In view of the fact that the hedging frequency of the futures and spots hedging strategy is not high, it is actually possible to operate manually. However, if you do it manually, it is very inconvenient to switch pages of various exchanges, observe prices, and calculate the difference, and sometimes you may want to see more varieties, and it is not necessary to set up several monitors to display the market. Is it possible to achieve this goal of manual operation with a semi-automatic strategy? It is better to have multi-species, oh! Yes, it is best to open and close positions with one-click. Oh! Yes, there is also a position display…

When there is a need, do it now!

Design a hedging strategy of cryptocurrency manual futures and spot

The writing is rather long-winded, with less than 600 lines of code.

function createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio) {

var self = {}

self.fuEx = fuEx

self.spEx = spEx

self.symbolPairs = symbolPairs

self.pairs = []

self.fuExTickers = null

self.spExTickers = null

self.tickerUpdateTS = 0

self.fuMarginLevel = fuMarginLevel

self.fuMarginReservedRatio = fuMarginReservedRatio

self.cmdHedgeAmount = cmdHedgeAmount

self.preUpdateAccTS = 0

self.accAndPosUpdateCount = 0

self.profit = []

self.allPairs = []

self.PLUS = 0

self.MINUS = 1

self.COVER_PLUS = 2

self.COVER_MINUS = 3

self.arrTradeTypeDesc = ["positive arbitrage", "reverse arbitrage", "close positive arbitrage", "close reverse arbitrage"]

self.updateTickers = function() {

self.fuEx.goGetTickers()

self.spEx.goGetTickers()

var fuExTickers = self.fuEx.getTickers()

var spExTickers = self.spEx.getTickers()

if (!fuExTickers || !spExTickers) {

return null

}

self.fuExTickers = fuExTickers

self.spExTickers = spExTickers

self.tickerUpdateTS = new Date().getTime()

return true

}

self.hedge = function(index, fuSymbol, spSymbol, tradeType, amount) {

var fe = self.fuEx

var se = self.spEx

var pair = self.pairs[index]

var timeStamp = new Date().getTime()

var fuDirection = null

var spDirection = null

var fuPrice = null

var spPrice = null

if (tradeType == self.PLUS) {

fuDirection = fe.OPEN_SHORT

spDirection = se.OPEN_LONG

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else if (tradeType == self.MINUS) {

fuDirection = fe.OPEN_LONG

spDirection = se.OPEN_SHORT

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_PLUS) {

fuDirection = fe.COVER_SHORT

spDirection = se.COVER_LONG

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_MINUS) {

fuDirection = fe.COVER_LONG

spDirection = se.COVER_SHORT

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else {

throw "unknow tradeType!"

}

fe.goGetAcc(fuSymbol, timeStamp)

se.goGetAcc(spSymbol, timeStamp)

var nowFuAcc = fe.getAcc(fuSymbol, timeStamp)

var nowSpAcc = se.getAcc(spSymbol, timeStamp)

if (!nowFuAcc || !nowSpAcc) {

Log(fuSymbol, spSymbol, ", failed to get account data")

return

}

pair.nowFuAcc = nowFuAcc

pair.nowSpAcc = nowSpAcc

var nowFuPos = fe.getFuPos(fuSymbol, timeStamp)

var nowSpPos = se.getSpPos(spSymbol, spPrice, pair.initSpAcc, pair.nowSpAcc)

if (!nowFuPos || !nowSpPos) {

Log(fuSymbol, spSymbol, ", failed to get position data")

return

}

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

var fuAmount = amount

var spAmount = amount

if (tradeType == self.PLUS || tradeType == self.MINUS) {

if (nowFuAcc.Balance < (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio + (fuAmount * fuPrice / self.fuMarginLevel)) {

Log(pair.fuSymbol, "insufficient deposit!", "this plan uses", (fuAmount * fuPrice / self.fuMarginLevel), "currently available:", nowFuAcc.Balance,

