It is completely transplanted from the “CTP Commodity Futures Variety Moving Average Strategy“. Since the Python version of the commodity futures strategy does not yet have a multi-variety strategy, the JavaScript version of the “CTP Commodity Futures Multi-Variable Moving Average Strategy” was ported. Providing some design ideas and examples of Python commodity futures multi-variety strategy. Regardless of the JavaScript version or the Python version, the strategy architecture design originates from the Commodity futures multi-varieties turtle strategy.

As the simplest strategy, the moving average strategy is very easy to learn, because the moving average strategy does not have any advanced algorithms and complex logic. The ideas are clear and easy, allowing beginners to focus more on the study of strategy design, and even remove the coding related part, leaving a multi-variety strategy framework that can be easily expanded into ATR, MACD, BOLL and other indicator strategies.

Articles related to the JavaScript version: https://www.fmz.com/bbs-topic/5235.

Strategy source code

'''backtest

start: 2019-07-01 09:00:00

end: 2020-03-25 15:00:00

period: 1d

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

'''

import json

import re

import time

_bot = ext.NewPositionManager()

class Manager:

'Strategy logic control'

ACT_IDLE = 0

ACT_LONG = 1

ACT_SHORT = 2

ACT_COVER = 3

ERR_SUCCESS = 0

ERR_SET_SYMBOL = 1

ERR_GET_ORDERS = 2

ERR_GET_POS = 3

ERR_TRADE = 4

ERR_GET_DEPTH = 5

ERR_NOT_TRADING = 6

errMsg = ["Success", "Failed to switch contract", "Failed to get order info", "Failed to get position info", "Placing Order failed", "Failed to get order depth info", "Not in trading hours"]

def __init__(self, needRestore, symbol, keepBalance, fastPeriod, slowPeriod):

# Get symbolDetail

symbolDetail = _C(exchange.SetContractType, symbol)

if symbolDetail["VolumeMultiple"] == 0 or symbolDetail["MaxLimitOrderVolume"] == 0 or symbolDetail["MinLimitOrderVolume"] == 0 or symbolDetail["LongMarginRatio"] == 0 or symbolDetail["ShortMarginRatio"] == 0:

Log(symbolDetail)

raise Exception("Abnormal contract information")

else :

Log("contract", symbolDetail["InstrumentName"], "1 lot", symbolDetail["VolumeMultiple"], "lot, Maximum placing order quantity", symbolDetail["MaxLimitOrderVolume"], "Margin rate: ", _N(symbolDetail["LongMarginRatio"]), _N(symbolDetail["ShortMarginRatio"]), "Delivery date", symbolDetail["StartDelivDate"])

# Initialization

self.symbol = symbol

self.keepBalance = keepBalance

self.fastPeriod = fastPeriod

self.slowPeriod = slowPeriod

self.marketPosition = None

self.holdPrice = None

self.holdAmount = None

self.holdProfit = None

self.task = {

"action" : Manager.ACT_IDLE,

"amount" : 0,

"dealAmount" : 0,

"avgPrice" : 0,

"preCost" : 0,

"preAmount" : 0,

"init" : False,

"retry" : 0,

"desc" : "idle",

"onFinish" : None

}

self.lastPrice = 0

self.symbolDetail = symbolDetail

# Position status information

self.status = {

"symbol" : symbol,

"recordsLen" : 0,

"vm" : [],

"open" : 0,

"cover" : 0,

"st" : 0,

"marketPosition" : 0,

"lastPrice" : 0,

"holdPrice" : 0,

"holdAmount" : 0,

"holdProfit" : 0,

"symbolDetail" : symbolDetail,

"lastErr" : "",

"lastErrTime" : "",

"isTrading" : False

}

# Other processing work during object construction

vm = None

if RMode == 0:

vm = _G(self.symbol)

else:

vm = json.loads(VMStatus)[self.symbol]

if vm:

Log("Ready to resume progress, current contract status is", vm)

self.reset(vm[0])

else:

if needRestore:

Log("could not find" + self.symbol + "progress recovery information")

self.reset()

def setLastError(self, err=None):

if err is None:

self.status["lastErr"] = ""

self.status["lastErrTime"] = ""

return

t = _D()

self.status["lastErr"] = err

self.status["lastErrTime"] = t

def reset(self, marketPosition=None):

if marketPosition is not None:

self.marketPosition = marketPosition

pos = _bot.GetPosition(self.symbol, PD_LONG if marketPosition > 0 else PD_SHORT)

if pos is not None:

self.holdPrice = pos["Price"]

self.holdAmount = pos["Amount"]

