Enter: The average of difference of opening price minus closing price determines the trend combined with ATR,

the entry point is also the exit point in reverse;

Exit: Stop-loss point should be fixed at the opening of the position,

and if there is a reverse trend in price, close the position.

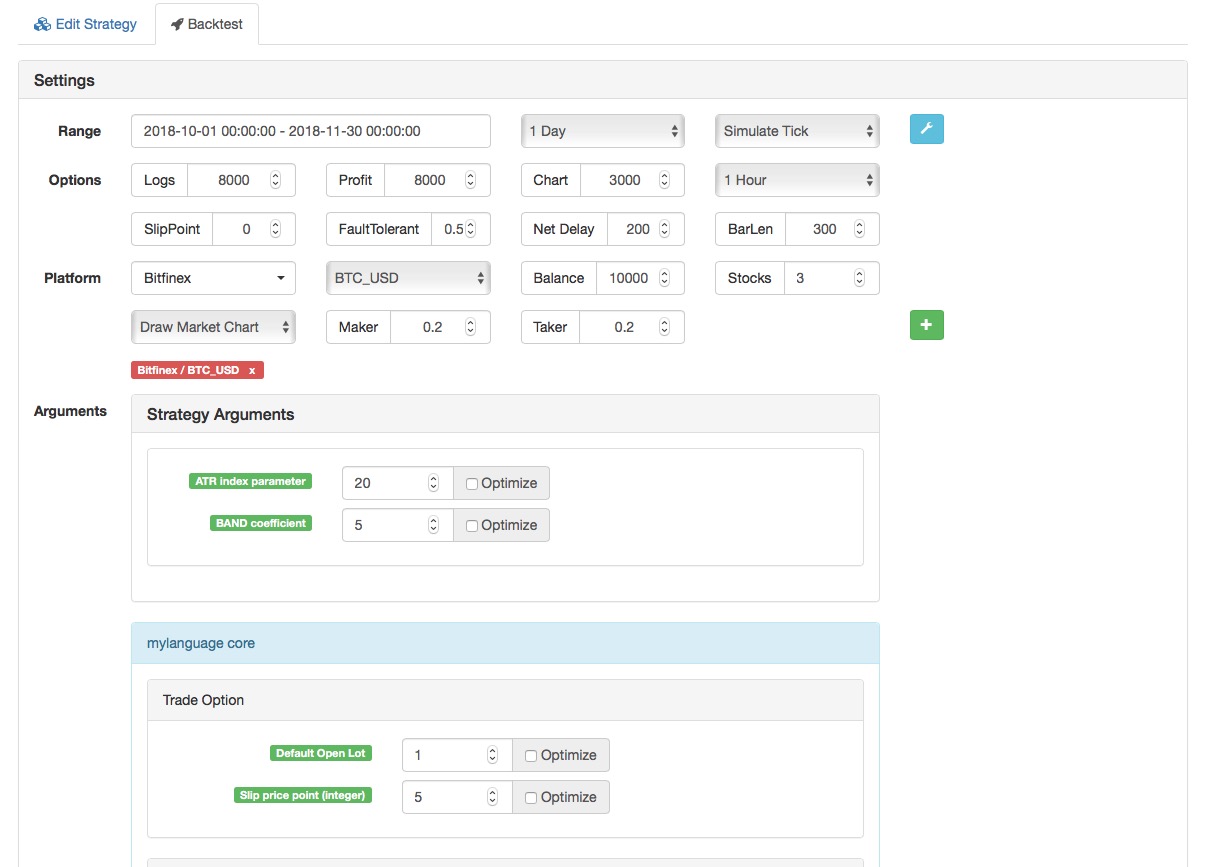

Data Cycle: 1 Day

Data contract: index contract

Transaction contract: main contract

- Main chart:

none - Secondary chart:

ATR, formula ATR ^^ MA (TR, N);

C_O, formula C_O: EMA (C, N) – EMA (O, N);

