Summary Some people may be unfamiliar with the word “arbitrage”, but “arbitrage” is very common in real life. For example, the owner of a convenience store buys a bottle of min...

There are many interesting strategies on the square page (https://www.fmz.com/square) of the FMZ Quant platform. Back then, most of the cryptocurrency exchanges API interface were using the rest&...

Commodity futures CTP and cryptocurrency API exchange have significant differences. Familiar with cryptocurrency exchange programming trading doesn’t mean familiar with commodity futures CTP pro...

In commodity futures trading, intertemporary arbitrage are a common trading method. This kind of arbitrage is not risk-free. When the unilateral direction of the spread continues to expand, the arbitr...

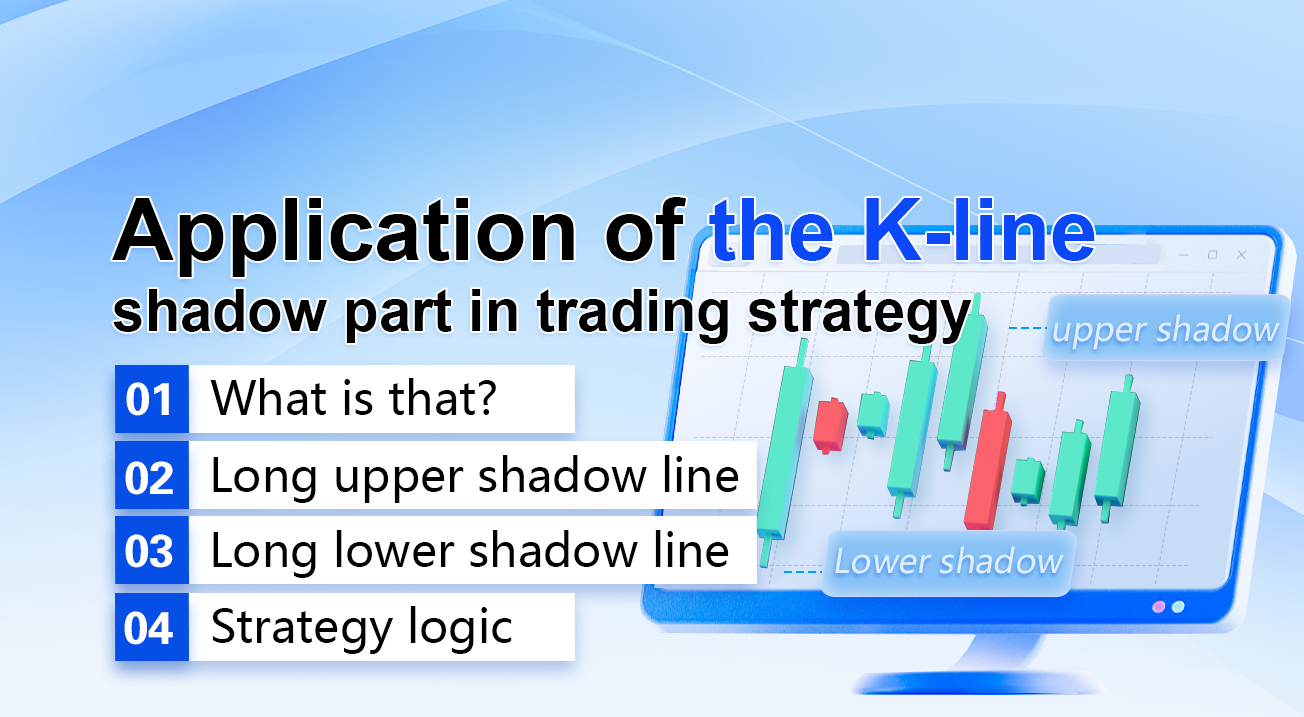

Summary The K line itself has little value, it is just a container of the price data. Starting from the lowest Tick data stream, it is divided into segments according to the time period. The first pri...

Summary What is the most important thing when backtest the trading strategy? the speed? The performance indicators? The answer is accuracy! The purpose of the backtest is to verify the logic and feasi...

The purpose of this article is to describe some experience in strategy development, as well as some tips, which will allow readers to quickly grasp the key point of trading strategy development. When ...

When writing a quantitative trading strategy, using the K-line data, there are often cases where non-standard cycle K-line data is required. For example, 12-minute cycle K-line data and 4-hour K-line ...

article originally from : https://www.quandl.com/ MACD is a popularly used technical indicator in trading stocks, currencies, cryptocurrencies, etc. Basics of MACD MACD is used and discussed in many d...

When going for an automated trading platform it is very important to look for some important features before you decide on the automated trading platform you want to trade on. Different auto...