Most people know that once Binance announces the listing of a new perpetual contract, the spot price of this cryptocurrency often rises immediately. This has led to some robots scraping announcements constantly to buy in at the first moment, not to mention so-called insider information where the currency price has already risen before the announcement is even made. But how do these contract cryptocurrencies perform after they start trading? Do they continue their upward trend or have a pullback? Let’s analyze it today.

Data Preparation

Download the 4h K-line data of Binance’s perpetual contract for the year 2023. The specific download code is introduced in the previous article: https://www.fmz.com/bbs-topic/10286. The listing time does not necessarily coincide with the 4-hour mark, which is a bit imprecise. However, the price at the start of trading is often chaotic. Using fixed intervals can filter out the impact of market opening without delaying analysis. In the data dataframe, NaN represents no data; once the first piece of data appears, it means that this coin has been listed. Here we calculate every 4 hours after listing relative to the first price increase and form a new table. Those already listed from the beginning are filtered out. As of November 16, 2023, Binance has listed a total of 86 currencies, averaging more than one every three days – quite frequent indeed.

The following is the specific processing code, where only data within 150 days of going live has been extracted.

df = df_close/df_close.fillna(method='bfill').iloc[0]

price_changes = {}

for coin in df.columns[df.iloc[0].isna()]:

listing_time = df[coin].first_valid_index()

price_changes[coin] = df[coin][df.index>listing_time].values

changes_df = pd.DataFrame.from_dict(price_changes, orient='index').T

changes_df.index = changes_df.index/6

changes_df = changes_df[changes_df.index<150]

changes_df.mean(axis=1).plot(figsize=(15,6),grid=True);

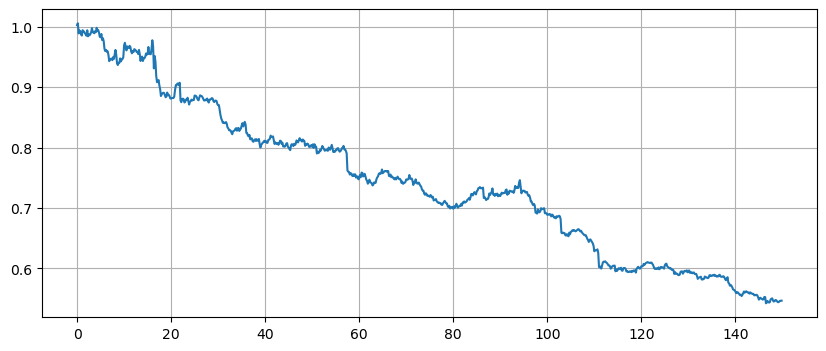

Result Analysis

The results are shown in the following graph, where the horizontal axis represents the number of days on the shelf and the vertical axis represents the average index. This result can be said to be unexpected but reasonable. Surprisingly, after new contracts are listed, they almost all fall, and the longer they are listed, the more they fall. At least within half a year there is no rebound. But it’s also reasonable to think about it; so-called listing benefits have been realized before listing, and subsequent continuous declines are normal. If you open up a K-line chart to look at weekly lines, you can also find that many newly-listed contract currencies follow this pattern – opening at their peak.

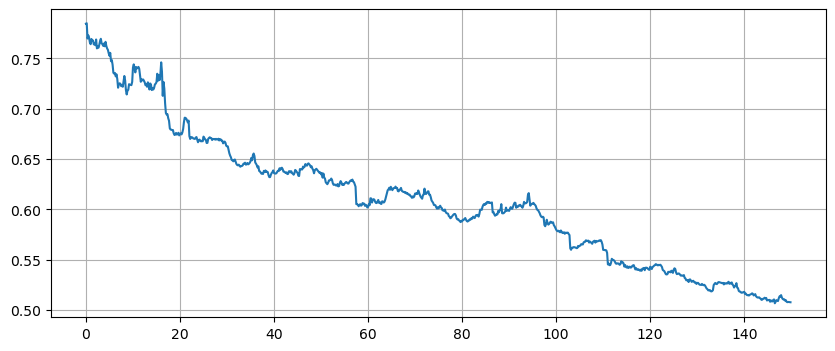

Exclude the Impact of the Index

The previous article has mentioned that digital currencies are greatly affected by simultaneous rises and falls. Does the overall index’s decline affect their performance? Here, let’s change the price changes to be relative to the index changes and look at the results again. From what we see on the graph, it still looks the same – a continuous decline. In fact, it has declined even more compared to the index.

total_index = df.mean(axis=1) df = df.divide(total_index,axis=0)

Binance’s Currency Listing

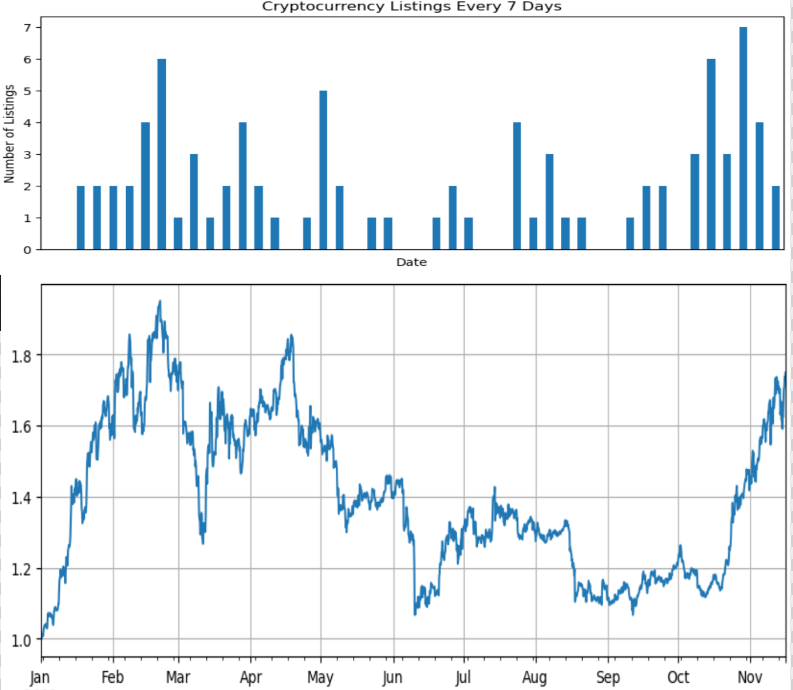

By analyzing the relationship between the number of currencies listed each week and the index, we can clearly see Binance’s listing strategy: frequent listings during a bull market, few listings during a bear market. February and October of this year were peak periods for listings, coinciding with bull markets. During times when the market was falling quite badly, Binance hardly listed any new contracts. It is evident that Binance also wants to take advantage of high trading volumes in bull markets and active new contracts to earn more transaction fees. They don’t want new contracts to fall too badly either, but unfortunately, they can’t always control it.

Summary

This article analyzes the 4h K-line data of Binance’s perpetual contracts for the year 2023, showing that newly listed contracts tend to decline over a long period. This may reflect the market’s gradual cooling off from initial enthusiasm and return to rationality. If you design a strategy to short a certain amount of funds on the first day of trading, and close out after holding for some time, there is a high probability of making money. Of course, this also carries risks; past trends do not represent the future. But one thing is certain: there is no need to chase hot spots or go long on newly listed contract currencies.