"Plan to reserve:", (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio)

return

}

if ((tradeType == self.PLUS && nowSpAcc.Balance < spAmount * spPrice)) {

Log(pair.spSymbol, "insufficient funds!", "this purchase plans to use", spAmount * spPrice, "currently available:", nowSpAcc.Balance)

return

} else if (tradeType == self.MINUS && nowSpAcc.Stocks < spAmount) {

Log(pair.spSymbol, "insufficient funds!", "this selling plans to use", spAmount, "currently available:", nowSpAcc.Stocks)

return

}

} else {

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if ((tradeType == self.COVER_PLUS && !fuShortPos) || (tradeType == self.COVER_MINUS && !fuLongPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in futures!")

return

} else if (tradeType == self.COVER_PLUS && Math.abs(fuShortPos.amount) < fuAmount) {

fuAmount = Math.abs(fuShortPos.amount)

} else if (tradeType == self.COVER_MINUS && Math.abs(fuLongPos.amount) < fuAmount) {

fuAmount = Math.abs(fuLongPos.amount)

}

if ((tradeType == self.COVER_PLUS && !spLongPos) || (tradeType == self.COVER_MINUS && !spShortPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in the spot!")

return

} else if (tradeType == self.COVER_PLUS && Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks) < spAmount) {

spAmount = Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks)

} else if (tradeType == self.COVER_MINUS && Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice) < spAmount) {

spAmount = Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice)

}

}

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount)

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, spAmount)

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

} else {

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount[1])

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, Math.min(fuAmount[1], spAmount[1]))

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

}

}

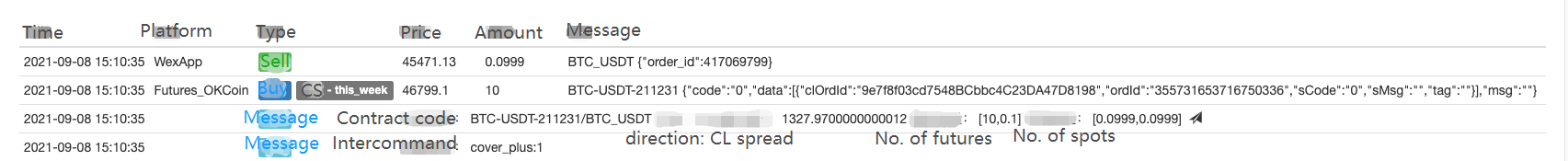

Log("contract code:", fuSymbol + "/" + spSymbol, "direction:", self.arrTradeTypeDesc[tradeType], "difference:", fuPrice - spPrice, "quantity of futures:", fuAmount, "quantity of spots:", spAmount, "@")

fe.goGetTrade(fuSymbol, fuDirection, fuPrice, fuAmount[0])

se.goGetTrade(spSymbol, spDirection, spPrice, spAmount[0])

var feIdMsg = fe.getTrade()

var seIdMsg = se.getTrade()

return [feIdMsg, seIdMsg]

}

self.process = function() {

var nowTS = new Date().getTime()

if(!self.updateTickers()) {

return

}

_.each(self.pairs, function(pair, index) {

var fuTicker = null

var spTicker = null

_.each(self.fuExTickers, function(ticker) {

if (ticker.originalSymbol == pair.fuSymbol) {

fuTicker = ticker

}

})

_.each(self.spExTickers, function(ticker) {

if (ticker.originalSymbol == pair.spSymbol) {

spTicker = ticker

}

})

if (fuTicker && spTicker) {

pair.canTrade = true

} else {

pair.canTrade = false

}

fuTicker = fuTicker ? fuTicker : {}

spTicker = spTicker ? spTicker : {}

pair.fuTicker = fuTicker

pair.spTicker = spTicker

pair.plusDiff = fuTicker.bid1 - spTicker.ask1

pair.minusDiff = fuTicker.ask1 - spTicker.bid1

if (pair.plusDiff && pair.minusDiff) {

pair.plusDiff = _N(pair.plusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.bid1), self.spEx.judgePrecision(spTicker.ask1)))

pair.minusDiff = _N(pair.minusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.ask1), self.spEx.judgePrecision(spTicker.bid1)))