Log(self.symbol, "Position", pos)

else :

raise Exception("Restore" + self.symbol + "position status is wrong, no position information found")

Log("Restore", self.symbol, "average holding position price:", self.holdPrice, "Number of positions:", self.holdAmount)

self.status["vm"] = [self.marketPosition]

else :

self.marketPosition = 0

self.holdPrice = 0

self.holdAmount = 0

self.holdProfit = 0

self.holdProfit = 0

self.lastErr = ""

self.lastErrTime = ""

def Status(self):

self.status["marketPosition"] = self.marketPosition

self.status["holdPrice"] = self.holdPrice

self.status["holdAmount"] = self.holdAmount

self.status["lastPrice"] = self.lastPrice

if self.lastPrice > 0 and self.holdAmount > 0 and self.marketPosition != 0:

self.status["holdProfit"] = _N((self.lastPrice - self.holdPrice) * self.holdAmount * self.symbolDetail["VolumeMultiple"], 4) * (1 if self.marketPosition > 0 else -1)

else :

self.status["holdProfit"] = 0

return self.status

def setTask(self, action, amount = None, onFinish = None):

self.task["init"] = False

self.task["retry"] = 0

self.task["action"] = action

self.task["preAmount"] = 0

self.task["preCost"] = 0

self.task["amount"] = 0 if amount is None else amount

self.task["onFinish"] = onFinish

if action == Manager.ACT_IDLE:

self.task["desc"] = "idle"

self.task["onFinish"] = None

else:

if action != Manager.ACT_COVER:

self.task["desc"] = ("Adding long position" if action == Manager.ACT_LONG else "Adding short position") + "(" + str(amount) + ")"

else :

self.task["desc"] = "Closing Position"

Log("Task received", self.symbol, self.task["desc"])

self.Poll(True)

def processTask(self):

insDetail = exchange.SetContractType(self.symbol)

if not insDetail:

return Manager.ERR_SET_SYMBOL

SlideTick = 1

ret = False

if self.task["action"] == Manager.ACT_COVER:

hasPosition = False

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

hasPosition = False

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

for i in range(len(positions)):

if positions[i]["ContractType"] != self.symbol:

continue

amount = min(insDetail["MaxLimitOrderVolume"], positions[i]["Amount"])

if positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD:

exchange.SetDirection("closebuy_today" if positions[i].Type == PD_LONG else "closebuy")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Bids"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_LONG else "Close yesterday's position", "Bid", depth["Bids"][0])

hasPosition = True

elif positions[i]["Type"] == PD_SHORT or positions[i]["Type"] == PD_SHORT_YD:

exchange.SetDirection("closesell_today" if positions[i]["Type"] == PD_SHORT else "closesell")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(amount, depth["Asks"][0]["Amount"]), self.symbol, "Close today's position" if positions[i]["Type"] == PD_SHORT else "Close yesterday's position", "Ask", depth["Asks"][0])

hasPosition = True

if hasPosition:

if not orderId:

return Manager.ERR_TRADE

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

if not hasPosition:

break

ret = True

elif self.task["action"] == Manager.ACT_LONG or self.task["action"] == Manager.ACT_SHORT:

while True:

if not ext.IsTrading(self.symbol):

return Manager.ERR_NOT_TRADING

Sleep(1000)

while True:

orders = exchange.GetOrders()

if orders is None:

return Manager.ERR_GET_ORDERS

if len(orders) == 0:

break

for i in range(len(orders)):

exchange.CancelOrder(orders[i]["Id"])

Sleep(500)

positions = exchange.GetPosition()

if positions is None:

return Manager.ERR_GET_POS

pos = None

for i in range(len(positions)):

if positions[i]["ContractType"] == self.symbol and (((positions[i]["Type"] == PD_LONG or positions[i]["Type"] == PD_LONG_YD) and self.task["action"] == Manager.ACT_LONG) or ((positions[i]["Type"] == PD_SHORT) or positions[i]["Type"] == PD_SHORT_YD) and self.task["action"] == Manager.ACT_SHORT):

if not pos:

pos = positions[i]

pos["Cost"] = positions[i]["Price"] * positions[i]["Amount"]

else :

pos["Amount"] += positions[i]["Amount"]

pos["Profit"] += positions[i]["Profit"]

pos["Cost"] += positions[i]["Price"] * positions[i]["Amount"]

