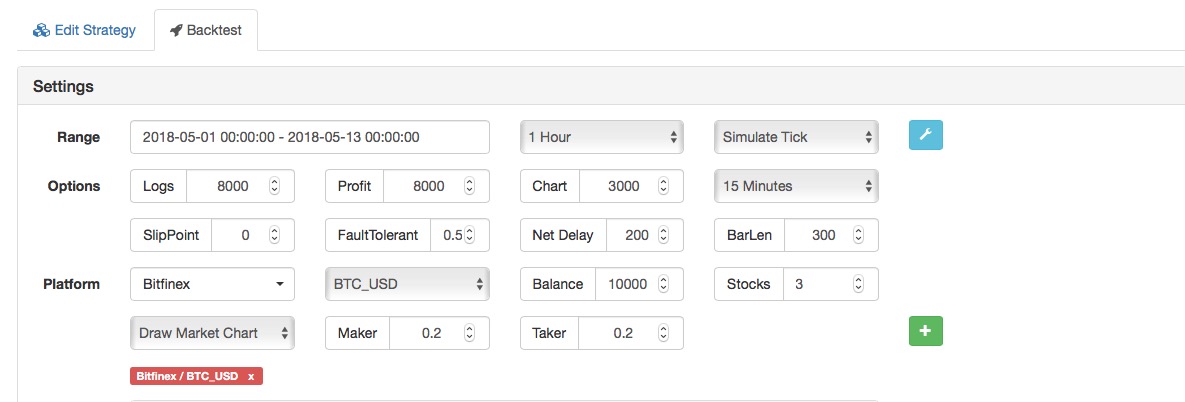

Data cycle: about 30 minutes

Support: Digital Currency Spot, Digital currency Futures

Support: Commodity futures

Digital Currency backtest:

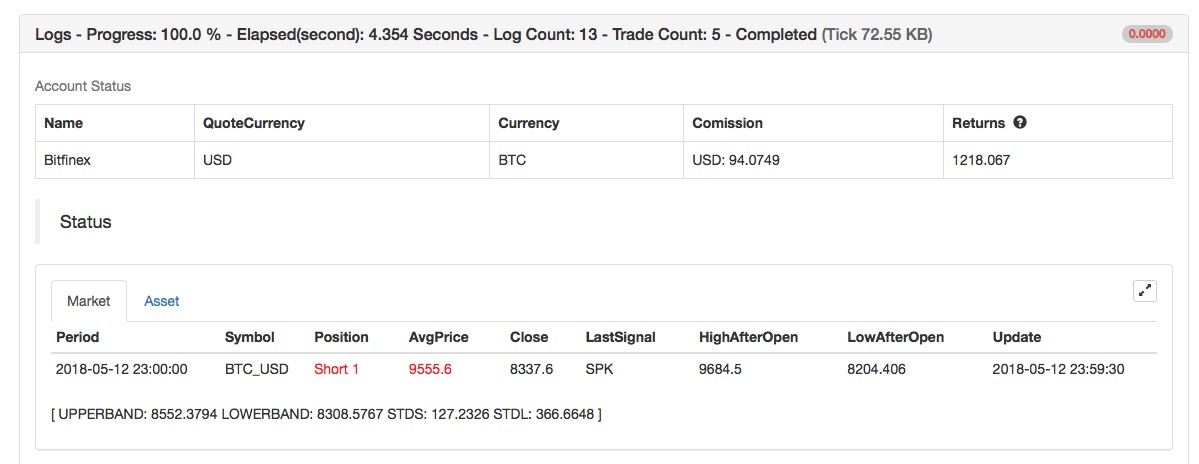

- Main chart:

upper line, formula: UPPERBAND^^AVGVALUE + SHIFTVALUE;

lower line, formula: LOWERBAND^^AVGVALUE – SHIFTVALUE; - Secondary chart:

standard deviation, formula: STDS: STD (C, 10);

standard deviation, formula: STDL: STD (C, 60);

(*backtest

start: 2018-05-01 00:00:00

end: 2018-06-30 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["ContractType","this_week",126961]]

*)

TPRICE:=(HIGH+LOW+OPEN+CLOSE)/4;

AVGVALUE:=MA(TPRICE,N);

// Find the maximum of these three values:

highest price minus lowest price,

the absolute value of (closing price a cycle ago minus the highest price),

the absolute value of (closing price a cycle ago minus the lowest price)

TR:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

SHIFTVALUE:=MA(TR,N);// Find the simple moving average of TR in N cycles

UPPERBAND^^AVGVALUE + SHIFTVALUE;

LOWERBAND^^AVGVALUE - SHIFTVALUE;

