JavaScript version SuperTrend strategy

There are many versions of the SuperTrend indicator on the TV. I found a relatively easy-to-understand algorithm and transplanted it. Compared with the SuperTrend indicator loaded on the TV chart of FMZ trading platform backtest system, I found a slight difference and did not understand the reason for the causes, I’m looking forward to the guidance of our readers. I will first show my understanding as follow.

SuperTrend indicator JavaScript version algorithm

Copy code// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30functionSuperTrend(r, period, multiplier) {

// atrvar atr = talib.ATR(r, period)

// baseUp , baseDownvar baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDownvar fiUp = []

var fiDown = []

var prevFiUp = 0var prevFiDown = 0for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaNfor (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} elseif (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} elseif (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} elseif (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// The main function for testing indicators is not a trading strategyfunctionmain() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Test code backtest comparison:

A simple strategy using SuperTrend indicator

The trading logic part is relatively simple, that is, when the short trend turns into a long trend, long positions are opened.

Open a short position when the long trend turns into a short trend.

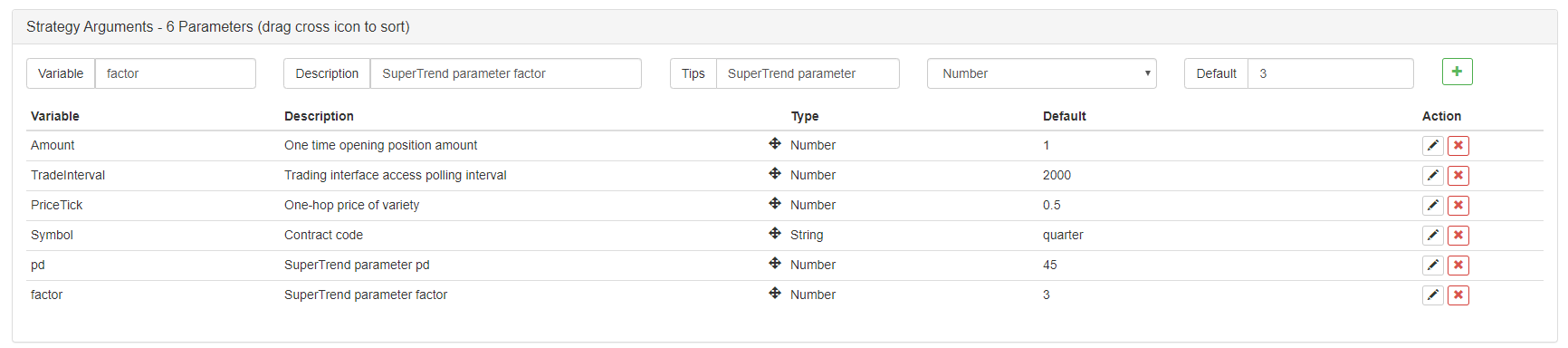

Strategy parameters:

SuperTrend trading strategy

Copy code/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/// Global variablesvarOpenAmount = 0// The number of open positions after openingvarKeepAmount = 0// Reserved positionvarIDLE = 0varLONG = 1varSHORT = 2varCOVERLONG = 3varCOVERSHORT = 4varCOVERLONG_PART = 5varCOVERSHORT_PART = 6varOPENLONG = 7varOPENSHORT = 8varState = IDLE// Trading logic partfunctionGetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/var count = 0for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw"positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

functionCancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

functionTrade(Type, Price, Amount, CurrPos, OnePriceTick){ // Processing transactionsif(Type == OPENLONG || Type == OPENSHORT){ // Handling open positions

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sellvar idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} elseif(Type == COVERLONG || Type == COVERSHORT){ // Deal with closing positions

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buyvar idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw"Type error:" + Type

}

}

functionSuperTrend(r, period, multiplier) {

// atrvar atr = talib.ATR(r, period)

// baseUp , baseDownvar baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDownvar fiUp = []

var fiDown = []

var prevFiUp = 0var prevFiDown = 0for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaNfor (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} elseif (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} elseif (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} elseif (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0functionmain() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} elseif(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} elseif (State == IDLE) {

State = OPENSHORT

}

}

// Execution signal

var pos = nullvar price = nullif(State == OPENLONG){ // Open long positions

pos = GetPosition(PD_LONG) // Check positions// Determine whether the status is satisfied, if it is satisfied, modify the statusif(pos[1] >= Amount){ // Open positions exceed or equal to the open positions set by the parametersSleep(1000)

$.PlotFlag(currBar.Time, "Open long positions", 'OL') // markOpenAmount = pos[1] // Record the number of open positionsState = LONG// Mark as longcontinue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2// Calculate the priceTrade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // Placing Order function (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // Open short position

pos = GetPosition(PD_SHORT) // Check positionsif(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "Open short position", 'OS')

OpenAmount = pos[1]

State = SHORTcontinue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // Handling long positions

pos = GetPosition(PD_LONG) // Get position informationif(pos[1] == 0){ // Determine if the position is 0

$.PlotFlag(currBar.Time, "Close long position", '----CL') // markState = IDLEcontinue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // Deal with long positions

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "Close short position", '----CS')

State = IDLEcontinue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // Partially close long positions

pos = GetPosition(PD_LONG) // Get positionsif(pos[1] <= KeepAmount){ // The position is less than or equal to the holding amount, this time the closing action is completed

$.PlotFlag(currBar.Time, "Close long positions, keep:" + KeepAmount, '----CL') // markState = pos[1] == 0 ? IDLE : LONG// update statuscontinue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "Close short positions, keep:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORTcontinue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Strategy address: https://www.fmz.com/strategy/201837

Backtest performance

Parameter setting, K line period, reference: homily SuperTrend V.1–Super trend line system

The K-line period is set to 15 minutes, and the SuperTrend parameter is set to 45, 3. Backtest the OKEX futures quarter contract for the most recent year, and set a contract to trade at a time. Due to the setting to trade only one contract at a time, the utilization rate of funds is very low and you don’t need to care about the Sharpe value.