Preface The previous article introduced the principle and backtesting of pair trading, https://www.fmz.com/bbs-topic/10459. Here is a practical source code based on the FMZ platform. The strategy...

In the cryptocurrency market, data is always an important basis for trading decisions. How to see through the complex data and discover valuable information to optimize trading strategies has always b...

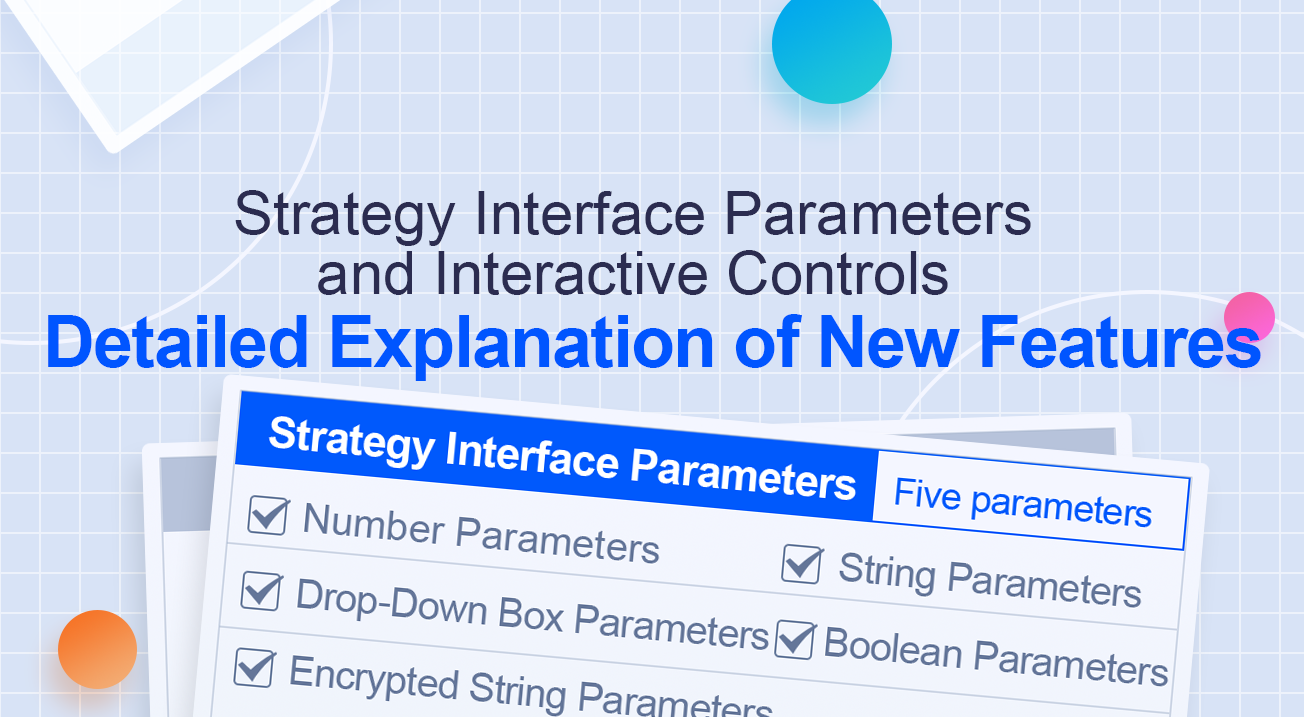

When developing strategies on the FMZ Quant Trading Platform, it is necessary to design strategy parameters and strategy interactions. The FMZ Quant Trading Platform is committed to providing easy-to-...

In response to the comments from readers in the previous article, they requested a program example for monitoring contract account transfers. In this article, we will use Binance exchange as the test ...

Opportunity Observation Recently, I found that Binance has a currency STORJ market is very strange unintentionally when I was watching the market, the trading volume is very large, and the trading fre...

In the cryptocurrency asset trading space, obtaining and analyzing market data, querying rates, and monitoring account asset movements are all critical operations. Below are code examples of implement...

How can I change the parameters of live tradings in batch on FMZ? When the number of live tradings exceeds dozens and reaches hundreds, it would be very inconvenient to configure live tradings one by ...

With the popularization and development of quantitative trading, investors often need to manage a large number of live accounts, which brings great challenges to trading decisions, monitoring and exec...

Looking at a not-so-reliable trading idea — the K-line area trading strategy, in this article, we will explore the concept and try to implement the script. Main Idea of the K-Line Area Strategy ...

In the field of quantitative trading, simple and easy-to-use quantitative trading tools have always been one of the keys to achieving wealth growth and risk management. However, with increasing market...