STDS:STD(C,10);

STDL:STD(C,60);

BKVOL=0 AND HIGH >= UPPERBAND AND STDS>=STDL,BPK;

SKVOL=0 AND LOW <= LOWERBAND AND STDS>=STDL,SPK;

BKVOL>0 AND BKHIGH-BKPRICE>=0.2*CLOSE AND C<LOWERBAND,SP;

SKVOL>0 AND SKPRICE-SKLOW>=0.2*CLOSE AND C>UPPERBAND,BP;

//Stop loss

C>=SKPRICE*(1+STOPRANGE*0.01),BP;

C<=BKPRICE*(1-STOPRANGE*0.01),SP;

AUTOFILTER;

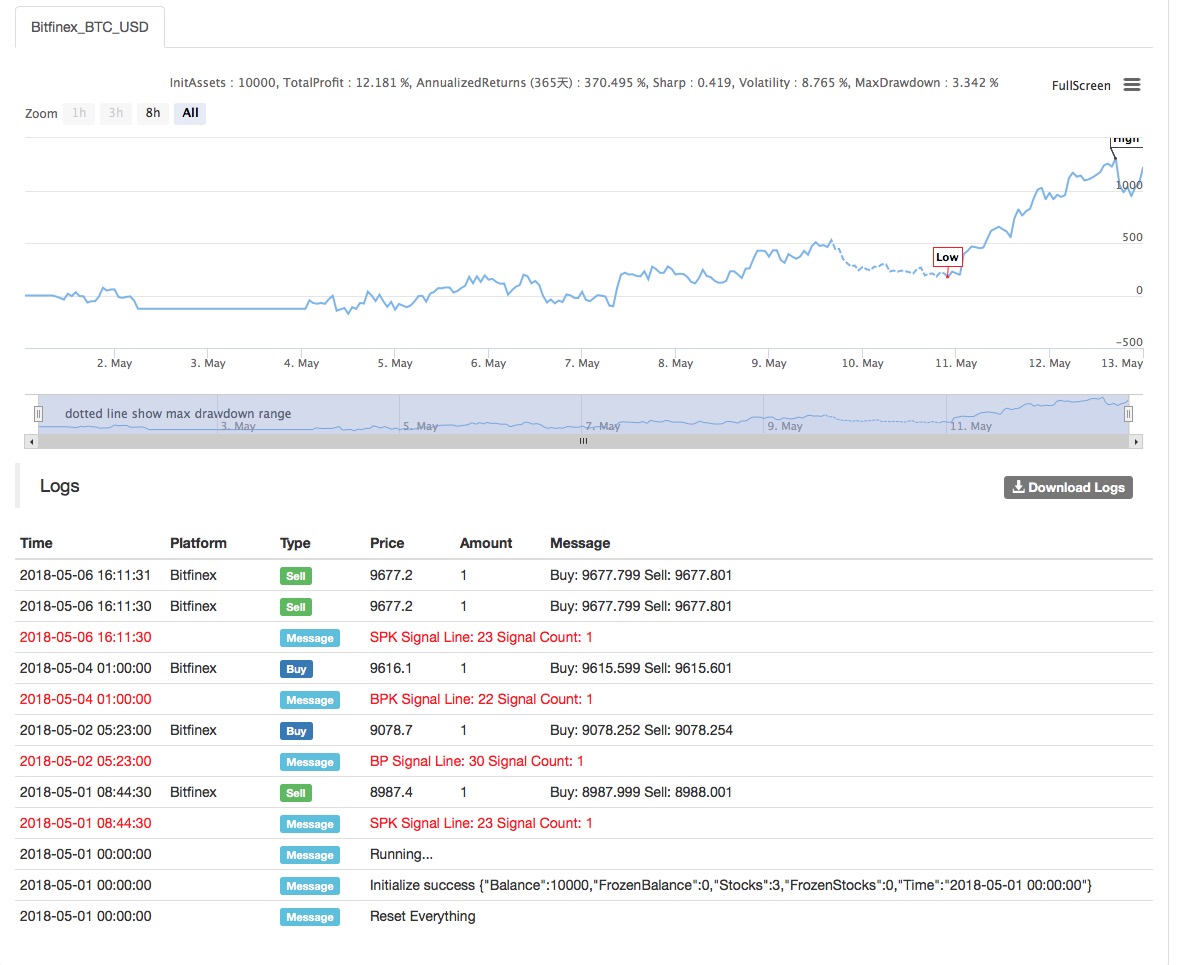

Backtest on FMZ Quant to know more

Source Code: https://www.fmz.com/strategy/128121