}

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.fuEx.goGetAcc(pair.fuSymbol, nowTS)

self.spEx.goGetAcc(pair.spSymbol, nowTS)

var fuAcc = self.fuEx.getAcc(pair.fuSymbol, nowTS)

var spAcc = self.spEx.getAcc(pair.spSymbol, nowTS)

if (fuAcc) {

pair.nowFuAcc = fuAcc

}

if (spAcc) {

pair.nowSpAcc = spAcc

}

var nowFuPos = self.fuEx.getFuPos(pair.fuSymbol, nowTS)

var nowSpPos = self.spEx.getSpPos(pair.spSymbol, (pair.spTicker.ask1 + pair.spTicker.bid1) / 2, pair.initSpAcc, pair.nowSpAcc)

if (nowFuPos && nowSpPos) {

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

self.keepBalance(pair)

} else {

Log(pair.fuSymbol, pair.spSymbol, "portfolio position update failed, nowFuPos:", nowFuPos, " nowSpPos:", nowSpPos)

}

self.accAndPosUpdateCount++

}

})

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.preUpdateAccTS = nowTS

self.profit = self.calcProfit()

LogProfit(self.profit[0], "futures:", self.profit[1], "spots:", self.profit[2], "&") // Print the total profit curve, use the & character not to print the profit log

}

var cmd = GetCommand()

if(cmd) {

Log("interactive commands:", cmd)

var arr = cmd.split(":")

if(arr[0] == "plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.PLUS, self.cmdHedgeAmount)

} else if (arr[0] == "cover_plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.COVER_PLUS, self.cmdHedgeAmount)

}

}

LogStatus("current time:", _D(), "data update time:", _D(self.tickerUpdateTS), "position account update count:", self.accAndPosUpdateCount, "\n", "Profit and loss:", self.profit[0], "futures profit and loss:", self.profit[1],

"spot profit and loss:", self.profit[2], "\n`" + JSON.stringify(self.returnTbl()) + "`", "\n`" + JSON.stringify(self.returnPosTbl()) + "`")

}

self.keepBalance = function (pair) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if (fuLongPos || spShortPos) {

Log("reverse arbitrage is not supported")

}

if (fuShortPos || spLongPos) {

var fuHoldAmount = fuShortPos ? fuShortPos.amount : 0

var spHoldAmount = spLongPos ? spLongPos.amount : 0

var sum = fuHoldAmount + spHoldAmount

if (sum > 0) {

var spAmount = self.spEx.calcAmount(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, Math.abs(sum), true)

if (spAmount) {

Log(pair.fuSymbol, pair.spSymbol, "excess spot positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.spEx.goGetTrade(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, spAmount[0])

var seIdMsg = self.spEx.getTrade()

}

} else if (sum < 0) {

var fuAmount = self.fuEx.calcAmount(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, Math.abs(sum), true)

if (fuAmount) {

Log(pair.fuSymbol, pair.spSymbol, "long futures positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.fuEx.goGetTrade(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, fuAmount[0])

var feIdMsg = self.fuEx.getTrade()

}

}

}

}

self.getLongPos = function (positions) {

return self.getPosByDirection(positions, PD_LONG)

}

self.getShortPos = function (positions) {

return self.getPosByDirection(positions, PD_SHORT)

}

self.getPosByDirection = function (positions, direction) {

var ret = null

if (positions.length > 2) {

Log("position error, three positions detected:", JSON.stringify(positions))

return ret

}

_.each(positions, function(pos) {

if ((direction == PD_LONG && pos.amount > 0) || (direction == PD_SHORT && pos.amount < 0)) {

ret = pos

}

})

return ret

}

self.calcProfit = function() {

var arrInitFuAcc = []

var arrNowFuAcc = []

_.each(self.pairs, function(pair) {

arrInitFuAcc.push(pair.initFuAcc)

arrNowFuAcc.push(pair.nowFuAcc)

})

var fuProfit = self.fuEx.calcProfit(arrInitFuAcc, arrNowFuAcc)

var spProfit = 0

var deltaBalance = 0

_.each(self.pairs, function(pair) {

var nowSpAcc = pair.nowSpAcc

var initSpAcc = pair.initSpAcc

var stocksDiff = nowSpAcc.Stocks + nowSpAcc.FrozenStocks - (initSpAcc.Stocks + initSpAcc.FrozenStocks)

var price = stocksDiff > 0 ? pair.spTicker.bid1 : pair.spTicker.ask1

spProfit += stocksDiff * price

deltaBalance = nowSpAcc.Balance + nowSpAcc.FrozenBalance - (initSpAcc.Balance + initSpAcc.FrozenBalance)