# records pre position

if not self.task["init"]:

self.task["init"] = True

if pos:

self.task["preAmount"] = pos["Amount"]

self.task["preCost"] = pos["Cost"]

else:

self.task["preAmount"] = 0

self.task["preCost"] = 0

remain = self.task["amount"]

if pos:

self.task["dealAmount"] = pos["Amount"] - self.task["preAmount"]

remain = int(self.task["amount"] - self.task["dealAmount"])

if remain <= 0 or self.task["retry"] >= MaxTaskRetry:

ret = {

"price" : (pos["Cost"] - self.task["preCost"]) / (pos["Amount"] - self.task["preAmount"]),

"amount" : (pos["Amount"] - self.task["preAmount"]),

"position" : pos

}

break

elif self.task["retry"] >= MaxTaskRetry:

ret = None

break

depth = exchange.GetDepth()

if depth is None:

return Manager.ERR_GET_DEPTH

orderId = None

if self.task["action"] == Manager.ACT_LONG:

exchange.SetDirection("buy")

orderId = exchange.Buy(_N(depth["Asks"][0]["Price"] + (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Asks"][0]["Amount"]), self.symbol, "Ask", depth["Asks"][0])

else:

exchange.SetDirection("sell")

orderId = exchange.Sell(_N(depth["Bids"][0]["Price"] - (insDetail["PriceTick"] * SlideTick), 2), min(remain, depth["Bids"][0]["Amount"]), self.symbol, "Bid", depth["Bids"][0])

if orderId is None:

self.task["retry"] += 1

return Manager.ERR_TRADE

if self.task["onFinish"]:

self.task["onFinish"](ret)

self.setTask(Manager.ACT_IDLE)

return Manager.ERR_SUCCESS

def Poll(self, subroutine = False):

# Judge the trading hours

self.status["isTrading"] = ext.IsTrading(self.symbol)

if not self.status["isTrading"]:

return

# Perform order trading tasks

if self.task["action"] != Manager.ACT_IDLE:

retCode = self.processTask()

if self.task["action"] != Manager.ACT_IDLE:

self.setLastError("The task was not successfully processed:" + Manager.errMsg[retCode] + ", " + self.task["desc"] + ", Retry:" + str(self.task["retry"]))

else :

self.setLastError()

return

if subroutine:

return

suffix = "@" if WXPush else ""

# switch symbol

_C(exchange.SetContractType, self.symbol)

# Get K-line data

records = exchange.GetRecords()

if records is None:

self.setLastError("Failed to get K line")

return

self.status["recordsLen"] = len(records)

if len(records) < self.fastPeriod + 2 or len(records) < self.slowPeriod + 2:

self.setLastError("The length of the K line is less than the moving average period:" + str(self.fastPeriod) + "or" + str(self.slowPeriod))

return

opCode = 0 # 0 : IDLE , 1 : LONG , 2 : SHORT , 3 : CoverALL

lastPrice = records[-1]["Close"]

self.lastPrice = lastPrice

fastMA = TA.EMA(records, self.fastPeriod)

slowMA = TA.EMA(records, self.slowPeriod)

# Strategy logic

if self.marketPosition == 0:

if fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 1

elif fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 2

else:

if self.marketPosition < 0 and fastMA[-3] < slowMA[-3] and fastMA[-2] > slowMA[-2]:

opCode = 3

elif self.marketPosition > 0 and fastMA[-3] > slowMA[-3] and fastMA[-2] < slowMA[-2]:

opCode = 3

# If no condition is triggered, the opcode is 0 and return

if opCode == 0:

return

# Preforming closing position action

if opCode == 3:

def coverCallBack(ret):

self.reset()

_G(self.symbol, None)

self.setTask(Manager.ACT_COVER, 0, coverCallBack)

return

account = _bot.GetAccount()

canOpen = int((account["Balance"] - self.keepBalance) / (self.symbolDetail["LongMarginRatio"] if opCode == 1 else self.symbolDetail["ShortMarginRatio"]) / (lastPrice * 1.2) / self.symbolDetail["VolumeMultiple"])

unit = min(1, canOpen)

# Set up trading tasks

def setTaskCallBack(ret):

if not ret:

self.setLastError("Placing Order failed")

return

self.holdPrice = ret["position"]["Price"]

self.holdAmount = ret["position"]["Amount"]

self.marketPosition += 1 if opCode == 1 else -1

self.status["vm"] = [self.marketPosition]

_G(self.symbol, self.status["vm"])

self.setTask(Manager.ACT_LONG if opCode == 1 else Manager.ACT_SHORT, unit, setTaskCallBack)

def onexit():

Log("Exited strategy...")

def main():

if exchange.GetName().find("CTP") == -1:

raise Exception("Only support commodity futures CTP")

SetErrorFilter("login|ready|flow control|connection failed|initial|Timeout")

mode = exchange.IO("mode", 0)

if mode is None:

raise Exception("Failed to switch modes, please update to the latest docker!")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D())

positions = _C(exchange.GetPosition)

if len(positions) > 0:

Log("Detecting the current holding position, the system will start to try to resume the progress...")

