Data Cycle: 15M, 30M, etc.

Support: Commodity Futures

Indicators are EMA, KD lines, and KD line use default parameters (index parameters fixed 3, 3, 9)

- Main chart:

EMA mean, formula: MAC ^^ EMA (C, N); - Secondary chart:

K line in KD, formula: K: SMA (RSV, M1, 1); //RSV moving average

D line in KD, formula: D: SMA (K, M2, 1); //K moving average value

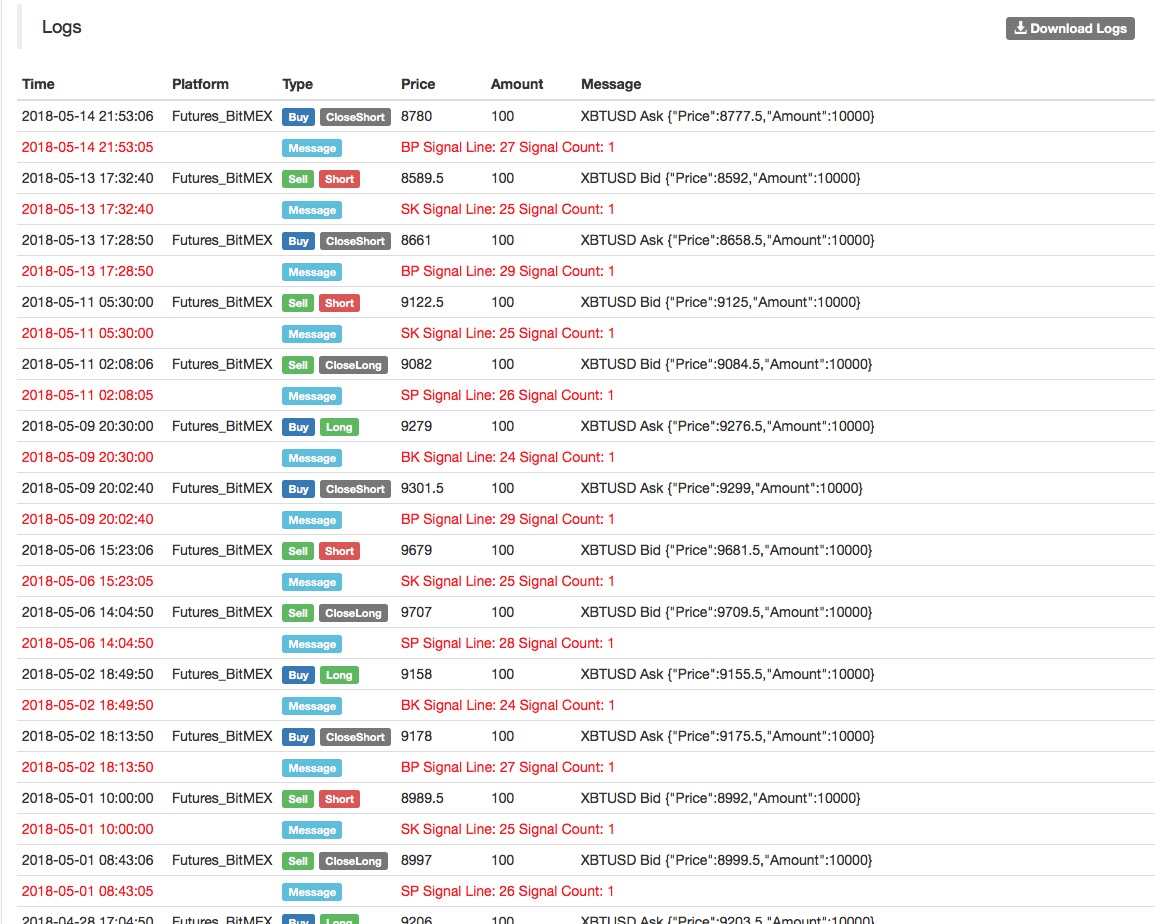

(*backtest

start: 2018-04-01 00:00:00

end: 2018-05-15 00:00:00

period: 30m

exchanges: [{"eid":"Futures_BitMEX","currency":"XBT_USD"}]

args: [["TradeAmount",100,126961],["ContractType","XBTUSD",126961]]

*)

MAC^^EMA(C,N);

NKD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,NKD))/(HHV(HIGH,NKD)-LLV(LOW,NKD))*100;

//(1)closing price minus the lowest value in NKD cycle,

(2)the highest value in NKD cycle minus the lowest value in NKD cycle,

then (1) divided by (2).

K:SMA(RSV,M1,1);//MA of RSV

D:SMA(K,M2,1);//MA of K

BARPOS>N AND C>MAC AND K<D,BK;

BARPOS>N AND C<MAC AND K>D,SK;

C<=BKPRICE*(1-SLOSS*0.01),SP(BKVOL);

C>=SKPRICE*(1+SLOSS*0.01),BP(SKVOL);

C>=BKPRICE*(1+SLOSS*0.01) AND C<MAC,SP(BKVOL);

C<=SKPRICE*(1-SLOSS*0.01) AND C>MAC,BP(SKVOL);

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128249