})

spProfit += deltaBalance

return [fuProfit + spProfit, fuProfit, spProfit]

}

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "positions",

cols : ["index", "future", "future leverage", "qunatity", "spot", "qunatity"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

for (var i = 0 ; i < nowFuPos.length ; i++) {

if (nowSpPos.length > 0) {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, nowSpPos[0].symbol, nowSpPos[0].amount])

} else {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, "--", "--"])

}

}

})

return posTbl

}

self.returnTbl = function() {

var fuExName = "[" + self.fuEx.getExName() + "]"

var spExName = "[" + self.spEx.getExName() + "]"

var combiTickersTbl = {

type : "table",

title : "combiTickersTbl",

cols : ["future", "code" + fuExName, "entrusted selling", "entrusted purchase", "spot", "code" + spExName, "entrusted selling", "entrusted purchase", "positive hedging spreads", "reverse hedging spreads", "positive hedge", "positive hedge closeout"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

combiTickersTbl.rows.push([

pair.fuTicker.symbol,

pair.fuTicker.originalSymbol,

pair.fuTicker.ask1,

pair.fuTicker.bid1,

pair.spTicker.symbol,

pair.spTicker.originalSymbol,

pair.spTicker.ask1,

pair.spTicker.bid1,

pair.plusDiff,

pair.minusDiff,

{'type':'button', 'cmd': 'plus:' + String(index), 'name': 'positive arbitrage'},

{'type':'button', 'cmd': 'cover_plus:' + String(index), 'name': 'close positive arbitrage'}

])

})

var accsTbl = {

type : "table",

title : "accs",

cols : ["code" + fuExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money",

"code" + spExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money"],

rows : []

}

_.each(self.pairs, function(pair) {

var arr = [pair.fuTicker.originalSymbol, pair.initFuAcc.Stocks, pair.initFuAcc.FrozenStocks, pair.initFuAcc.Balance, pair.initFuAcc.FrozenBalance, pair.nowFuAcc.Stocks, pair.nowFuAcc.FrozenStocks, pair.nowFuAcc.Balance, pair.nowFuAcc.FrozenBalance,

pair.spTicker.originalSymbol, pair.initSpAcc.Stocks, pair.initSpAcc.FrozenStocks, pair.initSpAcc.Balance, pair.initSpAcc.FrozenBalance, pair.nowSpAcc.Stocks, pair.nowSpAcc.FrozenStocks, pair.nowSpAcc.Balance, pair.nowSpAcc.FrozenBalance]

for (var i = 0 ; i < arr.length ; i++) {

if (typeof(arr[i]) == "number") {

arr[i] = _N(arr[i], 6)

}

}

accsTbl.rows.push(arr)

})

var symbolInfoTbl = {

type : "table",

title : "symbolInfos",

cols : ["contract code" + fuExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity", "spot code" + spExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity"],

rows : []

}

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuTicker.originalSymbol)

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

symbolInfoTbl.rows.push([fuSymbolInfo.symbol, fuSymbolInfo.amountPrecision, fuSymbolInfo.pricePrecision, fuSymbolInfo.multiplier, fuSymbolInfo.min,

spSymbolInfo.symbol, spSymbolInfo.amountPrecision, spSymbolInfo.pricePrecision, spSymbolInfo.multiplier, spSymbolInfo.min])

})

var allPairs = []

_.each(self.fuExTickers, function(fuTicker) {

_.each(self.spExTickers, function(spTicker) {

if (fuTicker.symbol == spTicker.symbol) {

allPairs.push({symbol: fuTicker.symbol, fuSymbol: fuTicker.originalSymbol, spSymbol: spTicker.originalSymbol, plus: fuTicker.bid1 - spTicker.ask1})

}

})

})