Log("Position information:", positions)

initAccount = _bot.GetAccount()

initMargin = json.loads(exchange.GetRawJSON())["CurrMargin"]

keepBalance = _N((initAccount["Balance"] + initMargin) * (KeepRatio / 100), 3)

Log("Asset information", initAccount, "Retain funds:", keepBalance)

tts = []

symbolFilter = {}

arr = Instruments.split(",")

arrFastPeriod = FastPeriodArr.split(",")

arrSlowPeriod = SlowPeriodArr.split(",")

if len(arr) != len(arrFastPeriod) or len(arr) != len(arrSlowPeriod):

raise Exception("The moving average period parameter does not match the number of added contracts, please check the parameters!")

for i in range(len(arr)):

symbol = re.sub(r'/\s+$/g', "", re.sub(r'/^\s+/g', "", arr[i]))

if symbol in symbolFilter.keys():

raise Exception(symbol + "Already exists, please check the parameters!")

symbolFilter[symbol] = True

hasPosition = False

for j in range(len(positions)):

if positions[j]["ContractType"] == symbol:

hasPosition = True

break

fastPeriod = int(arrFastPeriod[i])

slowPeriod = int(arrSlowPeriod[i])

obj = Manager(hasPosition, symbol, keepBalance, fastPeriod, slowPeriod)

tts.append(obj)

preTotalHold = -1

lastStatus = ""

while True:

if GetCommand() == "Pause/Resume":

Log("Suspending trading ...")

while GetCommand() != "Pause/Resume":

Sleep(1000)

Log("Continue trading...")

while not exchange.IO("status"):

Sleep(3000)

LogStatus("Waiting for connection with the trading server," + _D() + "\n" + lastStatus)

tblStatus = {

"type" : "table",

"title" : "Position information",

"cols" : ["Contract Name", "Direction of Position", "Average Position Price", "Number of Positions", "Position profits and Losses", "Number of Positions Added", "Current Price"],

"rows" : []

}

tblMarket = {

"type" : "table",

"title" : "Operating status",

"cols" : ["Contract name", "Contract multiplier", "Margin rate", "Trading time", "Bar length", "Exception description", "Time of occurrence"],

"rows" : []

}

totalHold = 0

vmStatus = {}

ts = time.time()

holdSymbol = 0

for i in range(len(tts)):

tts[i].Poll()

d = tts[i].Status()

if d["holdAmount"] > 0:

vmStatus[d["symbol"]] = d["vm"]

holdSymbol += 1

tblStatus["rows"].append([d["symbolDetail"]["InstrumentName"], "--" if d["holdAmount"] == 0 else ("long" if d["marketPosition"] > 0 else "short"), d["holdPrice"], d["holdAmount"], d["holdProfit"], abs(d["marketPosition"]), d["lastPrice"]])

tblMarket["rows"].append([d["symbolDetail"]["InstrumentName"], d["symbolDetail"]["VolumeMultiple"], str(_N(d["symbolDetail"]["LongMarginRatio"], 4)) + "/" + str(_N(d["symbolDetail"]["ShortMarginRatio"], 4)), "is #0000ff" if d["isTrading"] else "not #ff0000", d["recordsLen"], d["lastErr"], d["lastErrTime"]])

totalHold += abs(d["holdAmount"])

now = time.time()

elapsed = now - ts

tblAssets = _bot.GetAccount(True)

nowAccount = _bot.Account()

if len(tblAssets["rows"]) > 10:

tblAssets["rows"][0] = ["InitAccount", "Initial asset", initAccount]

else:

tblAssets["rows"].insert(0, ["NowAccount", "Currently available", nowAccount])

tblAssets["rows"].insert(0, ["InitAccount", "Initial asset", initAccount])

lastStatus = "`" + json.dumps([tblStatus, tblMarket, tblAssets]) + "`\nPolling time:" + str(elapsed) + " Seconds, current time:" + _D() + ", Number of varieties held:" + str(holdSymbol)

if totalHold > 0:

lastStatus += "\nManually restore the string:" + json.dumps(vmStatus)

