The cup and handle is both a continuation and a reversal pattern. The reversal pattern marks the end of a downtrend, and shows the price transitioning into an uptrend. The continuation pattern occurs ...

The head and shoulders (HS) is a reversal pattern signaling the prior trend is reversing, or has already reversed. The HS top alerts traders that an uptrend is over and the price could head lower, whi...

The size of a chart pattern, and where it occurs within a trend, provides clues as to how big the next price move will be once the chart pattern completes. When the price finally breaks out of the cha...

Technical traders use the price history of any asset, and the price patterns that form, as a basis for making trading decision and analysis. This is called technical analysis, a technique that uses th...

Scalping is a trading strategy geared towards profiting from minor price changes in a stock’s price. Traders who implement this strategy place anywhere from 10 to a few hundred trades ...

A day trader executes short and long trades to capitalize on intraday market price action resulting from temporary supply and demand inefficiencies. BREAKING DOWN Day Trader A day trader often closes ...

Swing trading has been described as a kind of fundamental trading in which positions are held for longer than a single day. Most fundamentalists are actually swing traders since changes in corpor...

What Is Buy and Hold? Buy and hold is a passive investment strategy in which an investor buys stocks (or other types of securities such as ETFs) and holds them for a long period regardless o...

What is Active Trading Active trading refers to buying and selling securities for quick profit based on short-term movements in price. BREAKING DOWN Active Trading Active trading seeks profit from pri...

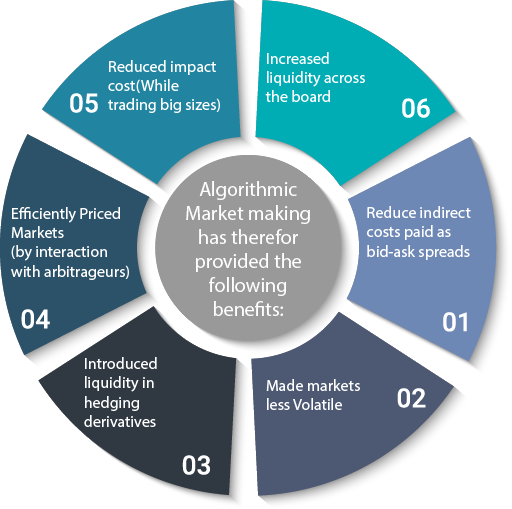

Active trading is the act of buying and selling securities based on short-term movements to profit from the price movements on a short-term stock chart. The mentality associated with an active tr...