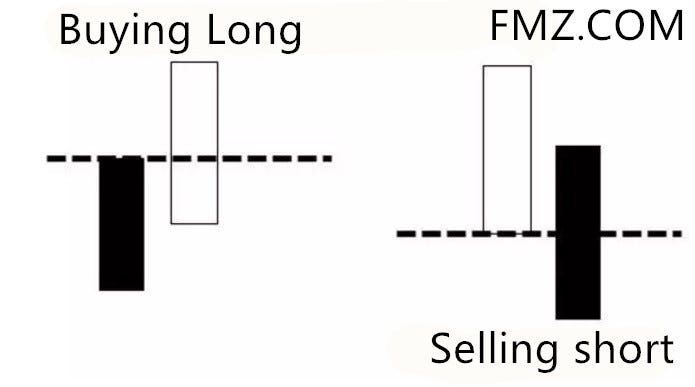

The basic method of Fairy’s four-price is as follows:

Upper rail = yesterday’s highest point;

Lower rail = yesterday’s lowest point;

The price broke through the upper rails buying long, and the price broke through the lower rails selling short, close all position no matter what before the day of the market closed.

However, if you trade according to this method, it only involves the two points of yesterday’s highest point and yesterday’s lowest point, and it can only be called “Fairy two-price”. What are the other two prices? Yesterday’s closing price and today’s opening price. Yesterday’s closing price and today’s opening price are not in the formula, they are part of the remaining subjective analysis.

Under normal circumstances, Fairy’s four prices are easy to operate. As shown in Figure 1, the opening price is in the range of the previous K line. When the price breaks through the previous highest or lowest price, the corresponding long or short position are created accordingly. If all goes well, you can hold it until the day closed.

Figure 2 is a chart of the Chinese commodity future contract of the rebar for the period from June 24 to July 27, 2016. The highest price of the leftmost K line in the figure is 2109, so when the second K line breaks through 2109, a long position order is placed at price 2110. Hold the position to the market closed at the price 2207. Earnings 97 points, 970 yuan per hand.

Figure 2 Rebar 1601 contract June 24 to July 27, 2016

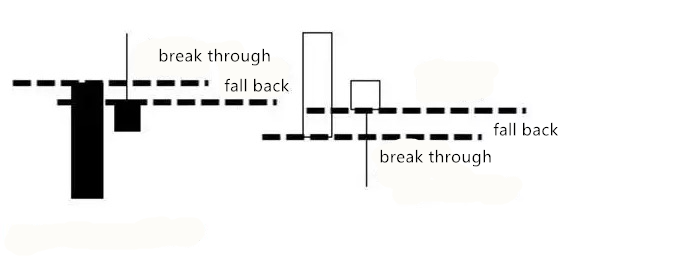

But what if it breaks the high point or break the low point and return to the original range? As shown in Figure 3, it evolved on the basis of the above example. When the price breaks through the highest or lowest price, once the price return to the opening price of the day, immediately stop the loss. This is the role of the opening price of the day in this trading system. Although, this is my understanding of Fairy’s method, not necessarily Fairy’s original intention.

Figure 3 Breaking through and return to the opening price of the day

Figure 4 is also a K-line diagram of the contract of rebar at that same time. At the top of the picture, the K line with a highest price of 2,489 yuan broke through the high point of the previous K line of 2,466 yuan. According to the method, a long position order should be placed at 2,467 yuan. However, the price began to fall after rising to 2,489, and finally below the opening price of 2,456 yuan, so we sold at 2,455 yuan to close the position. Loss 12 points, 120 yuan per hand.

Figure 4 Rebar breaks through the previous day’s highest price and fall below the opening price of current day.

But the problem is not that simple. If the given signal appears and the price just “rocket launch”, you don’t need worry much. But if the price break through the highest and lowest prices of the day, and then repeatedly cross up and down the opening price of the day in a short time, then we will fall into repeated open positions and stop losses. So, in this case, it is required the help of the smaller-level hourly K line chart.

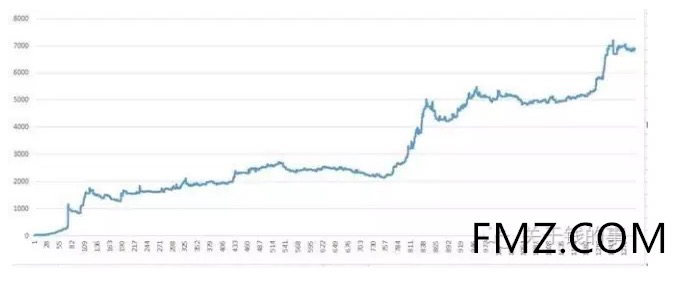

Fairy four-price short-term back test

The backtesting of the short-term trading system, for the Shanghai Composite Index, can only use its weekly data samples. On the backtesting details, when the opening price is within the K line of the previous week, the Fairy four-price system is trading normally. If the opening price shows an upward gap, buy directly at the opening price. Since there is a subjective analysis in the Fairy system, there is no stop loss.

Understanding

Before the opening of the position, basically know the direction of the opening of the position. When the price is near the highest price of the previous day, prepare to buy long. Conversely, when the price is near the lowest price of the previous day, it is ready to sell short. According to the stop loss method mentioned above, I know where to open the position, and I should know where to stop the loss.

Suppose you have 100,000 yuan, and the principle is not losing more than 2% of the total funds per transaction, then you can risk only 2,000 yuan. If you build a position and the stop loss is 24 points apart, in the ordinary commodity futures, 10 yuan per point, that is, 1 contract will lose 240 yuan. How many hands can I cover in 2000 yuan? 2000/240=8.33, so you can only open 8 hands position. If you are more conservative, you can take the risk of 1% of the total funds each time and do 4 contracts.

As long as one hour later breaks through the highest point, the stop loss will follow the lowest price of the hourly K line. After basically two consecutive hours of breakthrough, the stop loss will change to the “no cost” profit level. Although, there is also your subjective judgment. If the price movement is becoming weaker, the profit will be less in a few hours, and the stop loss has not changed. Then you can give up the stop-loss method with the lowest point of the hourly line, and change the take profit place to the opening position adding certain range. Why do you want to add certain range? In order to pay the commission fee. In this way, even if the kinetic energy of the price increase is weak, there will be no loss. This kind of application exists between one thought. If you do not have the subjective analysis ability, it is better to follow the rules.

Multiple systems can be used at the same time. For example, we use Fairy’s four-price system to open a long position, and the stop loss has become a profit-taking position. In other words, we have made a profit, and after we put in a take profit order, the profit has been locked. At the same time, the RangeBreak system also gives a buying signal, at which point you can add some position with the trend.

How many positions are added? This is another question. Basically, you must also set a stop loss after you add a position. The general principle is that the total stop loss amount after the adding position cannot exceed the amount of your profit. In short, no matter how much you add, you must use the money you earn.

For example, if you buy 2 lottery tickets every day, you will never buy more. You will get 5 yuan a day, and you will get rid of the cost and profit of 3 yuan. Then you want to buy more on this day, you can only buy one more bet, because the cost of this 1 bet is the money you earn, and can’t exceed the limit of 2 yuan per day.