LogStatus(lastStatus)

if preTotalHold > 0 and totalHold == 0:

LogProfit(nowAccount.Balance - initAccount.Balance - initMargin)

preTotalHold = totalHold

Sleep(LoopInterval * 1000)

Strategy address: https://www.fmz.com/strategy/208512

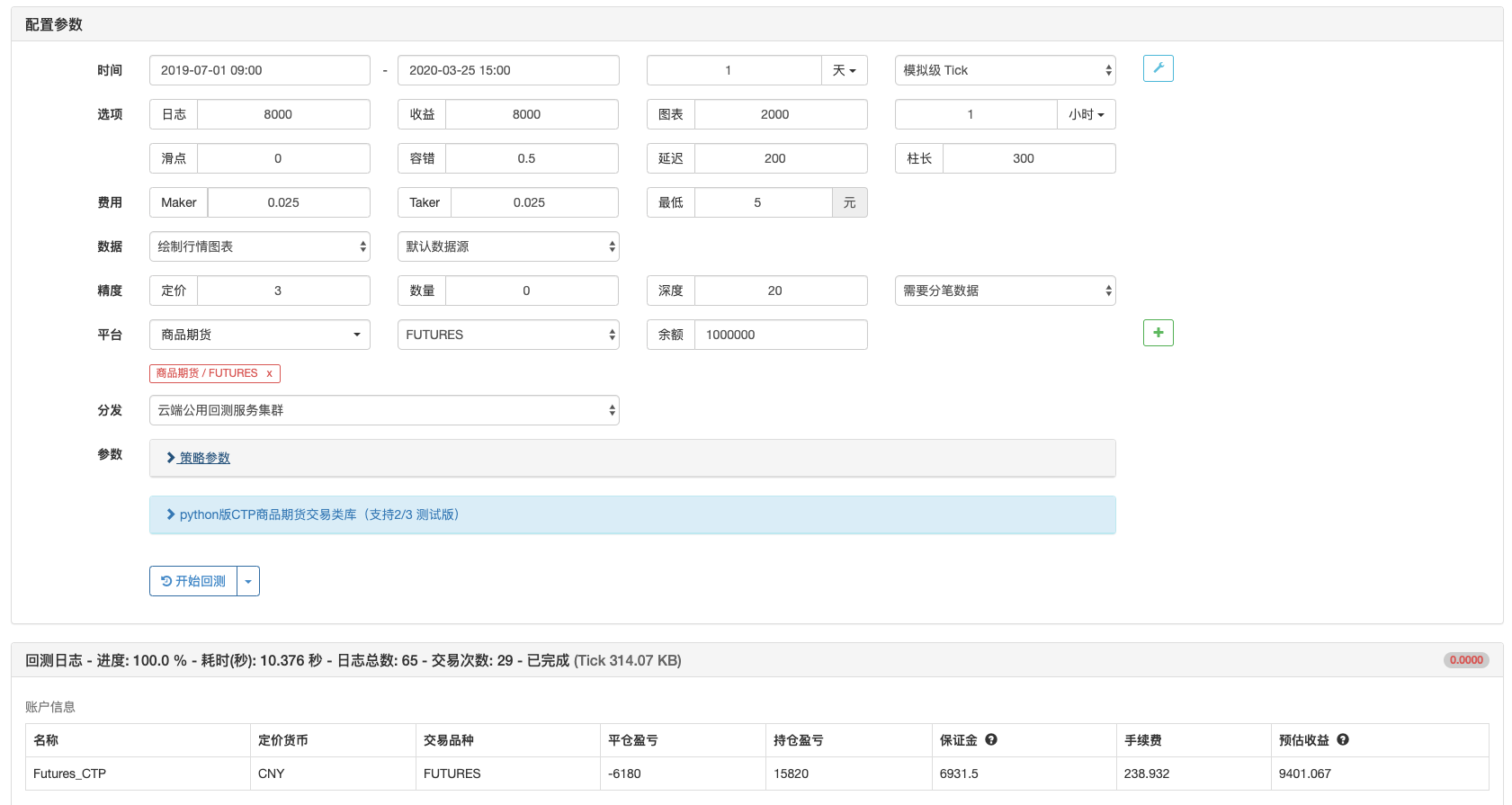

Backtest comparison

We compared the JavaScript version and Python version of the strategy with backtest.

- Python version backtest

We use a public server for backtest, and we can see that the backtest of the Python version is slightly faster.