_.each(allPairs, function(pair) {

var findPair = null

_.each(self.allPairs, function(selfPair) {

if (pair.fuSymbol == selfPair.fuSymbol && pair.spSymbol == selfPair.spSymbol) {

findPair = selfPair

}

})

if (findPair) {

findPair.minPlus = pair.plus < findPair.minPlus ? pair.plus : findPair.minPlus

findPair.maxPlus = pair.plus > findPair.maxPlus ? pair.plus : findPair.maxPlus

pair.minPlus = findPair.minPlus

pair.maxPlus = findPair.maxPlus

} else {

self.allPairs.push({symbol: pair.symbol, fuSymbol: pair.fuSymbol, spSymbol: pair.spSymbol, plus: pair.plus, minPlus: pair.plus, maxPlus: pair.plus})

pair.minPlus = pair.plus

pair.maxPlus = pair.plus

}

})

return [combiTickersTbl, accsTbl, symbolInfoTbl]

}

self.onexit = function() {

_G("pairs", self.pairs)

_G("allPairs", self.allPairs)

Log("perform tailing processing and save data", "#FF0000")

}

self.init = function() {

var fuExName = self.fuEx.getExName()

var spExName = self.spEx.getExName()

var gFuExName = _G("fuExName")

var gSpExName = _G("spExName")

if ((gFuExName && gFuExName != fuExName) || (gSpExName && gSpExName != spExName)) {

throw "the exchange object has changed and the data needs to be reset"

}

if (!gFuExName) {

_G("fuExName", fuExName)

}

if (!gSpExName) {

_G("spExName", spExName)

}

self.allPairs = _G("allPairs")

if (!self.allPairs) {

self.allPairs = []

}

var arrPair = _G("pairs")

if (!arrPair) {

arrPair = []

}

var arrStrPair = self.symbolPairs.split(",")

var timeStamp = new Date().getTime()

_.each(arrStrPair, function(strPair) {

var arrSymbol = strPair.split("|")

var recoveryPair = null

_.each(arrPair, function(pair) {

if (pair.fuSymbol == arrSymbol[0] && pair.spSymbol == arrSymbol[1]) {

recoveryPair = pair

}

})

if (!recoveryPair) {

var pair = {

fuSymbol : arrSymbol[0],

spSymbol : arrSymbol[1],

fuTicker : {},

spTicker : {},

plusDiff : null,

minusDiff : null,

canTrade : false,

initFuAcc : null,

initSpAcc : null,

nowFuAcc : null,

nowSpAcc : null,

nowFuPos : null,

nowSpPos : null,

fuMarginLevel : null

}

self.pairs.push(pair)

Log("初始化:", pair)

} else {

self.pairs.push(recoveryPair)

Log("恢复:", recoveryPair)

}

self.fuEx.pushSubscribeSymbol(arrSymbol[0])

self.spEx.pushSubscribeSymbol(arrSymbol[1])

if (!self.pairs[self.pairs.length - 1].initFuAcc) {

self.fuEx.goGetAcc(arrSymbol[0], timeStamp)

var nowFuAcc = self.fuEx.getAcc(arrSymbol[0], timeStamp)

self.pairs[self.pairs.length - 1].initFuAcc = nowFuAcc

self.pairs[self.pairs.length - 1].nowFuAcc = nowFuAcc

}

if (!self.pairs[self.pairs.length - 1].initSpAcc) {

self.spEx.goGetAcc(arrSymbol[1], timeStamp)

var nowSpAcc = self.spEx.getAcc(arrSymbol[1], timeStamp)

self.pairs[self.pairs.length - 1].initSpAcc = nowSpAcc

self.pairs[self.pairs.length - 1].nowSpAcc = nowSpAcc

}

Sleep(300)

})

Log("self.pairs:", self.pairs)

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuSymbol)

if (!fuSymbolInfo) {

throw pair.fuSymbol + ", species information acquisition failure!"

} else {

Log(pair.fuSymbol, fuSymbolInfo)

}

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spSymbol)

if (!spSymbolInfo) {

throw pair.spSymbol + ", species information acquisition failure!"

