(Please note that this strategy has expired and is for learning purposes only.)

This is a high-frequency trading strategy on the OKCoin bitcoin trading platform. Running from June 2016, to mid-January 2017, this strategy successfully accumulated the initial investment of 6,000 yuan to 250,000 yuan. Due to the recent high-pressure policy of the central bank on Bitcoin, all major platforms have stopped allocating funds and began to collect transaction fees. This strategy has actually failed, but still a good lesson for a trend strategy design.

This strategy is based on two main ideas:

Trend principle: When the price fluctuates in a trend, the order is followed up in time, that is, chasing the price no matter it raises or falls.

Balance principle: When the opened position deviates from 50%, the small order is released to make the position gradually return to 50%, preventing the reversal of the end of the trend and causing the retreat, that is, take the profit in time.

This strategy requires a balanced position, ie (funds money + financing money = financing coin), so that when the position is 50%, the net assets do not fluctuate with the price, and also ensure that both the ups and downs of the trend fluctuations are earned.

function LeeksReaper() {

var self = {}

self.numTick = 0

self.lastTradeId = 0

self.vol = 0

self.askPrice = 0

self.bidPrice = 0

self.orderBook = {Asks:[], Bids:[]}

self.prices = []

self.tradeOrderId = 0

self.p = 0.5

self.account = null

self.preCalc = 0

self.preNet = 0

self.updateTrades = function() {

var trades = _C(exchange.GetTrades)

if (self.prices.length == 0) {

while (trades.length == 0) {

trades = trades.concat(_C(exchange.GetTrades))

}

for (var i = 0; i < 15; i++) {

self.prices[i] = trades[trades.length - 1].Price

}

}

self.vol = 0.7 * self.vol + 0.3 * _.reduce(trades, function(mem, trade) {

// Huobi not support trade.Id

if ((trade.Id > self.lastTradeId) || (trade.Id == 0 && trade.Time > self.lastTradeId)) {

self.lastTradeId = Math.max(trade.Id == 0 ? trade.Time : trade.Id, self.lastTradeId)

mem += trade.Amount

}

return mem

}, 0)

}

self.updateOrderBook = function() {

var orderBook = _C(exchange.GetDepth)

self.orderBook = orderBook

if (orderBook.Bids.length < 3 || orderBook.Asks.length < 3) {

return

}

self.bidPrice = orderBook.Bids[0].Price * 0.618 + orderBook.Asks[0].Price * 0.382 + 0.01

self.askPrice = orderBook.Bids[0].Price * 0.382 + orderBook.Asks[0].Price * 0.618 - 0.01

self.prices.shift()

self.prices.push(_N((orderBook.Bids[0].Price + orderBook.Asks[0].Price) * 0.35 +

(orderBook.Bids[1].Price + orderBook.Asks[1].Price) * 0.1 +

(orderBook.Bids[2].Price + orderBook.Asks[2].Price) * 0.05))

}

self.balanceAccount = function() {

var account = exchange.GetAccount()

if (!account) {

return

}

self.account = account

var now = new Date().getTime()

if (self.orderBook.Bids.length > 0 && now - self.preCalc > (CalcNetInterval * 1000)) {

self.preCalc = now

var net = _N(account.Balance + account.FrozenBalance + self.orderBook.Bids[0].Price * (account.Stocks + account.FrozenStocks))

if (net != self.preNet) {

self.preNet = net

LogProfit(net)

}

}

self.btc = account.Stocks

self.cny = account.Balance

self.p = self.btc * self.prices[self.prices.length-1] / (self.btc * self.prices[self.prices.length-1] + self.cny)

var balanced = false

if (self.p < 0.48) {

Log("Start balancing", self.p)

self.cny -= 300

if (self.orderBook.Bids.length >0) {

exchange.Buy(self.orderBook.Bids[0].Price + 0.00, 0.01)

exchange.Buy(self.orderBook.Bids[0].Price + 0.01, 0.01)

exchange.Buy(self.orderBook.Bids[0].Price + 0.02, 0.01)