- JavaScript version backtest

It can be seen that the backtest results are exactly the same. Interested friends can delve into the code, and there will be no small gains.

Expand

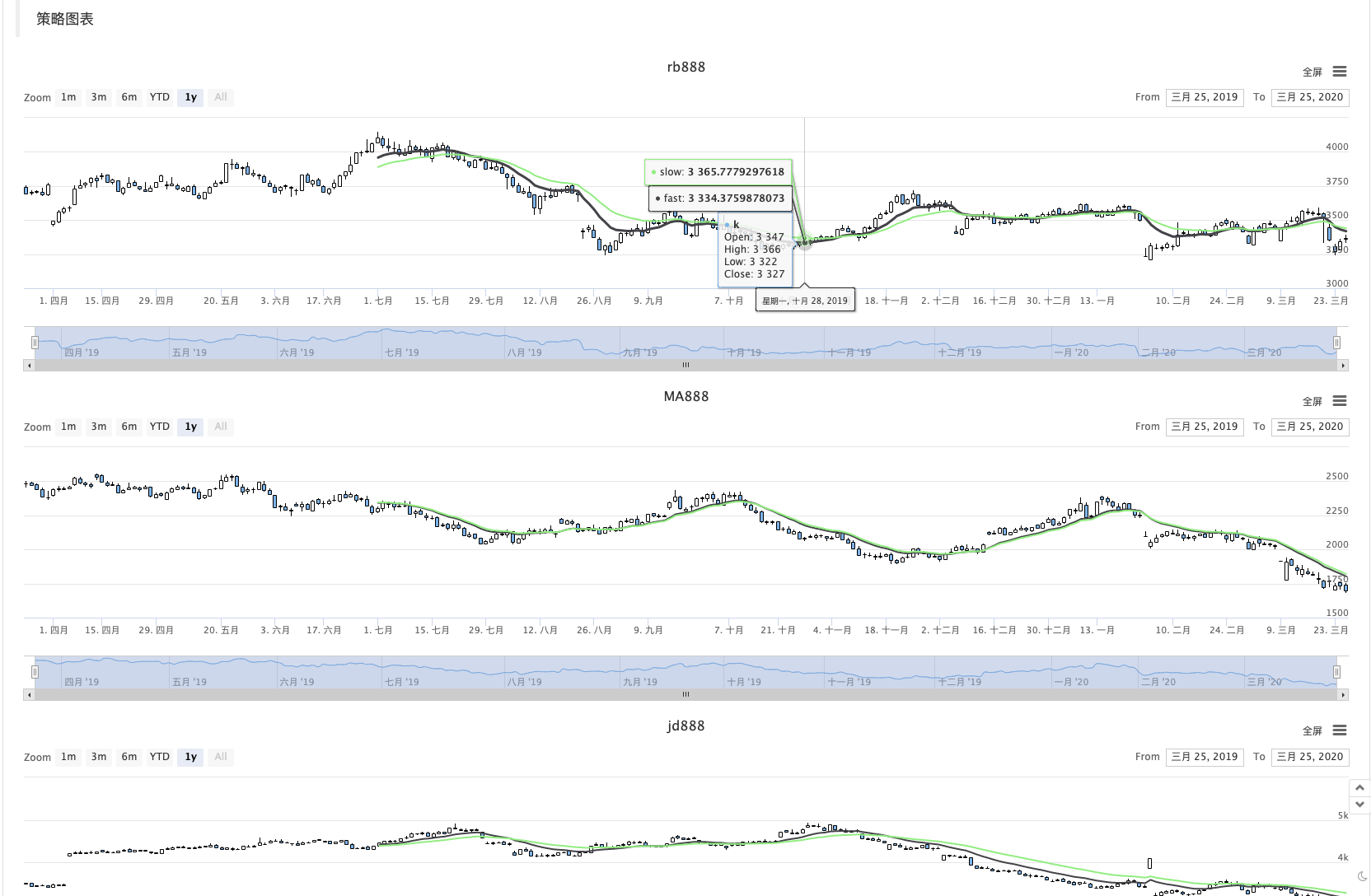

Let’s make an extension demonstration and extend the chart function to the strategy, as shown in the figure:

Mainly increase the coding part:

- Add a member to the Manager class:

objChart - Add a method to the Manager class:

PlotRecords

Some other modifications are made around these two points. You can compare the differences between the two versions and learn the ideas of extended functions.

Python version of commodity futures multi-variable moving average strategy (extended chart)