} else {

Log(pair.spSymbol, spSymbolInfo)

}

})

_.each(self.pairs, function(pair) {

pair.fuMarginLevel = self.fuMarginLevel

var ret = self.fuEx.setMarginLevel(pair.fuSymbol, self.fuMarginLevel)

Log(pair.fuSymbol, "leverage settings:", ret)

if (!ret) {

throw "initial setting of leverage failed!"

}

})

}

self.init()

return self

}

var manager = null

function main() {

if(isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("reset all data", "#FF0000")

}

if (isOKEX_V5_Simulate) {

for (var i = 0 ; i < exchanges.length ; i++) {

if (exchanges[i].GetName() == "Futures_OKCoin" || exchanges[i].GetName() == "OKEX") {

var ret = exchanges[i].IO("simulate", true)

Log(exchanges[i].GetName(), "switch analog disk")

}

}

}

var fuConfigureFunc = null

var spConfigureFunc = null

if (exchanges.length != 2) {

throw "two exchange objects need to be added!"

} else {

var fuName = exchanges[0].GetName()

if (fuName == "Futures_OKCoin" && isOkexV5) {

fuName += "_V5"

Log("Use OKEX V5 interface")

}

var spName = exchanges[1].GetName()

fuConfigureFunc = $.getConfigureFunc()[fuName]

spConfigureFunc = $.getConfigureFunc()[spName]

if (!fuConfigureFunc || !spConfigureFunc) {

throw (fuConfigureFunc ? "" : fuName) + " " + (spConfigureFunc ? "" : spName) + " not support!"

}

}

var fuEx = $.createBaseEx(exchanges[0], fuConfigureFunc)

var spEx = $.createBaseEx(exchanges[1], spConfigureFunc)

manager = createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio)

while(true) {

manager.process()

Sleep(interval)

}

}

function onerror() {

if (manager) {

manager.onexit()

}

}

function onexit() {

if (manager) {

manager.onexit()

}

}

Since the multi-species strategy is more suitable for IO design, a template class library named MultiSymbolCtrlLib is used in the code (encapsulation, calling the exchange interface through IO). Therefore, the strategy cannot be backtested, but it can be tested with the simulated bot (although the real bot has been run for 2 months, the test and familiarization stage is still run with the simulated bot).