}

} else if (self.p > 0.52) {

Log("Start balancing", self.p)

self.btc -= 0.03

if (self.orderBook.Asks.length >0) {

exchange.Sell(self.orderBook.Asks[0].Price - 0.00, 0.01)

exchange.Sell(self.orderBook.Asks[0].Price - 0.01, 0.01)

exchange.Sell(self.orderBook.Asks[0].Price - 0.02, 0.01)

}

}

Sleep(BalanceTimeout)

var orders = exchange.GetOrders()

if (orders) {

for (var i = 0; i < orders.length; i++) {

if (orders[i].Id != self.tradeOrderId) {

exchange.CancelOrder(orders[i].Id)

}

}

}

}

self.poll = function() {

self.numTick++

self.updateTrades()

self.updateOrderBook()

self.balanceAccount()

var burstPrice = self.prices[self.prices.length-1] * BurstThresholdPct

var bull = false

var bear = false

var tradeAmount = 0

if (self.account) {

LogStatus(self.account, 'Tick:', self.numTick, ', lastPrice:', self.prices[self.prices.length-1], ', burstPrice: ', burstPrice)

}

if (self.numTick > 2 && (

self.prices[self.prices.length-1] - _.max(self.prices.slice(-6, -1)) > burstPrice ||

self.prices[self.prices.length-1] - _.max(self.prices.slice(-6, -2)) > burstPrice && self.prices[self.prices.length-1] > self.prices[self.prices.length-2]

)) {

bull = true

tradeAmount = self.cny / self.bidPrice * 0.99

} else if (self.numTick > 2 && (

self.prices[self.prices.length-1] - _.min(self.prices.slice(-6, -1)) < -burstPrice ||

self.prices[self.prices.length-1] - _.min(self.prices.slice(-6, -2)) < -burstPrice && self.prices[self.prices.length-1] < self.prices[self.prices.length-2]

)) {

bear = true

tradeAmount = self.btc

}

if (self.vol < BurstThresholdVol) {

tradeAmount *= self.vol / BurstThresholdVol

}

if (self.numTick < 5) {

tradeAmount *= 0.8

}

if (self.numTick < 10) {

tradeAmount *= 0.8

}

if ((!bull && !bear) || tradeAmount < MinStock) {

return

}

var tradePrice = bull ? self.bidPrice : self.askPrice

while (tradeAmount >= MinStock) {

var orderId = bull ? exchange.Buy(self.bidPrice, tradeAmount) : exchange.Sell(self.askPrice, tradeAmount)

Sleep(200)

if (orderId) {

self.tradeOrderId = orderId

var order = null

while (true) {

order = exchange.GetOrder(orderId)

if (order) {

if (order.Status == ORDER_STATE_PENDING) {

exchange.CancelOrder(orderId)

Sleep(200)

} else {

break

}

}

}

self.tradeOrderId = 0

tradeAmount -= order.DealAmount

tradeAmount *= 0.9

if (order.Status == ORDER_STATE_CANCELED) {

self.updateOrderBook()

while (bull && self.bidPrice - tradePrice > 0.1) {

tradeAmount *= 0.99

tradePrice += 0.1

}

while (bear && self.askPrice - tradePrice < -0.1) {

tradeAmount *= 0.99

tradePrice -= 0.1

}

}

}

}

self.numTick = 0

}

return self

}

function main() {

var reaper = LeeksReaper()

while (true) {

reaper.poll()

Sleep(TickInterval)

}

}

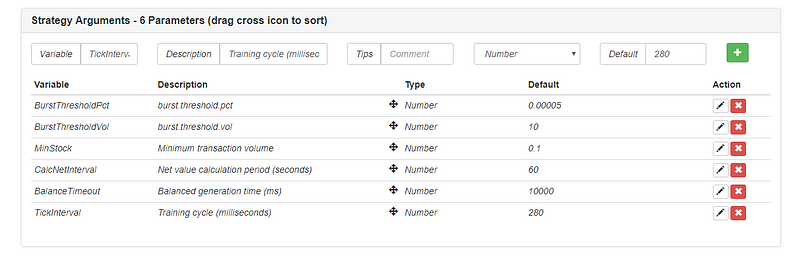

also the Strategy Arguments setting:

for more information, please see: https://www.fmz.com/bbs-topic/2287