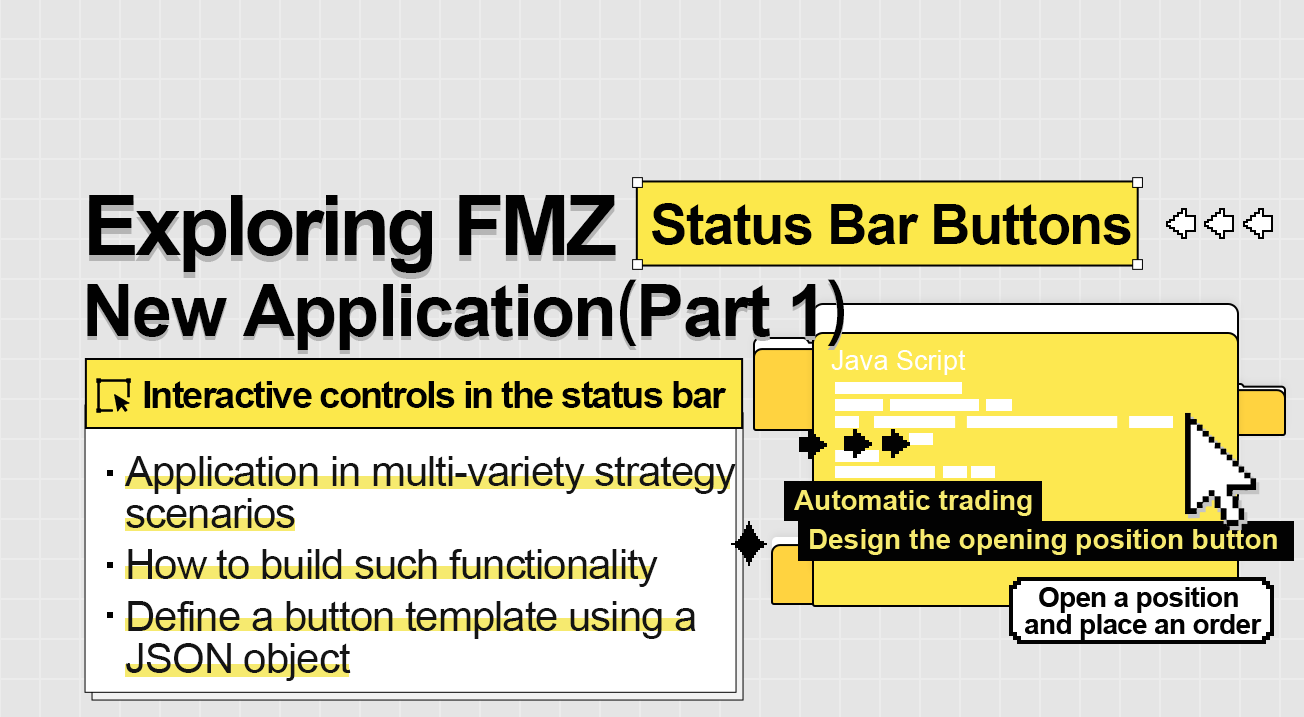

With a major update of the FMZ Quant Trading Platform API interface, the platform’s strategy interface parameters, interactive controls and other functions have been adjusted, and many new funct...

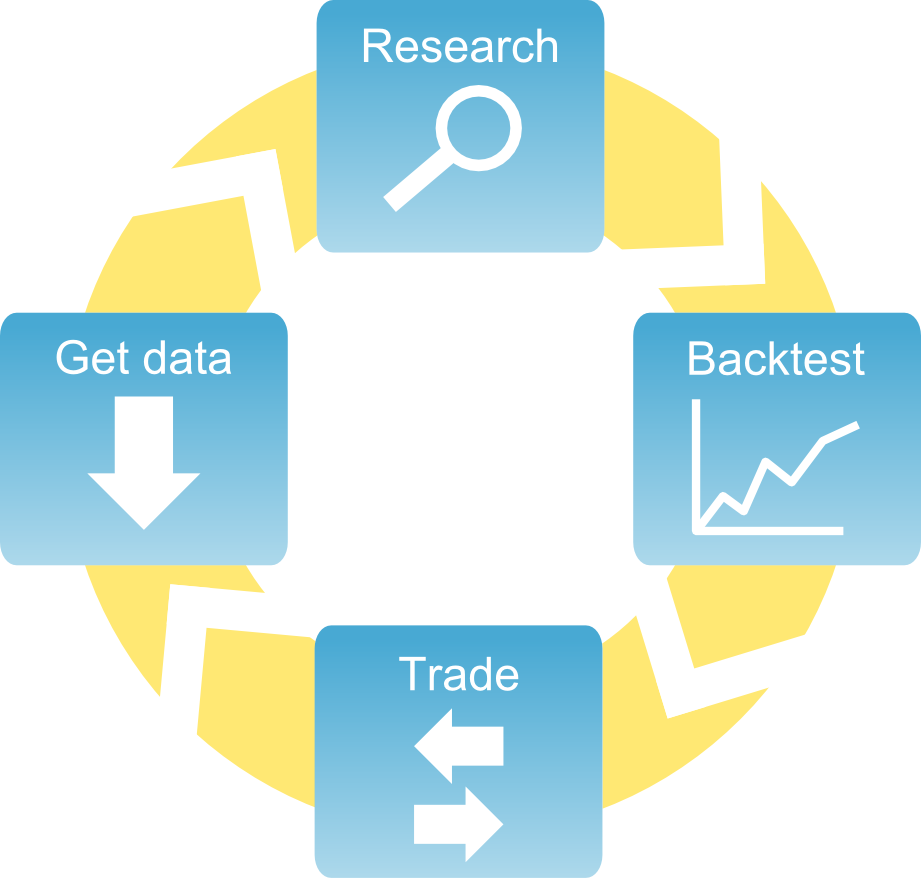

NO.1 Preface In recent years, the digital currency industry based on blockchain technology and cryptography has witnessed explosive growth. As one of the most important links in the digital currency i...

When implementing the quantitative strategy, concurrent execution can reduce latency and improve efficiency in many cases. Taking the hedging robot as an example, we need to obtain the depth of two co...

Digital currency algorithm transaction guide In this article, we will discuss the design and implementation of the trading algorithm in Canadian currency. In particular, we focus on execution algorith...

Saying that “trading digital currency may be profitable” can be regarded as an understatement. Because many digital currencies have experienced several improvements year on year, they outp...

The average true range (ATR) is the moving average of the volatility of stock price in a certain period of time, which is mainly used to study and judge the trading opportunity. The ATR is an indicato...

When writing JavaScript strategies, due to some problems of the scripting language itself, it often leads to numerical accuracy problems in calculations. It has a certain influence on some calculation...

Many developers who write strategies in Python want to put the strategy code files locally, worrying about the safety of the strategy. As a solution proposed in the FMZ API document: Strategy security...

Summary The K line itself has little value, it is just a container of the price data. Starting from the lowest Tick data stream, it is divided into segments according to the time period. The first pri...

When writing a quantitative trading strategy, using the K-line data, there are often cases where non-standard cycle K-line data is required. For example, 12-minute cycle K-line data and 4-hour K-line ...