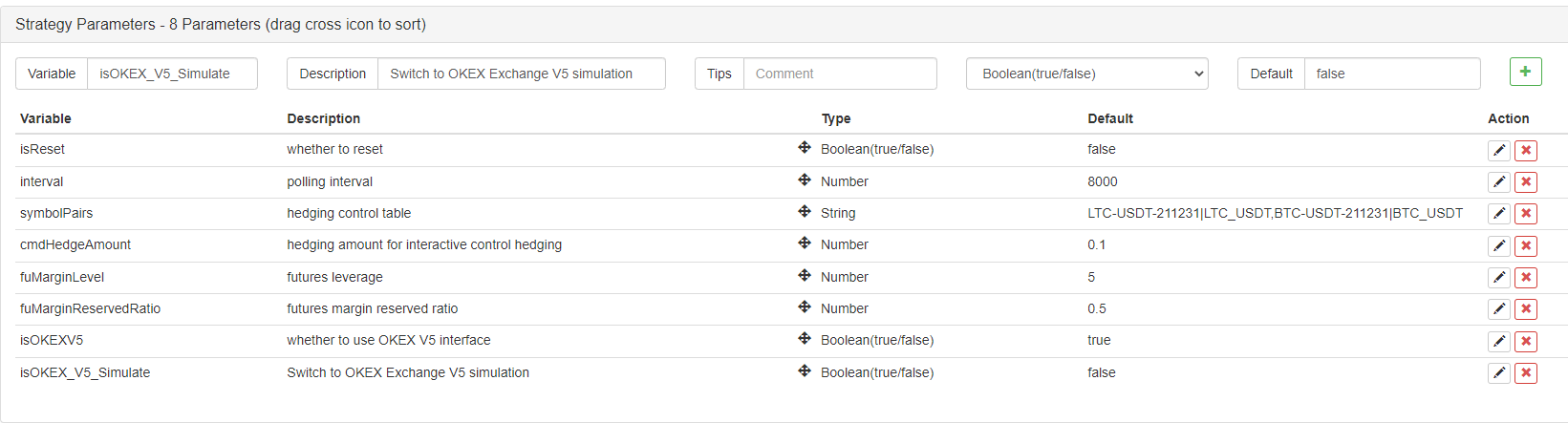

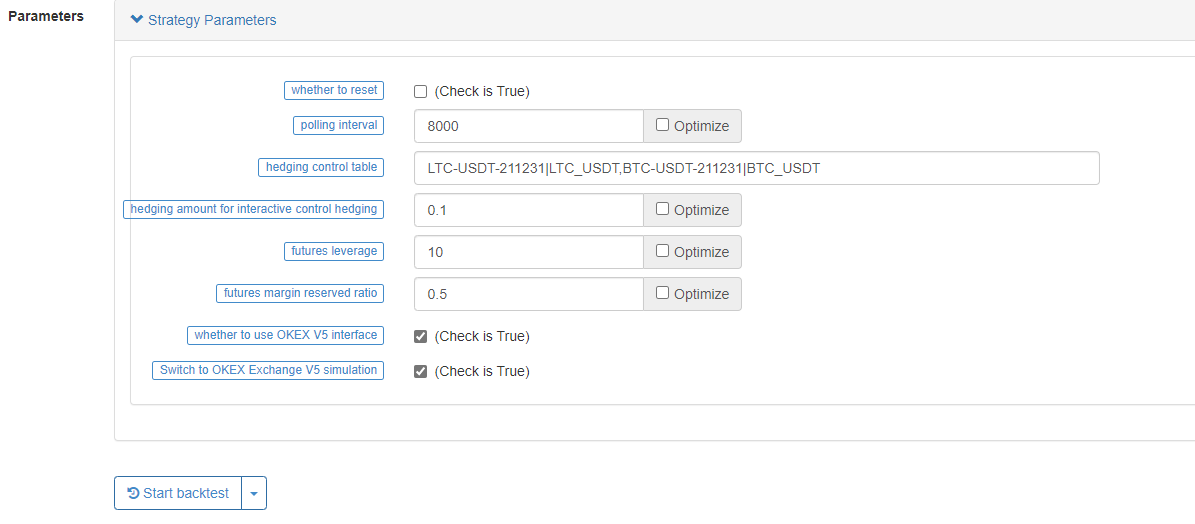

Parameters

Before starting the test, let’s talk about the parameter design first.

There are not many strategy parameters, the more important ones are:

- Hedging control table

LTC-USDT-211231|LTC_USDT,BTC-USDT-211231|BTC_USDT

Here is the setup strategy to monitor those combinations. For example, the above setup is to monitor the Litecoin contract (LTC-USDT-211231) of the future exchange and the Litecoin (LTC_USDT) of the spot exchange. A combination of future contract and spot trading pair are separated by | symbols to form a combination. Different combinations are separated by , symbols. Note that the symbols here are all in the state of the English input method!

Then you may ask me how to find the contract code. These contract codes and spot trading pairs are all defined by the exchange, not defined by the FMZ platform.

For example, LTC-USDT-211231 is a second-quarter contract currently, called next_quarter on FMZ, and OKEX’s interface system is called LTC-USDT-211231. For the Litecoin/USDT trading pair, the WexApp simulation bot is written as LTC_USDT. So how to fill in here depends on the name defined in the exchange.

- Hedging amount for interactive control hedging

Click the status bar control button to hedge the amount. The unit is the number of coins, and the strategy will be automatically converted into the number of contracts to place an order.

Other functions are to set the analog disk, reset the data, use the OKEX V5 interface (because it is also compatible with V3) and so on, which are not particularly important.

Testing

The first exchange object adds the futures exchange, and the second adds the spot exchange object.

Futures exchanges use OKX’s V5 interface simulation bots, and spot exchanges use WexApp simulation bots.

Click the positive set button of the BTC combination and open the position.

Click to close the positive arbitrage then.

Lose!!! It seems that closing the position cannot cover the handling fee when the profit spread is small, it is necessary to calculate the handling fee, the approximate slippage, and plan the spread reasonably, and then close the position.

Strategy source code: https://www.fmz.com/strategy/314352

Those who are interested can use and modify it.