Summary C++ is a very difficult programming language. The hard part mainly is to learn in depth, but if you just write strategy logic by C++, it won’t need much deep knowledge, as long as it is ...

Summary In the previous article, we learned about the introduction to the Python language, the basic syntax, the strategy framework and more. Although the content was boring, but it’s a must-req...

Preliminary fluff So, you want to learn the Python programming language but can’t find a concise and yet full-featured tutorial. This tutorial will attempt to teach you Python in 10 minutes. It’s prob...

Summary In the previous article, we introduced the fundamental knowledge that when using JavaScript to write a program, including the basic grammar and materials. In this article, we will use it with ...

Background This section gives a little background on JavaScript to help you understand why it is the way it is. JavaScript Versus ECMAScript ECMAScript is the official name for JavaScript. A new name ...

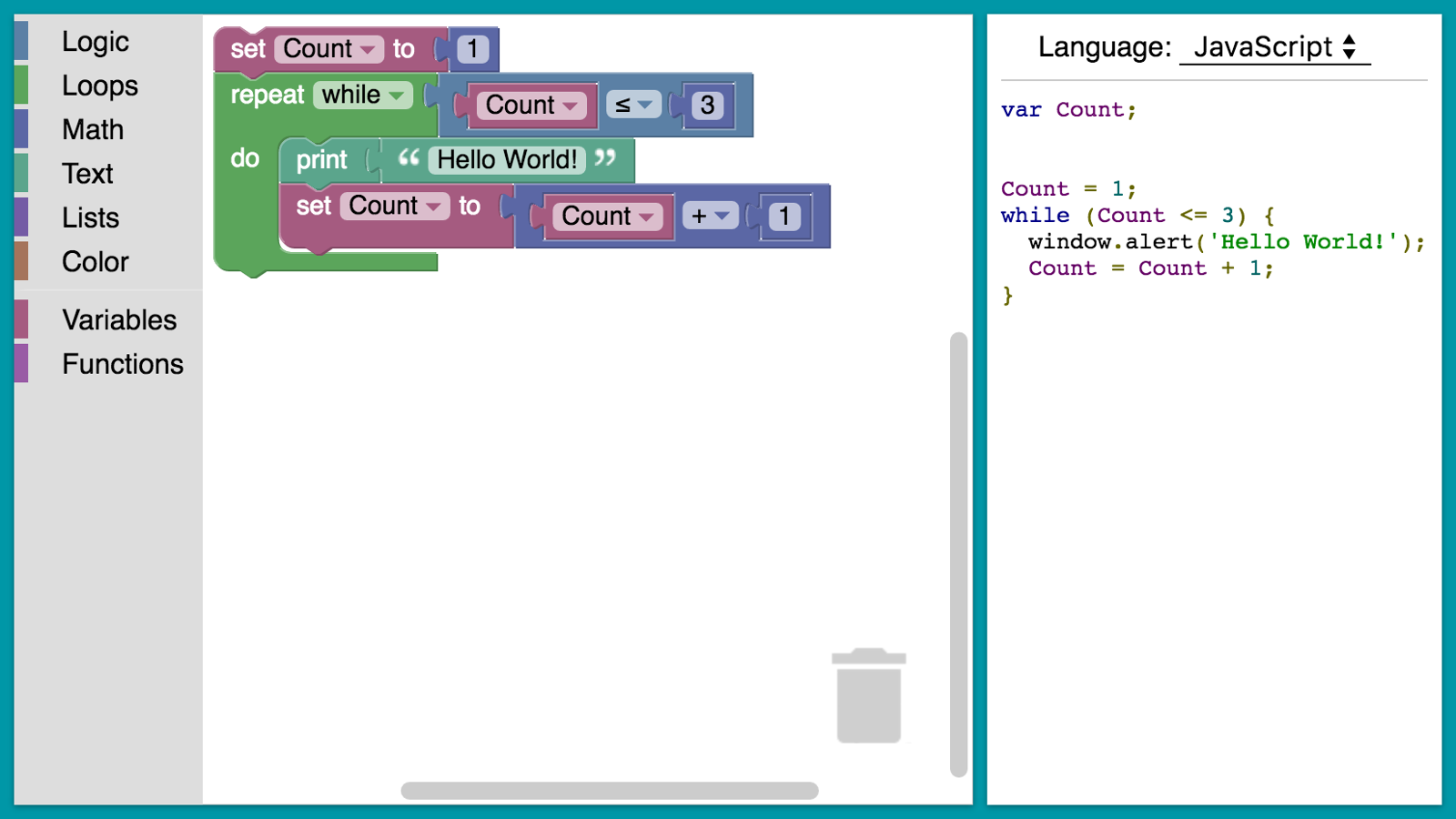

Summary In the previous section, we learned about the introduction and characteristics of the visual programming tool, the ” hello world ” example, and the strategy writing on the FMZ Quan...

Summary Many subjective traders are interested in quantitative trading, at first, they begin with full confidence. After learning the basic grammar, data operations, data structure, logic control of t...

www.fmz.com Summary In the previous article, we explained the premise of realizing the trading strategy from the aspects of the introduction of the M language , the basic grammar, the model execution ...

https://www.fmz.com/bbs-topic/3695 Summary What is the M language? The so-called M language is a set of programmatic functions that extend from the early stock trading technical indicators. Encapsulat...

Summary In Chapters 1 and 2, we learned the basics of quantitative trading and the uses of FMZ Quant tools. In this chapter, we will implement the actual trading strategies. If a worker wants to do so...