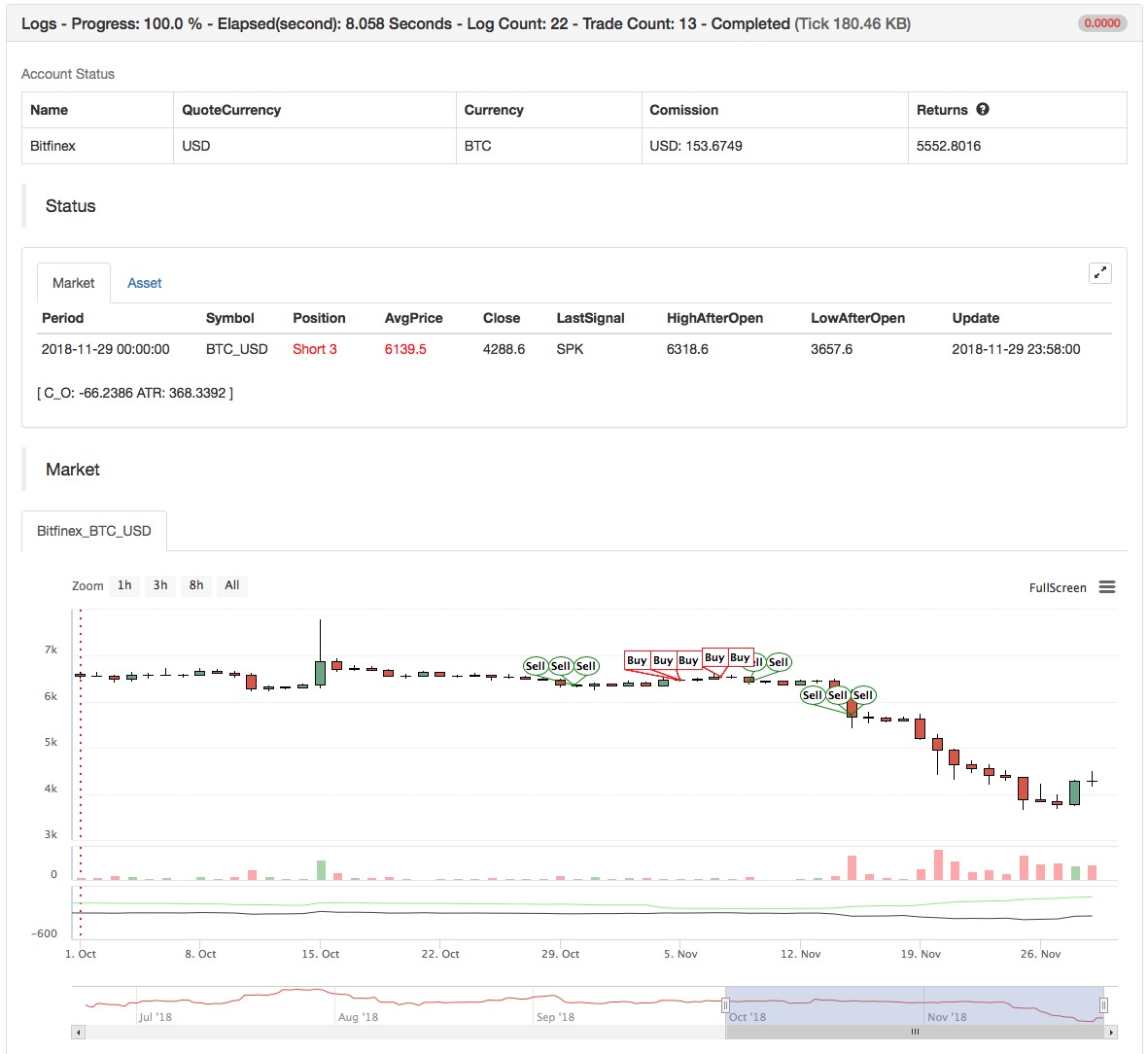

(*backtest

start: 2018-10-01 00:00:00

end: 2018-11-30 00:00:00

period: 1d

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES","balance":20000}]

*)

// variable

LOTS:=MAX(1,INTPART(MONEYTOT/(O*UNIT*0.1)));

C_O:EMA(C,N)-EMA(O,N);

B:=CROSSUP(C_O,0);

S:=CROSSDOWN(C_O,0);

TR:=MAX(MAX((H-L),ABS(REF(C,1)-H)),ABS(REF(C,1)-L));

ATR:MA(TR,N);

BAND:=ATR*0.1*M;

PRICE_BPK:=VALUEWHEN(B,H+BAND);

PRICE_SP:=VALUEWHEN(B,L-BAND);

PRICE_SPK:=VALUEWHEN(S,L-BAND);

PRICE_BP:=VALUEWHEN(S,H+BAND);

// strategy logic

BARPOS>N AND C_O>0 AND C>=PRICE_BPK,BPK(LOTS);

BARPOS>N AND C_O<0 AND C<=PRICE_SPK,SPK(LOTS);

// place an order

S,SP(BKVOL);

B,BP(SKVOL);

C<=PRICE_SP,SP(BKVOL);

C>=PRICE_BP,BP(SKVOL);

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128136